Question

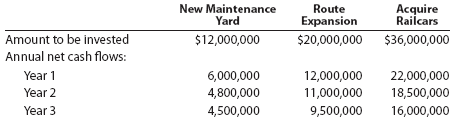

Mid Continent Railroad Company wishes to evaluate three capital investment proposals by using the net present value method. Relevant data related to the proposals are

Mid Continent Railroad Company wishes to evaluate three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows:

| Present Value of $1 at Compound Interest | |||||

| Year | 6% | 10% | 12% | 15% | 20% |

| 1 | 0.943 | 0.909 | 0.893 | 0.870 | 0.833 |

| 2 | 0.890 | 0.826 | 0.797 | 0.756 | 0.694 |

| 3 | 0.840 | 0.751 | 0.712 | 0.658 | 0.579 |

| 4 | 0.792 | 0.683 | 0.636 | 0.572 | 0.482 |

| 5 | 0.747 | 0.621 | 0.567 | 0.497 | 0.402 |

| 6 | 0.705 | 0.564 | 0.507 | 0.432 | 0.335 |

| 7 | 0.665 | 0.513 | 0.452 | 0.376 | 0.279 |

| 8 | 0.627 | 0.467 | 0.404 | 0.327 | 0.233 |

| 9 | 0.592 | 0.424 | 0.361 | 0.284 | 0.194 |

| 10 | 0.558 | 0.386 | 0.322 | 0.247 | 0.162 |

Required:

1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each proposal. Use the present value of $1 table present above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest dollar.

| New Maintenance Yard | Route Expansion | Acquire Railcars | |

| Present value of net cash flow total: | $ | $ | $ |

| Less amount to be invested: | $ | $ | $ |

| Net present value: | $ | $ | $ |

2. Determine a present value index for each proposal. If required, round your answers to two decimal places.

| Present Value Index | |

| New Maintenance Yard: | |

| Route Expansion: | |

| Acquire Railcars: | |

3. Which proposal offers the largest amount of present value per dollar of investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started