Question

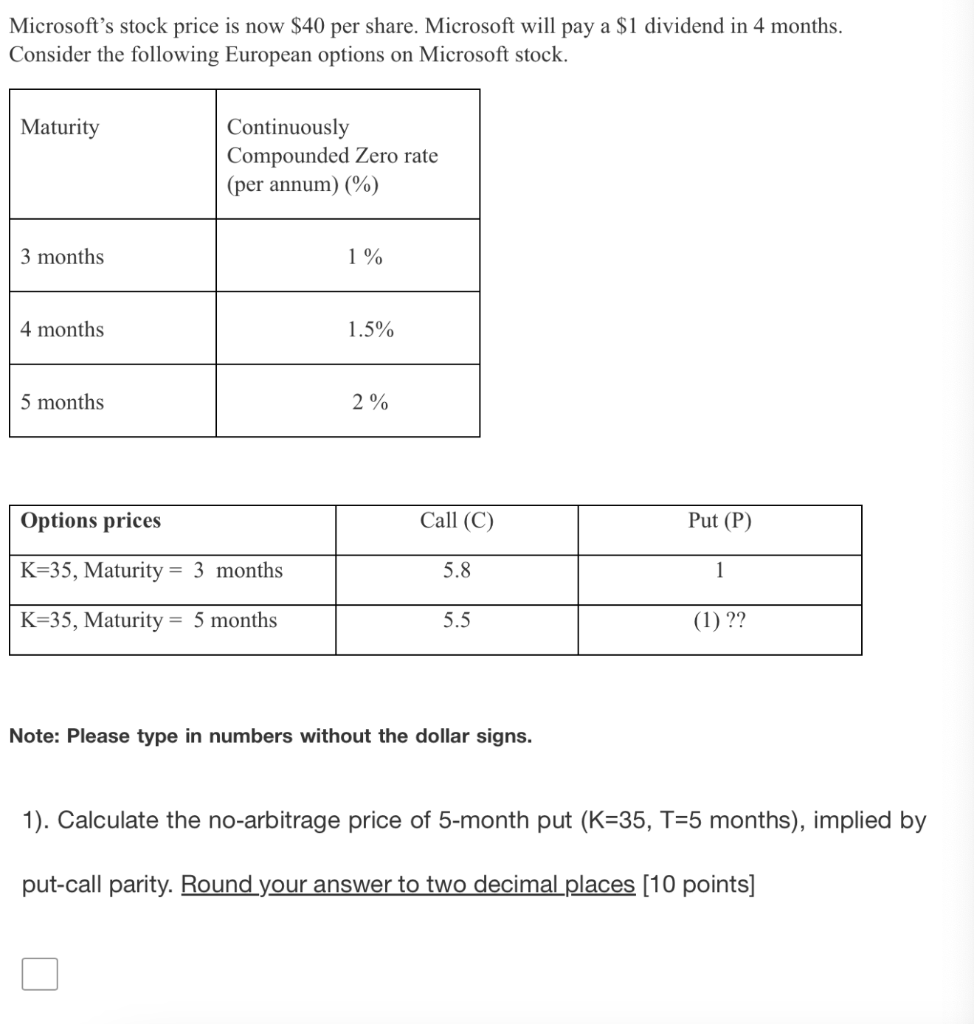

Microsoft's stock price is now $40 per share. Microsoft will pay a $1 dividend in 4 months. Consider the following European options on Microsoft stock.

Microsoft's stock price is now $40 per share. Microsoft will pay a $1 dividend in 4 months.

Consider the following European options on Microsoft stock.

1). Calculate the no-arbitrage price of 5-month put (K=35, T=5 months), implied by

put-call parity? Round your answer to two decimal places

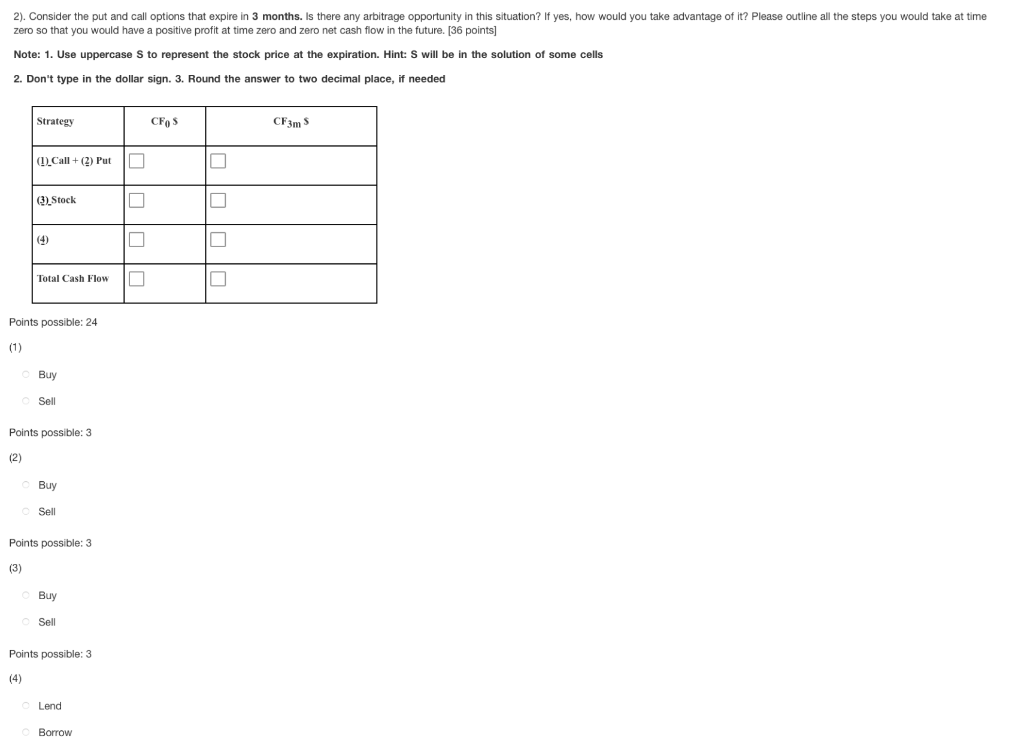

2). Consider the put and call options that expire in 3 months. Is there any arbitrage opportunity in this situation? If yes, how would you take advantage of it? Please outline all the steps you would take at time zero so that you would have a positive profit at time zero and zero net cash flow in the future?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started