MICROECONOMICS - We need to consider the following function to solve tasks (a) (b) and (c)

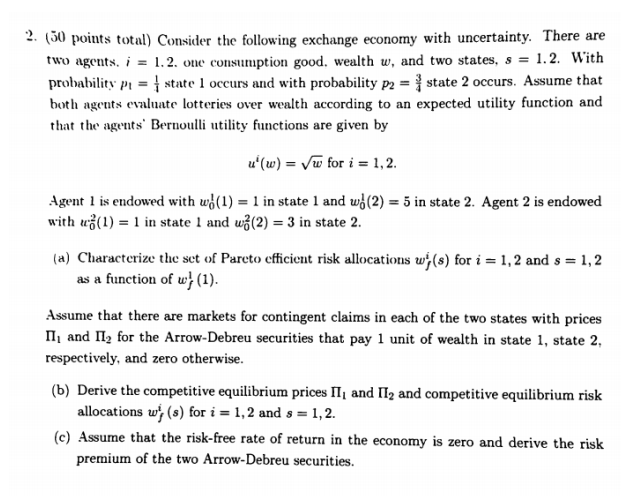

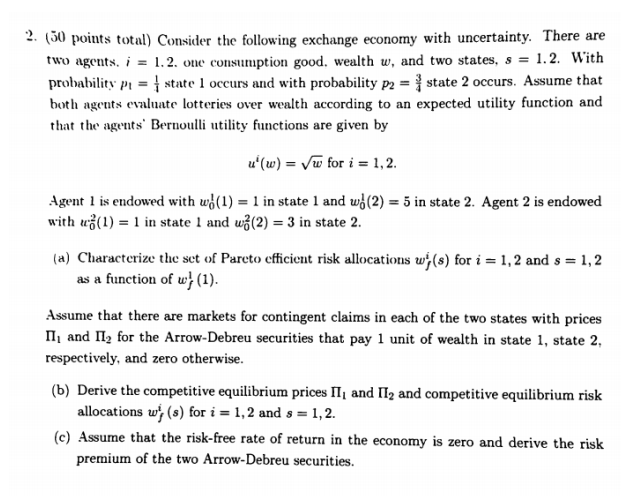

2. (50 points total) Consider the following exchange economy with uncertainty. There are two agents. i = 1.2. One consumption good, wealth w, and two states, s = 1.2. With probability Pi = state 1 occurs and with probability P2 = state 2 occurs. Assume that buth agents evaluate lotteries over wealth according to an expected utility function and that the agents' Bernoulli utility functions are given by u'(w) = Vw for i = 1,2. Agent 1 is endowed with w(1) = 1 in state 1 and w(2) = 5 in state 2. Agent 2 is endowed with v(1) = 1 in state 1 and w(2) = 3 in state 2. (a) Characterize the set of Pareto efficient risk allocations wy(s) for i = 1, 2 and s = 1, 2 as a function of w; (1). Assume that there are markets for contingent claims in each of the two states with prices 11, and II, for the Arrow-Debreu securities that pay 1 unit of wealth in state 1, state 2, respectively, and zero otherwise. (b) Derive the competitive equilibrium prices II and II, and competitive equilibrium risk allocations w; (s) for i = 1, 2 and s = 1,2. (c) Assume that the risk-free rate of return in the economy is zero and derive the risk premium of the two Arrow-Debreu securities. 2. (50 points total) Consider the following exchange economy with uncertainty. There are two agents. i = 1.2. One consumption good, wealth w, and two states, s = 1.2. With probability Pi = state 1 occurs and with probability P2 = state 2 occurs. Assume that buth agents evaluate lotteries over wealth according to an expected utility function and that the agents' Bernoulli utility functions are given by u'(w) = Vw for i = 1,2. Agent 1 is endowed with w(1) = 1 in state 1 and w(2) = 5 in state 2. Agent 2 is endowed with v(1) = 1 in state 1 and w(2) = 3 in state 2. (a) Characterize the set of Pareto efficient risk allocations wy(s) for i = 1, 2 and s = 1, 2 as a function of w; (1). Assume that there are markets for contingent claims in each of the two states with prices 11, and II, for the Arrow-Debreu securities that pay 1 unit of wealth in state 1, state 2, respectively, and zero otherwise. (b) Derive the competitive equilibrium prices II and II, and competitive equilibrium risk allocations w; (s) for i = 1, 2 and s = 1,2. (c) Assume that the risk-free rate of return in the economy is zero and derive the risk premium of the two Arrow-Debreu securities