Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Microsoft sold the rights to use one of their patented processes that will give cash payments of 10000 at the end of every six months

Microsoft sold the rights to use one of their patented processes that will give cash payments of 10000 at the end of every six months for each of the next 4 years along with a lump sum payment of 20000 at the end of year 5 and a lump sum payment of 15000 at the end of year 6.

Determine the total present value of these payments. Assume the interest rate is ten percent compounded semi-annually

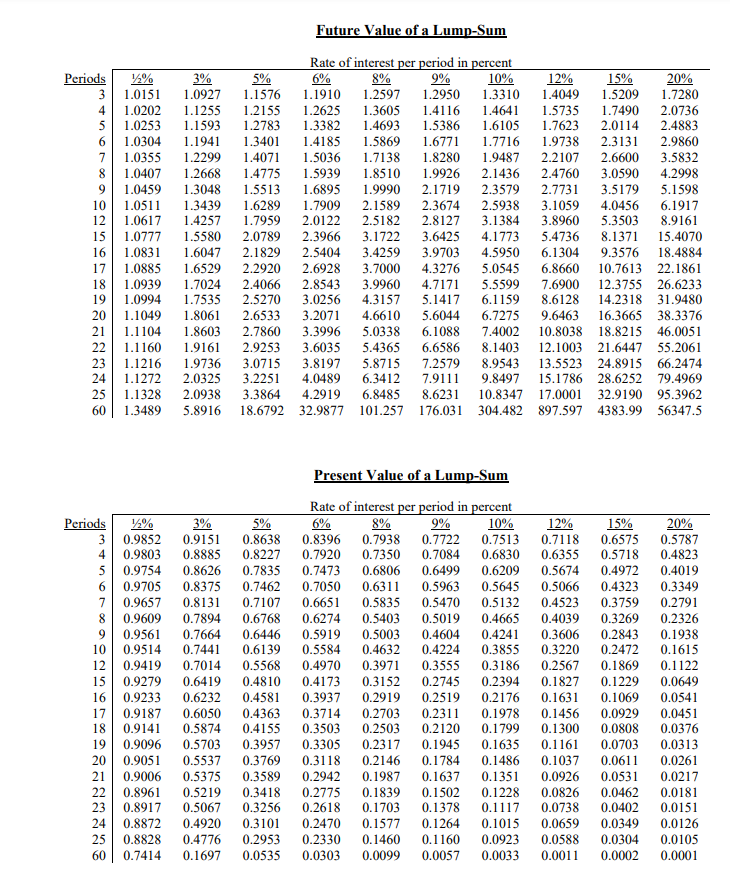

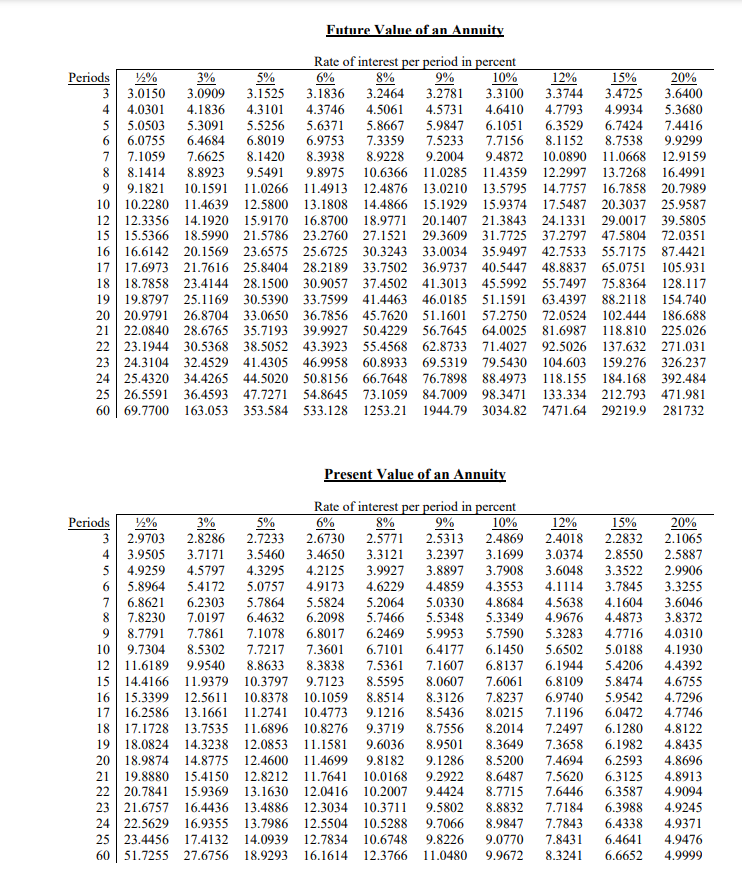

Future Value of a Lump-Sum Periods 12% 3 1.0151 4 1.0202 5 1.0253 6 1.0304 7 1.0355 8 1.0407 9 1.0459 10 1.0511 12 1.0617 15 1.0777 16 1.0831 17 1.0885 18 1.0939 19 1.0994 20 1.1049 21 1.1104 22 1.1160 23 1.1216 24 1.1272 25 1.1328 60 1.3489 3% 1.0927 1.1255 1.1593 1.1941 1.2299 1.2668 1.3048 1.3439 1.4257 1.5580 1.6047 1.6529 1.7024 1.7535 1.8061 1.8603 1.9161 1.9736 2.0325 2.0938 5.8916 Rate of interest per period in percent 5% 6% 8% 9% 10% 12% 15% 20% 1.1576 1.1910 1.2597 1.2950 1.3310 1.4049 1.5209 1.7280 1.2155 1.2625 1.3605 1.4116 1.4641 1.5735 1.7490 2.0736 1.2783 1.3382 1.4693 1.5386 1.6105 1.7623 2.0114 2.4883 1.3401 1.4185 1.5869 1.6771 1.7716 1.9738 2.3131 2.9860 1.4071 1.5036 1.7138 1.8280 1.9487 2.2107 2.6600 3.5832 1.4775 1.5939 1.8510 1.9926 2.1436 2.4760 3.0590 4.2998 1.5513 1.6895 1.9990 2.1719 2.3579 2.7731 3.5179 5.1598 1.6289 1.7909 2.1589 2.3674 2.5938 3.1059 4.0456 6.1917 1.7959 2.0122 2.5182 2.8127 3.1384 3.8960 5.3503 8.9161 2.0789 2.3966 3.1722 3.6425 4.1773 5.4736 8.1371 15.4070 2.1829 2.5404 3.4259 3.9703 4.5950 6.1304 9.3576 18.4884 2.2920 2.6928 3.7000 4.3276 5.0545 6.8660 10.7613 22.1861 2.4066 2.8543 3.9960 4.7171 5.5599 7.6900 12.3755 26.6233 2.5270 3.0256 4.3157 5.1417 6.1159 8.6128 14.2318 31.9480 2.6533 3.2071 4.6610 5.6044 6.7275 9.6463 16.3665 38.3376 2.7860 3.3996 5.0338 6.1088 7.4002 10.8038 18.8215 46.0051 2.9253 3.6035 5.4365 6.6586 8.1403 12.1003 21.6447 55.2061 3.0715 3.8197 5.8715 7.2579 8.9543 13.5523 24.8915 66.2474 3.2251 4.0489 6.3412 7.9111 9.8497 15.1786 28.6252 79.4969 3.3864 4.2919 6.8485 8.6231 10.8347 17.0001 32.9190 95.3962 18.6792 32.9877 101.257 176.031 304.482 897.597 4383.99 56347.5 5% 8% 10% Periods 1% 3 0.9852 4 0.9803 5 0.9754 6 0.9705 7 0.9657 8 0.9609 9 0.9561 10 0.9514 12 0.9419 15 0.9279 16 0.9233 17 0.9187 18 0.9141 19 0.9096 20 0.9051 21 0.9006 22 0.8961 23 0.8917 24 0.8872 25 0.8828 60 0.7414 3% 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7014 0.6419 0.6232 0.6050 0.5874 0.5703 0.5537 0.5375 0.5219 0.5067 0.4920 0.4776 0.1697 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5568 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.3589 0.3418 0.3256 0.3101 0.2953 0.0535 Present Value of a Lump-Sum Rate of interest per period in percent 9% 0.8396 0.7938 0.7722 0.7513 0.7920 0.7350 0.7084 0.6830 0.7473 0.6806 0.6499 0.6209 0.7050 0.6311 0.5963 0.5645 0.6651 0.5835 0.5470 0.5132 0.6274 0.5403 0.5019 0.4665 0.5919 0.5003 0.4604 0.4241 0.5584 0.4632 0.4224 0.3855 0.4970 0.3971 0.3555 0.3186 0.4173 0.3152 0.2745 0.2394 0.3937 0.2919 0.2519 0.2176 0.3714 0.2703 0.2311 0.1978 0.3503 0.2503 0.2120 0.1799 0.3305 0.2317 0.1945 0.1635 0.3118 0.2146 0.1784 0.1486 0.2942 0.1987 0.1637 0.1351 0.2775 0.1839 0.1502 0.1228 0.2618 0.1703 0.1378 0.1117 0.2470 0.1577 0.1264 0.1015 0.2330 0.1460 0.1160 0.0923 0.0303 0.0099 0.0057 0.0033 12% 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2567 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 0.0926 0.0826 0.0738 0.0659 0.0588 0.0011 15% 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.1869 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 0.0531 0.0462 0.0402 0.0349 0.0304 0.0002 20% 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1122 0.0649 0.0541 0.0451 0.0376 0.0313 0.0261 0.0217 0.0181 0.0151 0.0126 0.0105 0.0001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started