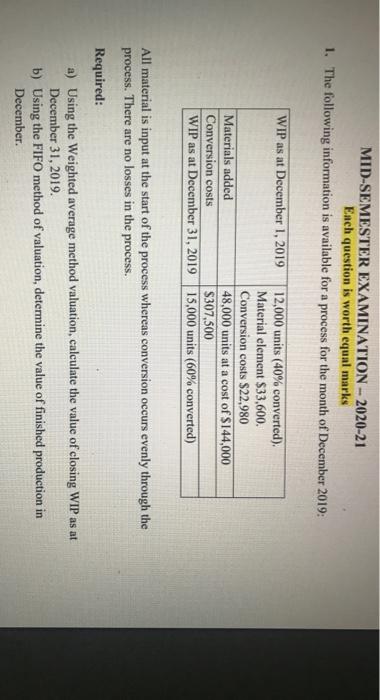

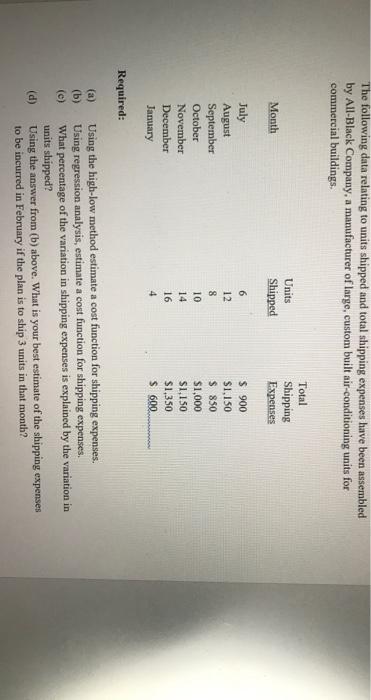

MID-SEMESTER EXAMINATION - 2020-21 Each question is worth equal marks 1. The following information is available for a process for the month of December 2019: WIP as at December 1, 2019 12,000 units (40% converted), Material element $33,600. Conversion costs $22,980 Materials added 48,000 units at a cost of $144,000 Conversion costs $307,500 WIP as at December 31, 2019 15,000 units (60% converted) All material is input at the start of the process whereas conversion occurs evenly through the process. There are no losses in the process. Required: a) Using the Weighted average method valuation, calculate the value of closing WIP as at December 31, 2019. b) Using the FIFO method of valuation, determine the value of finished production in December The following data relating to units shipped and total shipping expenses have been assembled by All-Black Company, a manufacturer of large, custom built air-conditioning units for commercial buildings Total Shipping Expenses Units Shipped Month July August September October November December January 6 12 8 10 14 16 4 S 900 $1,150 S 850 $1,000 $1,150 $1,350 S 600 Required: (a) (b) (0) Using the high-low method estimate a cost function for shipping expenses. Using regression analysis, estimate a cost function for shipping expenses. What percentage of the variation in shipping expenses is explained by the variation in units shipped? Using the answer from (b) above. What is your best estimate of the shipping expenses to be incurred in February if the plan is to ship 3 units in that month? (d) MID-SEMESTER EXAMINATION - 2020-21 Each question is worth equal marks 1. The following information is available for a process for the month of December 2019: WIP as at December 1, 2019 12,000 units (40% converted), Material element $33,600. Conversion costs $22,980 Materials added 48,000 units at a cost of $144,000 Conversion costs $307,500 WIP as at December 31, 2019 15,000 units (60% converted) All material is input at the start of the process whereas conversion occurs evenly through the process. There are no losses in the process. Required: a) Using the Weighted average method valuation, calculate the value of closing WIP as at December 31, 2019. b) Using the FIFO method of valuation, determine the value of finished production in December The following data relating to units shipped and total shipping expenses have been assembled by All-Black Company, a manufacturer of large, custom built air-conditioning units for commercial buildings Total Shipping Expenses Units Shipped Month July August September October November December January 6 12 8 10 14 16 4 S 900 $1,150 S 850 $1,000 $1,150 $1,350 S 600 Required: (a) (b) (0) Using the high-low method estimate a cost function for shipping expenses. Using regression analysis, estimate a cost function for shipping expenses. What percentage of the variation in shipping expenses is explained by the variation in units shipped? Using the answer from (b) above. What is your best estimate of the shipping expenses to be incurred in February if the plan is to ship 3 units in that month? (d)