Answered step by step

Verified Expert Solution

Question

1 Approved Answer

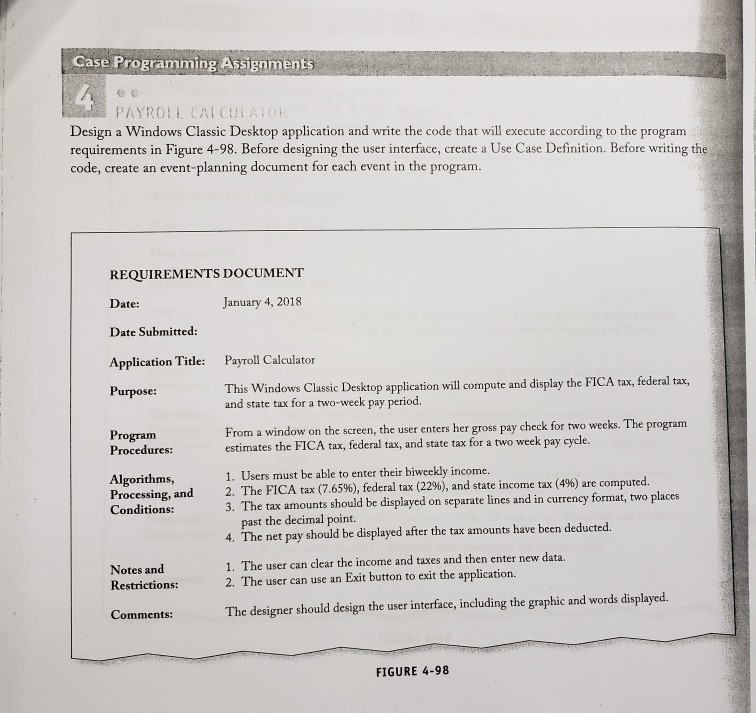

Microsoft Visual Basic Form Load Event. Complete and submit both a Use Case Definition and an Event Planning Documents. Follow the textbook naming conventions for

Microsoft Visual Basic Form Load Event. Complete and submit both a Use Case Definition and an Event Planning Documents. Follow the textbook naming conventions for all objects. Introductory Comments as well as comments in the code (such as the content from an event planning document) for each event should be included in the code describing the purpose and function.

Also, make sure you:

- use a Form Load Event as demonstrated in the chapter project

- set the AcceptButton and CancelButton values in the Form Properties for your program

- set the tax rates as Constant variables

- Note that because the tax rate variables do not have to be used in two different event-handling procedures, it does NOT have to be defined at the class level

- use the Option Strict On statement in your code

- set the currency results to be displayed in a currency format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started