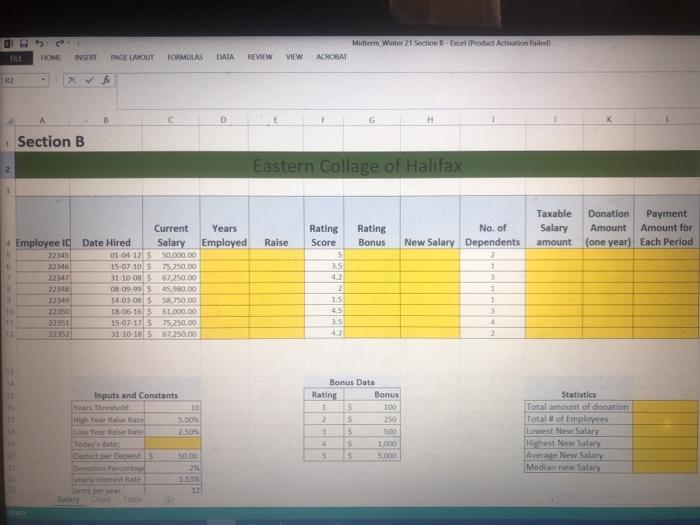

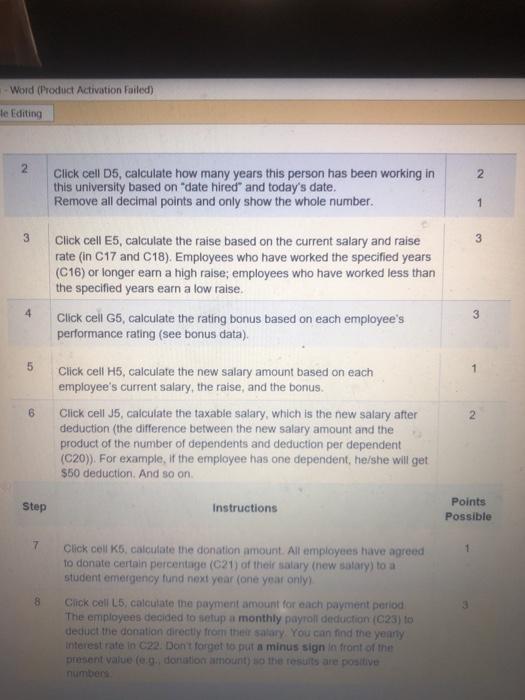

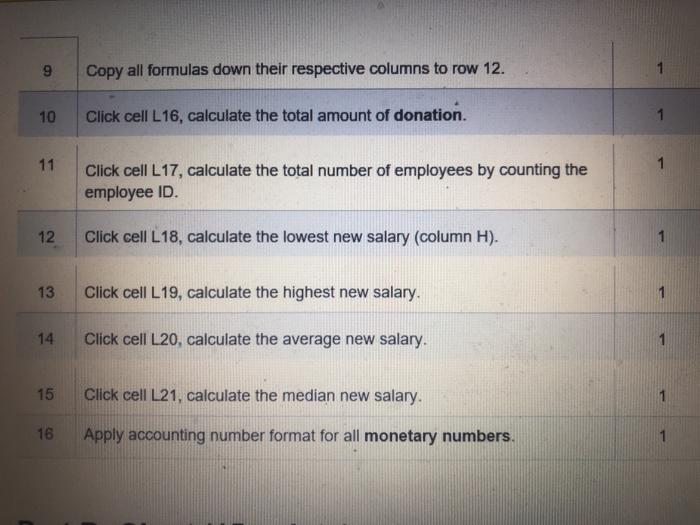

Midler Winter 21 Section - Excel Product Activation Toiled HOME INSER GE LAYOUT FORMULAS DAIA REVIEW VIEW ACROBAT RZ VA A c D G H 1 Section B Eastern Collage of Halifax Years Employed Rating Bonus No. of New Salary Dependents Taxable Salary amount Donation Payment Amount Amount for (one year) Each Period Raise Rating Score 5 3.5 4.2 2 15 Current 4 Employee 10 Date Hired Salary 5 23315 01-04-12 50,000.00 22146 15-07-10 75,250.00 7 22342 31-10-OS 57,250.00 2214 08.09.99 $ 45.980.00 22349 14-03-08 58.750.00 15-06-165 61.000.00 22351 15.07.17 75 250.00 31-10-1815 67 25000 1 1 15 Inputs and Constants 10 SOON Bonus Data Rating Bonus 1 5 100 2 $ 250 3 $ 500 - 3 1.000 Sood Statistics Total amount of donation Total of Employees Lowest New Salary Highest New Salary Average New Salary Modian now Salary Deduct persons Donec 50.00 23 12 Word (Product Activation Failed) le Editing 2 2 Click cell D5, calculate how many years this person has been working in this university based on "date hired" and today's date. Remove all decimal points and only show the whole number. 1 3 3 Click cell E5, calculate the raise based on the current salary and raise rate (in C17 and C18). Employees who have worked the specified years (C16) or longer earn a high raise; employees who have worked less than the specified years earn a low raise. Click cell G5, calculate the rating bonus based on each employee's performance rating (see bonus data) 3 5 6 Click cell H5, calculate the new salary amount based on each employee's current salary, the raise, and the bonus Click cell J5, calculate the taxable salary, which is the new salary after deduction (the difference between the new salary amount and the product of the number of dependents and deduction per dependent (C20)). For example, if the employee has one dependent, he/she will get $50 deduction. And so on. Step Instructions Points Possible 7 8 Click cell K5, calculate the donation amount. All employees have agreed to donate certain percentage (C21) of their salary (new stary) to a student emergency fund next year (one year only) Click cell 5, calculate the payment amount for each payment period The employees decided to setup a monthly payroll deduction (C23) to deduct the donation directly from the salary. You can find the yearly Interest rate in C22. Dont forget to put a minus sign in front of the present Value (.. donation amount to the results are positive numbers 9 Copy all formulas down their respective columns to row 12. 10 Click cell L16, calculate the total amount of donation. 1 11 1 Click cell L17, calculate the total number of employees by counting the employee ID. 12 Click cell L18, calculate the lowest new salary (column H). 13 Click cell L19, calculate the highest new salary. 14 Click cell L20, calculate the average new salary. 15 Click cell L21, calculate the median new salary. 1 16 Apply accounting number format for all monetary numbers. 1