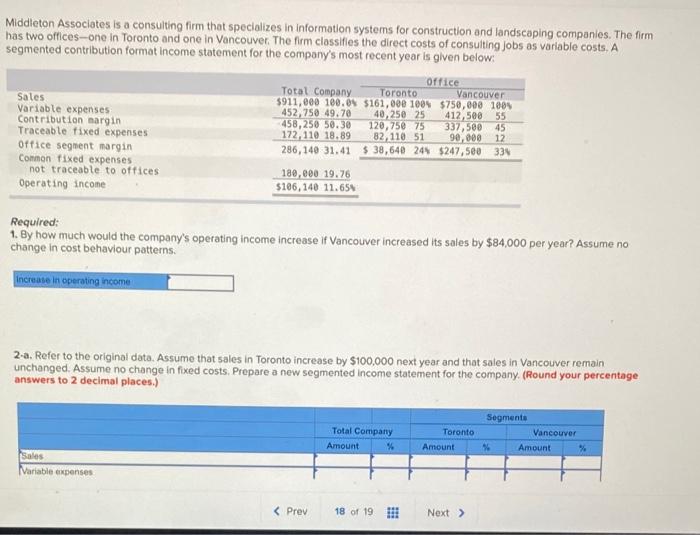

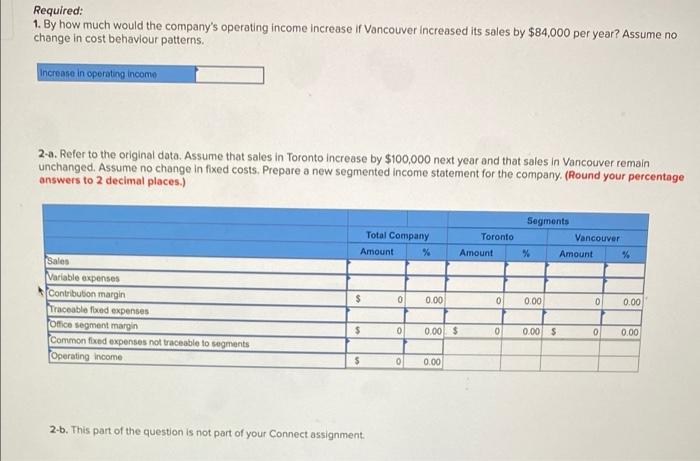

Middleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies. The firm has two offices-one in Toronto and one in Vancouver. The firm classifies the direct costs of consulting Jobs as variable costs. A segmented contribution format Income statement for the company's most recent year is given below: office Total Company Toronto Vancouver Sales $911,000 180.09 5161,000 1001 $750,000 1000 Variable expenses 452,750 49.70 40,250 25 412,508 55 Contribution margin 458,250 50.30 120, 750 75 337,500 Traceable fixed expenses 172, 110 18.89 82, 110 51 90,000 office segment margin 286,140 31.41 $ 38,640 244 $247,500 33 Connon fixed expenses not traceable to offices 180,000 19.76 Operating income $106,140 11.654 45 12 Required: 1. By how much would the company's operating income increase if Vancouver increased its sales by $84,000 per year? Assume no change in cost behaviour patterns. increase in operating income 2-a. Refer to the original data. Assume that sales in Toronto increase by $100,000 next year and that sales in Vancouver remain unchanged. Assume no change in fixed costs. Prepare a new segmented income statement for the company. (Round your percentage answers to 2 decimal places.) Total Company Amount % Toronto Amount Segmente Vancouver % Amount Sales Variable expenses Required: 1. By how much would the company's operating income increase if Vancouver Increased its sales by $84,000 per year? Assume no change in cost behaviour patterns. Increase in operating income 2-a. Refer to the original data. Assume that sales in Toronto increase by $100,000 next year and that sales in Vancouver remain unchanged. Assume no change in fixed costs. Prepare a new segmented income statement for the company. (Round your percentage answers to 2 decimal places.) Total Company Amount % Toronto Amount Segments Vancouver % Amount % $ 0 0.00 0 0.00 0 0.00 Sales Variable expenses Contribution margin Traceable foxed expenses office segment margin Common foued expenses not traceable to segments Operating income $ 0 0.00 $ 0 0.00 $ 0 0.00 $ 0 0.00 2-b. This part of the question is not part of your Connect assignment