Question

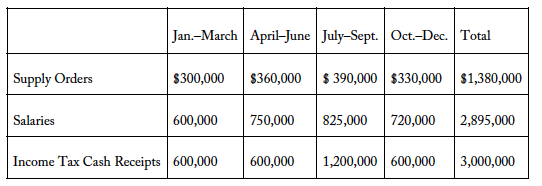

Middleboro Township plans to order supplies every quarter of the year. It expects to receive the supplies in the quarter after they are ordered. It

Middleboro Township plans to order supplies every quarter of the year. It expects to receive the

supplies in the quarter after they are ordered. It expects to use them the quarter after that and to pay for

them the quarter after that. For example, if it orders supplies in the first quarter of the year, it will receive them in the second quarter, use them in the third quarter, and pay for them in the fourth quarter. The township pays salaries in the quarter that the employees work.

The township earns its income tax revenues in equal amounts throughout the year. However, it receives

substantially more cash in April, when tax returns are filed. It plans to borrow $35,000 on a 20-year, 5

percent annual interest note on the first day of the fourth quarter. Interest will be paid once each year at

the end of the third quarter. Interest is paid only on outstanding debtthat which has not yet been

repaid.

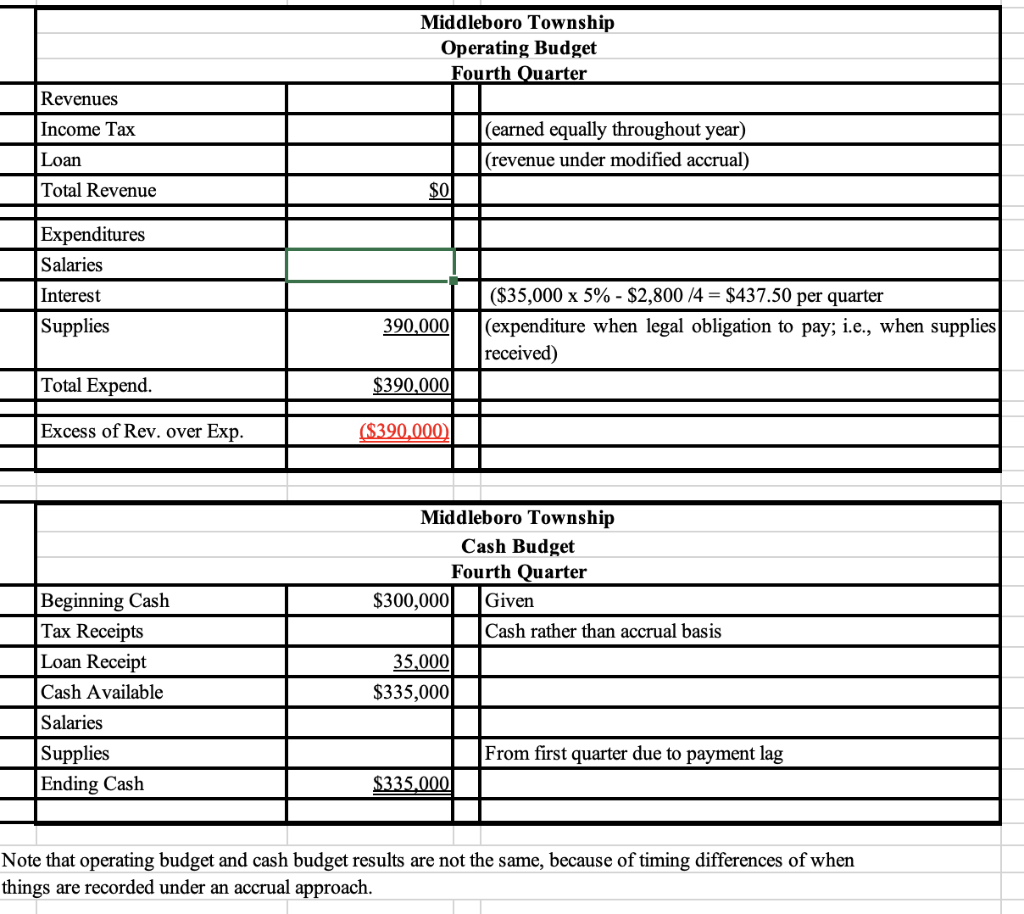

The town prepares its operating budget following the unique rules of modified accrual accounting used

by governments. Under these rules expenses are recognized when the town receives goods or services

and becomes legally obligated to pay for them. It does not matter if they have been used or not. Also,

cash inflows or proceeds from long-term loans are treated as if they were revenues. Using the

information from the table below, prepare an operating budget and a cash budget for Middleboro

Township for the fourth quarter only. Assume the town has $300,000 in cash when the fourth quarter

starts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started