2. Firm ABC has based on nominal interest rate to compute and pay the interest payment because of its debt amount. Moreover, the firm

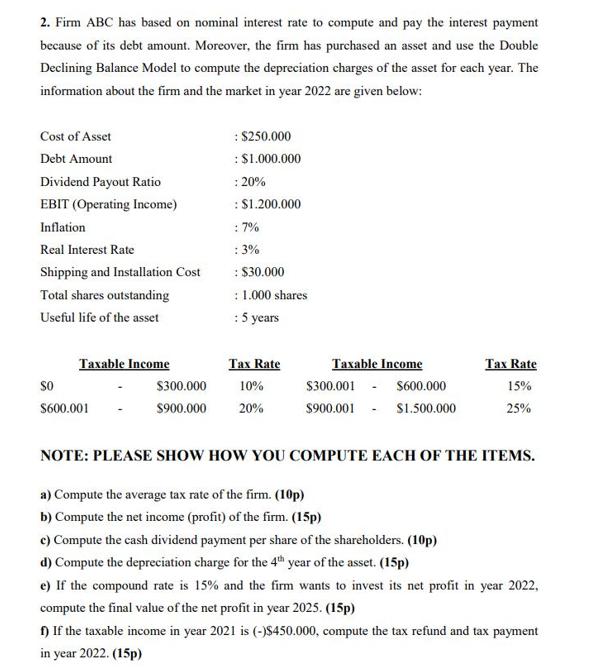

2. Firm ABC has based on nominal interest rate to compute and pay the interest payment because of its debt amount. Moreover, the firm has purchased an asset and use the Double Declining Balance Model to compute the depreciation charges of the asset for each year. The information about the firm and the market in year 2022 are given below: Cost of Asset Debt Amount Dividend Payout Ratio EBIT (Operating Income) Inflation Real Interest Rate Shipping and Installation Cost Total shares outstanding Useful life of the asset Taxable Income So $600.001 $300.000 $900.000 : $250.000 : $1.000.000 : 20% : $1.200.000 : 7% : 3% : $30.000 : 1.000 shares : 5 years Tax Rate 10% 20% Taxable Income $300.001 - $600.000 $900.001 $1.500.000 Tax Rate 15% 25% NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. a) Compute the average tax rate of the firm. (10p) b) Compute the net income (profit) of the firm. (15p) c) Compute the cash dividend payment per share of the shareholders. (10p) d) Compute the depreciation charge for the 4th year of the asset. (15p) e) If the compound rate is 15% and the firm wants to invest its net profit in year 2022, compute the final value of the net profit in year 2025. (15p) f) If the taxable income in year 2021 is (-)$450.000, compute the tax refund and tax payment in year 2022. (15p)

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Compute the average tax rate of the firm From the given information Taxable Income 1200000 The tax rates for the given income brackets are as follow...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started