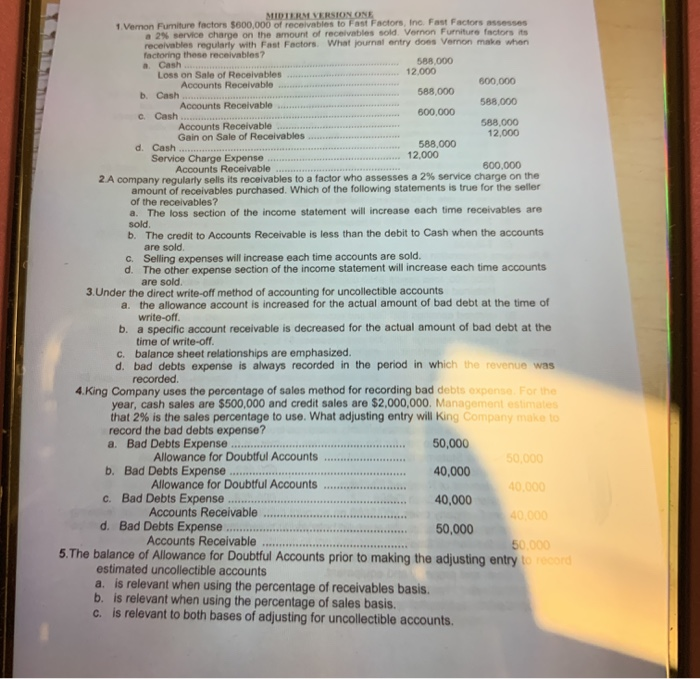

MIDIERM VERSION ONE 1.Vemon Fumiture factors $600,000 of receivables to Fast Factors, Inc. Fast Factors assesses a 2% service charge on the amount of receivables sold. Vernon Furniture factors its receivables regularty with Fast Factors What journal entry does Vernon make when factoring these receivables? a. Cash.. Loss on Sale of Receivables 588,000 12,000 600,000 Accounts Receivable 588,000 b. Cash 588,000 Accounts Receivable 600,000 c. Cash 588,000 12,000 Accounts Receivable Gain on Sale of Receivables 588,000 12,000 d. Cash Service Charge Expense Accounts Receivable 600,000 2A company regularly sells its receivables to a factor who assesses a 2% service charge on the amount of receivables purchased. Which of the following statements is true for the seller of the receivables? a. The loss section of the income statement will increase each time receivables are sold. b. The credit to Accounts Receivable is less than the debit to Cash when the accounts are sold. c. Selling expenses will increase each time accounts are sold. d. The other expense section of the income statement will increase each time accounts are sold 3.Under the direct write-off method of accounting for uncollectible accounts a. the allowance account is increased for the actual amount of bad debt at the time of write-off. b. a specific account receivable is decreased for the actual amount of bad debt at the time of write-off. c. balance sheet relationships are emphasized. d. bad debts expense is always recorded in the period in which the revenue was recorded. 4.King Company uses the percentage of sales method for recording bad debts expense. For the year, cash sales are $500,000 and credit sales are $2,000,000. Management estimates that 2% is the sales percentage to use. What adjusting entry will King Company make to record the bad debts expense? a. Bad Debts Expense 50,000 Allowance for Doubtful Accounts 50,000 b. Bad Debts Expense 40,000 Allowance for Doubtful Accounts 40,000 c. Bad Debts Expense. 40,000 Accounts Receivable d. Bad Debts Expense. Accounts Receivable 40,000 50,000 50,000 5.The balance of Allowance for Doubtful Accounts prior to making the adjusting entry to record estimated uncollectible accounts a. is relevant when using the percentage of receivables basis. b. is relevant when using the percentage of sales basis. c. is relevant to both bases of adjusting for uncollectible accounts