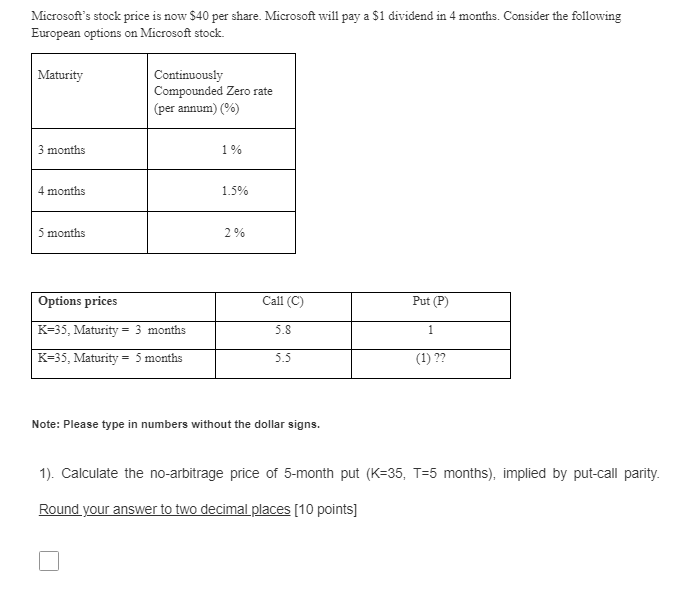

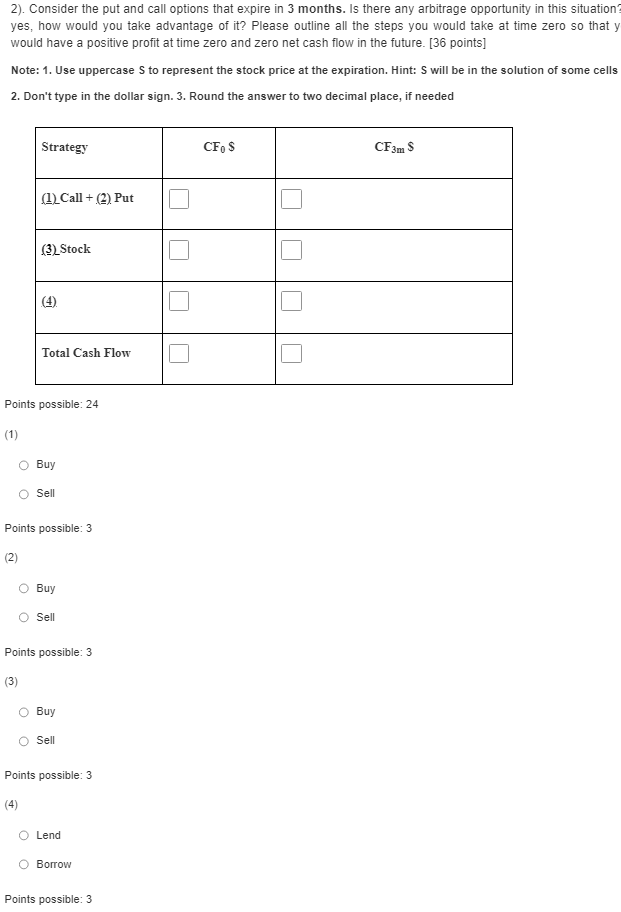

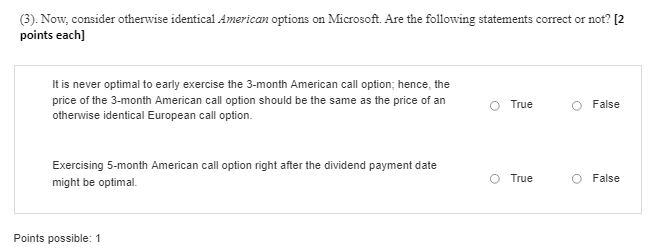

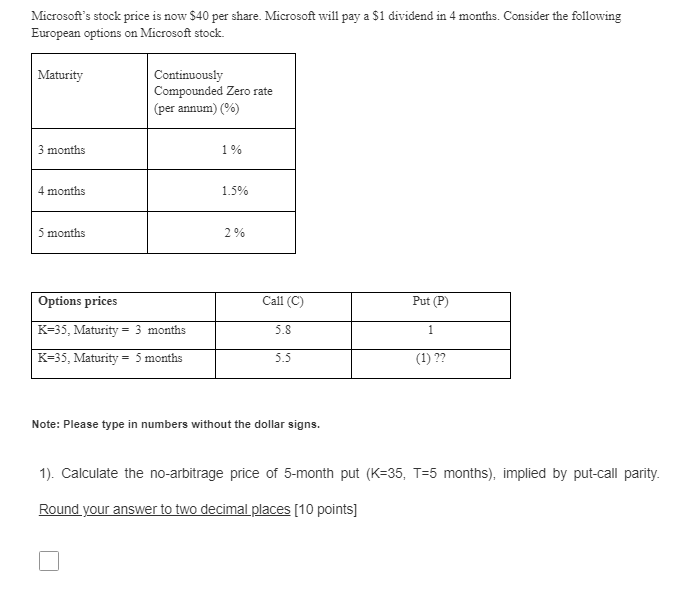

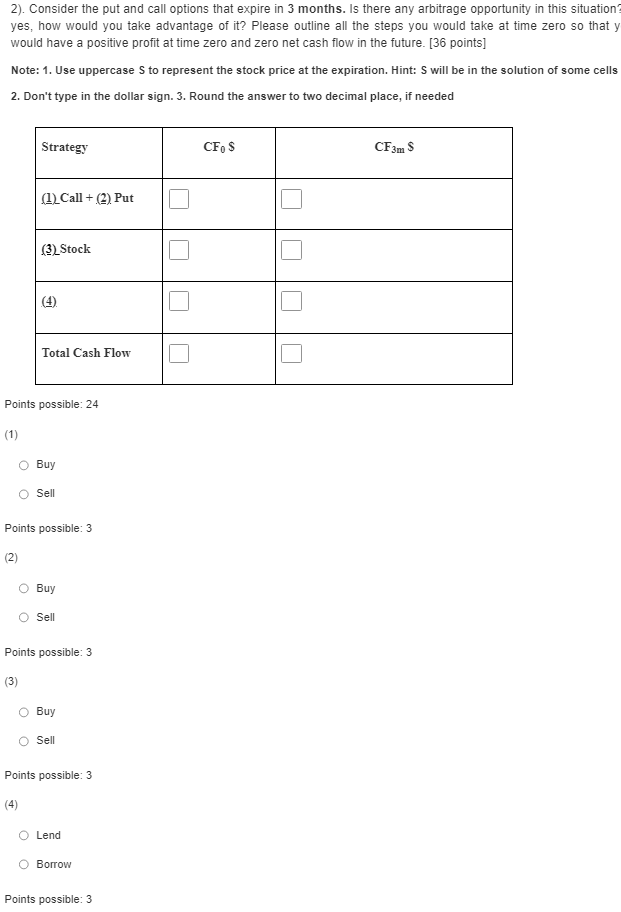

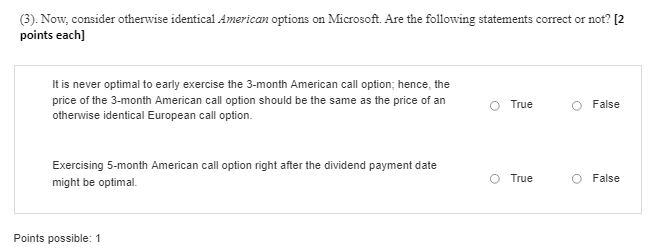

Microsoft's stock price is now $40 per share. Microsoft will pay a $1 dividend in 4 months. Consider the following European options on Microsoft stock. Note: Please type in numbers without the dollar signs. 1). Calculate the no-arbitrage price of 5 -month put ( K=35,T=5 months), implied by put-call parity. Round your answer to two decimal places [10 points] 2). Consider the put and call options that expire in 3 months. Is there any arbitrage opportunity in this situation? yes, how would you take advantage of it? Please outline all the steps you would take at time zero so that y would have a positive profit at time zero and zero net cash flow in the future. [36 points] Note: 1. Use uppercase S to represent the stock price at the expiration. Hint: S will be in the solution of some cells 2. Don't type in the dollar sign. 3. Round the answer to two decimal place, if needed Points possible: 24 (1) Buy Sell Points possible: 3 (2) Buy Sell Points possible: 3 (3) Buy Sell Points possible: 3 (4) Lend Borrow Points possible: 3 (3). Now, consider otherwise identical American options on Microsoft. Are the following statements correct or not? [2 points each] It is never optimal to early exercise the 3-month American call option; hence, the price of the 3-month American call option should be the same as the price of an True False otherwise identical European call option. Exercising 5-month American call option right after the dividend payment date might be optimal. True False Points possible: 1 Microsoft's stock price is now $40 per share. Microsoft will pay a $1 dividend in 4 months. Consider the following European options on Microsoft stock. Note: Please type in numbers without the dollar signs. 1). Calculate the no-arbitrage price of 5 -month put ( K=35,T=5 months), implied by put-call parity. Round your answer to two decimal places [10 points] 2). Consider the put and call options that expire in 3 months. Is there any arbitrage opportunity in this situation? yes, how would you take advantage of it? Please outline all the steps you would take at time zero so that y would have a positive profit at time zero and zero net cash flow in the future. [36 points] Note: 1. Use uppercase S to represent the stock price at the expiration. Hint: S will be in the solution of some cells 2. Don't type in the dollar sign. 3. Round the answer to two decimal place, if needed Points possible: 24 (1) Buy Sell Points possible: 3 (2) Buy Sell Points possible: 3 (3) Buy Sell Points possible: 3 (4) Lend Borrow Points possible: 3 (3). Now, consider otherwise identical American options on Microsoft. Are the following statements correct or not? [2 points each] It is never optimal to early exercise the 3-month American call option; hence, the price of the 3-month American call option should be the same as the price of an True False otherwise identical European call option. Exercising 5-month American call option right after the dividend payment date might be optimal. True False Points possible: 1