Question

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company can offer competitive prices due to volume buying and requires

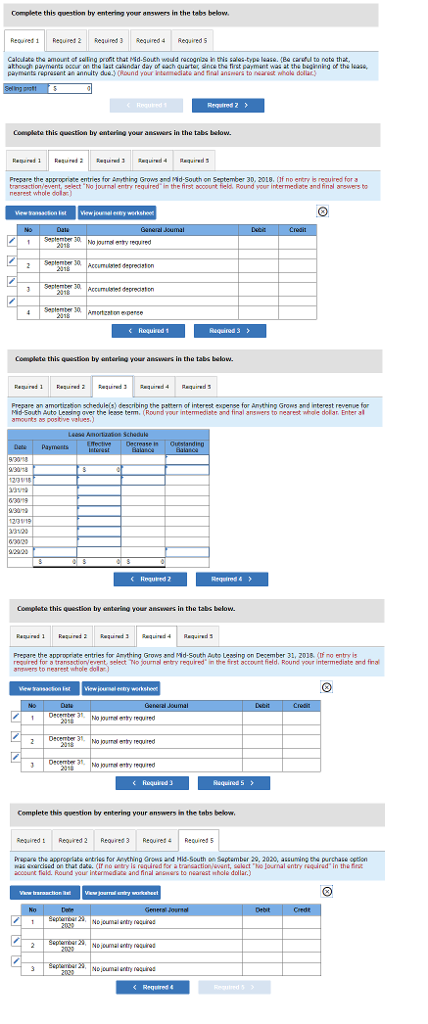

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company can offer competitive prices due to volume buying and requires an interest rate implicit in the lease that is one percent below alternate methods of financing. On September 30, 2018, the company leased a delivery truck to a local florist, Anything Grows. The lease agreement specified quarterly payments of $4,500 beginning September 30, 2018, the beginning of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2021 (three-year lease term). The florist had the option to purchase the truck on September 29, 2020, for $9,000 when it was expected to have a residual value of $11,500. The estimated useful life of the truck is four years. Mid-South Auto Leasings quarterly interest rate for determining payments was 2% (approximately 8% annually). Mid-South paid $35,000 for the truck. Both companies use straight-line depreciation or amortization. Anything Grows incremental interest rate is 8%. Hint: A lease term ends for accounting purposes when an option becomes exercisable if its expected to be exercised (i.e., a BPO). (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the amount of selling profit that Mid-South would recognize in this sales-type lease. (Be careful to note that, although payments occur on the last calendar day of each quarter, since the first payment was at the beginning of the lease, payments represent an annuity due.) 2. Prepare the appropriate entries for Anything Grows and Mid-South on September 30, 2018. 3. Prepare an amortization schedule(s) describing the pattern of interest expense for Anything Grows and interest revenue for Mid-South Auto Leasing over the lease term. 4. Prepare the appropriate entries for Anything Grows and Mid-South Auto Leasing on December 31, 2018. 5. Prepare the appropriate entries for Anything Grows and Mid-South on September 29, 2020, assuming the purchase option was exercised on that date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started