Mid-Term I: CL

We have accounting and non-accounting students in 3380. Therefore, the case mid-term has qualitative and quantitative options. Typically, accounting students opt for quantitative while others prefer qualitative. However, you are free to choose which route to go for regardless of your major.

Qualitative Option

Suggested analytical models (pick anyone you feel comfortable to work with):

-

SWOT: Strengths/Weaknesses/Opportunities/Threats

-

4-P: Price, Promotion, Product, and Place

-

5-C: Capital (whether the entrepreneur himself/herself has sufficient capital) / Capacity (whether the business has earning capacity to repay the loan) / Collateral (whether the lender can provide adequate collateral) / Condition (general market, industry, social, and economy condition) / Character (general trustworthiness of the borrower)

The end result of your analysis should clearly indicate the possibilities of getting the loan and why.

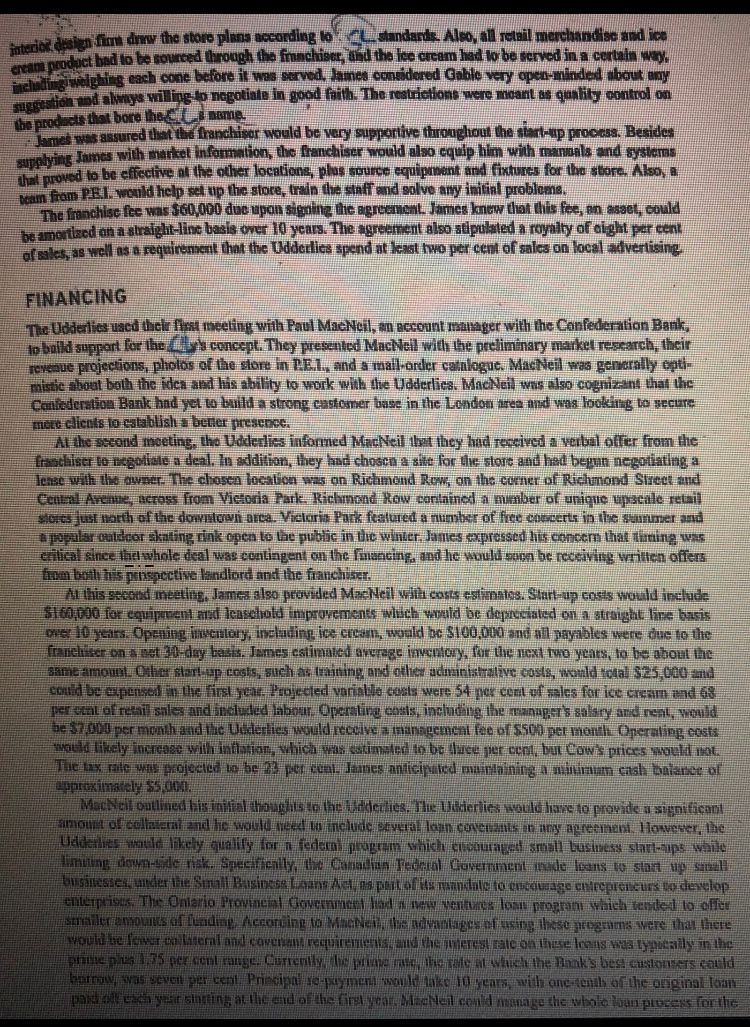

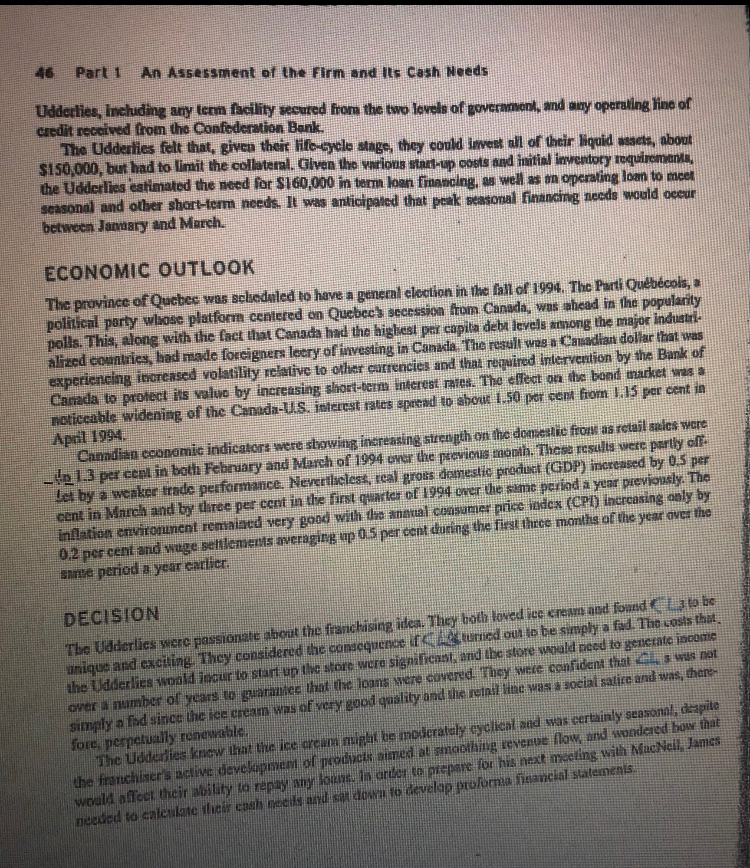

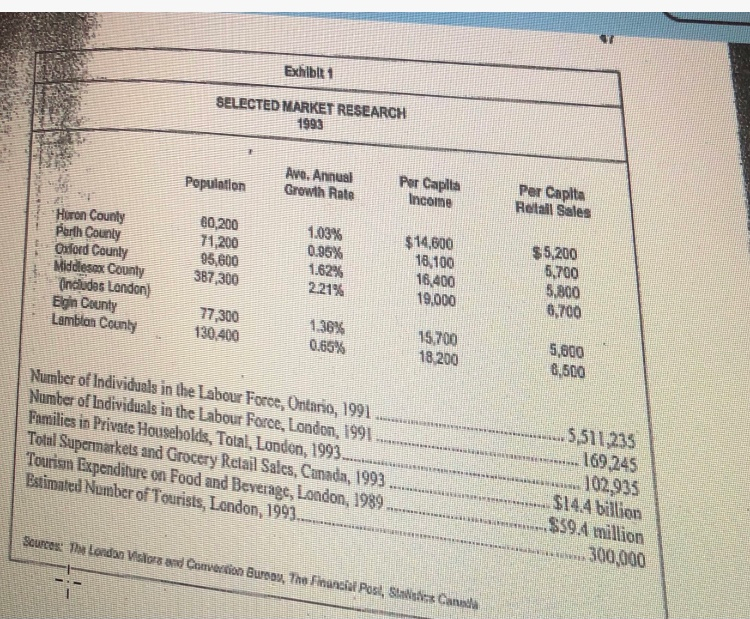

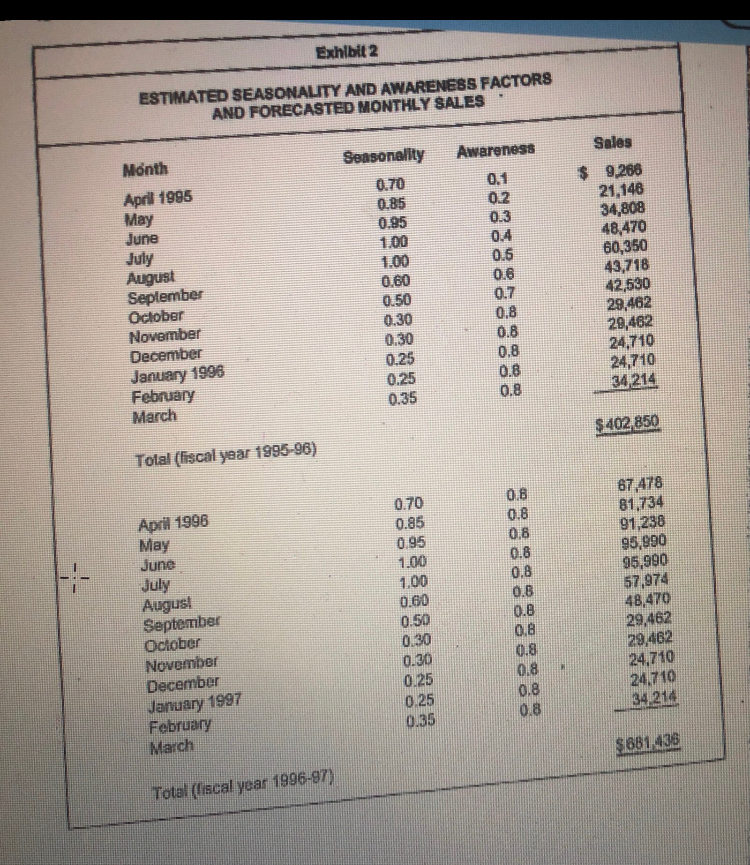

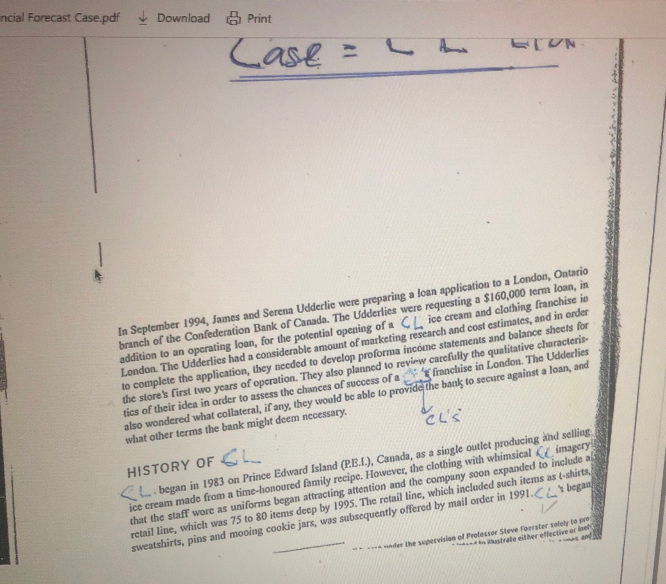

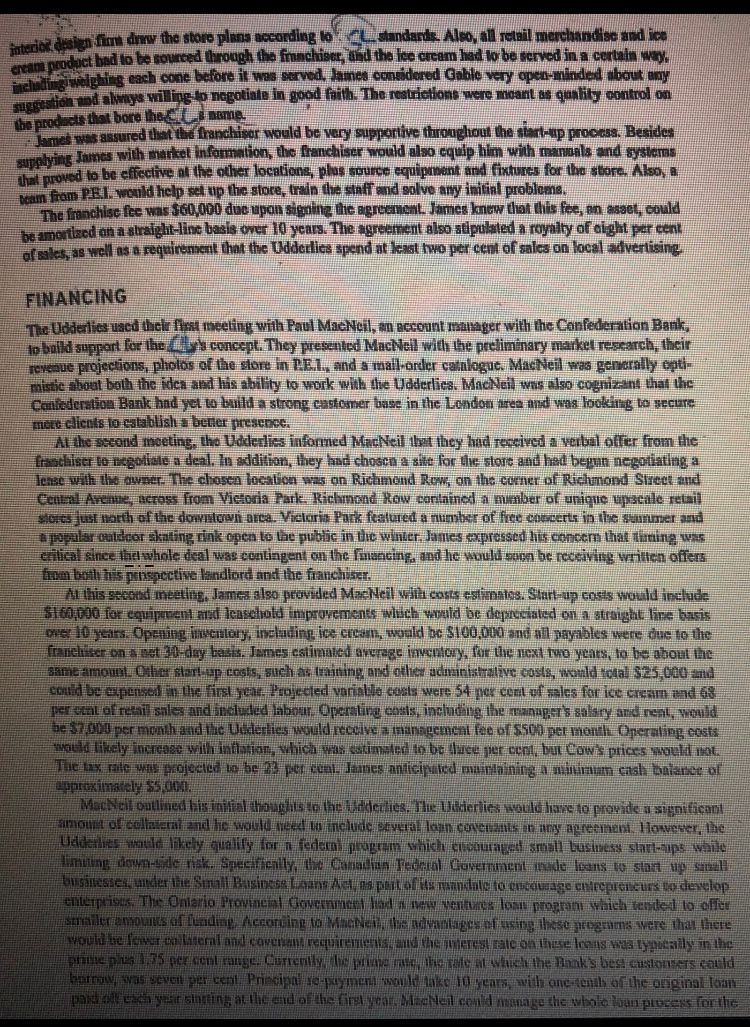

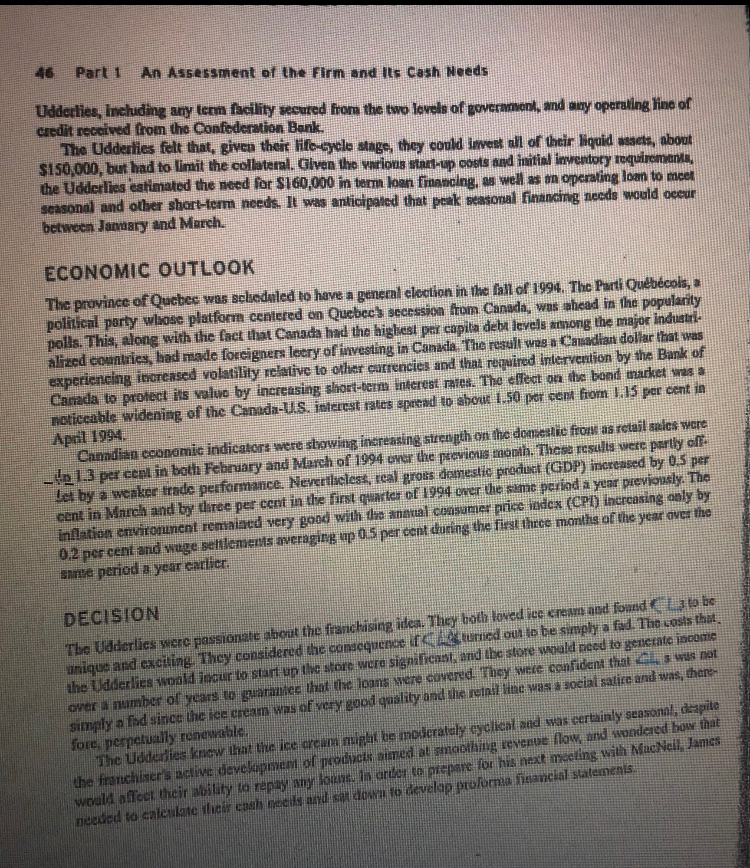

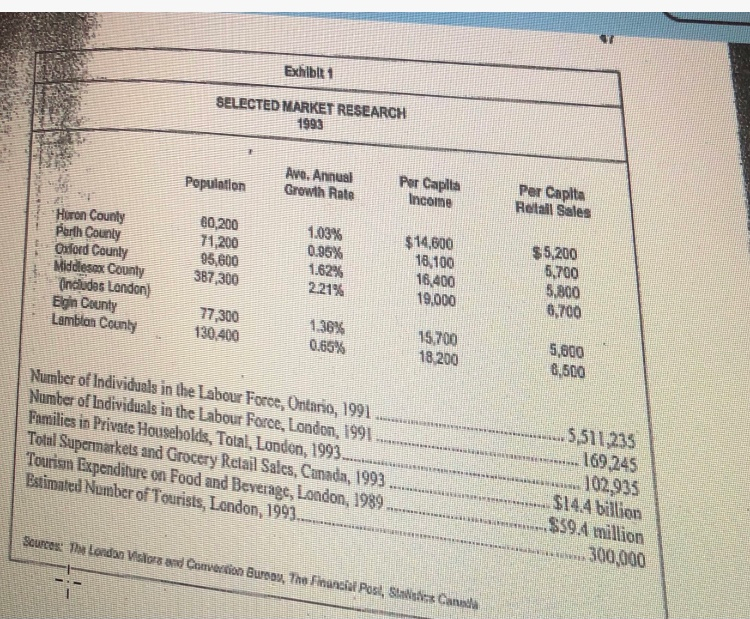

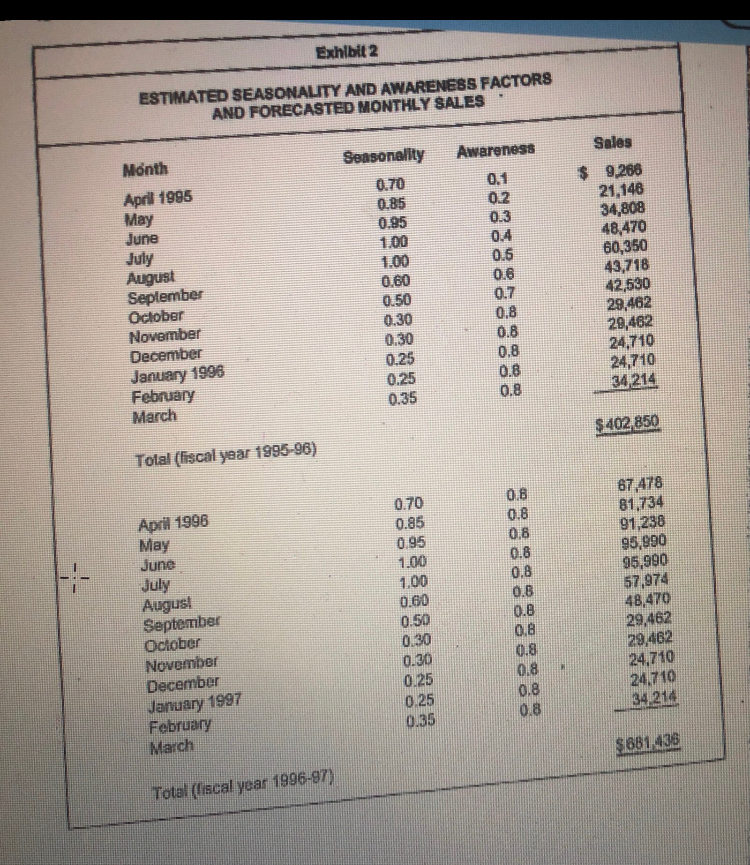

ncial Forecast Case.pdf Download Print ETUN Case = els In September 1994, James and Serena Udderlie were preparing a loan application to a London, Ontario branch of the Confederation Bank of Canada. The Udderlies were requesting a $160,000 term loan, in addition to an operating loan, for the potential opening of CL ice cream and clothing franchise in London. The Udderlies had a considerable amount of marketing research and cost estimates, and in order to complete the application, they needed to develop proforma income statements and balance sheets for the stores first two years of operation. They also planned to review carefully the qualitative characteris tics of their idea in order to assess the chances of success of a franchise in London. The Udderlies also wondered what collateral, if any, they would be able to provide the banks to secure against a loan, and what other terms the bank might deem nccessary. HISTORY OF GL CL began in 1983 on Prince Edward Island (P.E.1.), Canada, as a single outlet producing and selling ice cream made from a time-honoured family recipe. However, the clothing with whimsical imagery that the staff wore as uniforms began attracting attention and the company soon expanded to include a retail line, which was 75 to 80 items deep by 1995. The retail line, which included such items as t-shirts, sweatshirts, pins and mooing cookie jars, was subsequently offered by mail order in 1991.C began der the supervision of Professor Steve Foster setely to pro ustaleither effective or in takich listing with the opening of a store in Vancouver, British Columbin in 1993, and later opened stores in Punk Clty, Umb and Whistler, British Columbia CL sold only premium ice cream, with ingredients that included dairy fresh crown, sugar, fresh eggs and puro vanilln. Also, the ice cream included very little of the air found in most commercial ice creams to Increase volume. All loe cream was served in a fresh waffle conc made at the ice cream counter in full view of the customers. When customers ordered their conte, they often selected from colourful names such as Customers were treated to a complete experience at CL. The staff were very friendly and were will- Ing to give customers a sample before they decided on an ice cream flavour. All stores were innovatively deo- crated to incinde clocks displaying both the local and PB.I. time, as well as an ice crearn menu shaped as a cow with a swinging tongue. But most important to the experience were the clothing items with witty satir. jal designs and captions. Cllg founder, Cobie Gable, still managed the company in July 1994. The company's creative director, Marc Gallant, a well-known PE1. artist, had recently passed away. While Gable was responsible for most of the business decisions that had brought t His success, Gailant was to crentive person behind the art work on the whimsical clothing. Gallant's creativity, inspired by his fasciialion with cows, was preserved by siv- ing many of his preliminary designs in ner that could easily be manipulated by his creative team to develop new designs JAMES AND SERENA UDDERLIE James Udderlic was the Dirdar of Market Development in the limployee Benefits Division of the Provincial Life Insurance Company. He completed hia MBA from the Western Business School in 1983 and joined Provincial in the same year. Although successful and haply in his current position, au James noted, being citepreneur is in the back of the mind of most business school graduates." Serena Udderlio was a spe- educatinn Ichcher who was curitntly volunteering the dny a week while managing their three children Hime, inchading the youngest child who had not yet entered public school. Serena planned on reluming tu werk full-time once their ungest child was in school. She received a Bachelor of Ans, Bachelor art Education and a Master of Education from the University of Western Ortado, and was the gold medalist while opening the Master's degree. Serena, like Ist husband was excited to open up a furnily business Ddderlies tequired that any business they waited would neicher alleet James commitment la Provincial Life mor their commitment to their family. While James and Serena accepted dual changes would TIesary to the family routine, hey did not want their children to sullur because or the business and discussed it will hear before making a final decision. The Calderlics were made the fusion about the commitment they would have to make to the venture, but they anticipated that if they were to hire a full-time person to manage their investment in the eme regalement could be kept to manageable level. They Febreir regularne bemel in London since the duce locations, the tentative behen of the sore, Provincial Lilet and would only be a short distance from cache Jmnes and Serena planted to conne, wit ench was so pekarthe business. James would be responsible for strelcgie plein. Go and general mancato Seren would take care of hiring the stall and marketing they wont bodiake duns meeting with their manager on a weekly basis to keep labs on the western reviewing thing tower and an emotious. THE IDEA "The idea for the Ludhise came about wheeled Yamily was camping en El in the summer 1992. At that the wanase ce cream that caught in atention Windrucktes was the wholesamunal of the layout the depicted a young boy wear mg clothing with the distinctive at and leaving fun eniglie cream. Later their neighbours the campsite said they cijele more y Misine and see the liderlles visited the store themselves, they were greatly impressed i Cewexperiene. lit part, they noticed the dressing clothing and is displays, duard and has been opened Drevent modification. Enable Editing 44 Part 1 An Assessment of the Fire the store's layout, the friendliness of the staff and most importantly, the delicious ice cream. After the Udderlies inquired about franchising. a company representative told them that the first company franchise was to open later that summer in Vancouver, Baltish Columbia and that no other franchises were being con- sidered. The representative advised the Udderlies that if they were to write a letter outlining their desire to own a franchise, the company wondd get back to them. The Uddedlies had a strong conviction that the uc L's concept would work in London The first decision the Uddedlies had to make wat whether or not to invest time examining the feasibility of a franchise before taking the idea to a financial institution for possible financing. It was not wait the summer of 1994 that the Udderlies decided to write to dla tepresentatives, at which time they received a favourable response inviting them to visit the company in PEL James travelod alone to PE.I. in July 1994 and spent three days meeting with the franchiser and learning more about the company. During this time, it became obvious to James that while was a profitable business, a franchisco hnd to want more than just profit from owning a store. The company's core values included a strong persuasion for quality and creativ ity that made owning a store an expensive proposition. It was believed that only by following these values would a store have all the elements necessary for it to be successfiol. MARKET RESEARCH James brouglu with him te P.E.1. some preliminary market research that he had gathered from Statistics Canada, the Conference Board of Canada and the Convention Bureau of London. He felt that it was in this area that his MBA helped him most be knew lire to differentiate the important information from the intelevant as well as how to deal will incomplete taket information. From the research, he gathered two lesy pieces of information: Aggregate spending on take-out food in the London area and an estimate of the albumber of visitors to Londra, The information in Exhibit 1 was meant to give Jamesa Buse of how many potential Le crustomers existed and the extent of their buying power. He focused on the counties around London James figured that his largel segment would include tourists, local employed families, and local non- married-employed individuals not the age of 16. He believed that employment was an important duracteristic of his target segment since the price point would be grecalca thanic average price in the industry The population of London in 1994 was approximately 300,000. Using information he received from the franchiser, anses figured that local monthly visits would be the product of both the specific month and the degree of local awareness of the store. Fur comple, in the store's first month of operation, targeted for April 1995, he predicted that the seasonality" factor would be 20 person, presus a high of 100 percent in July and the acness Factor 10 percent, versus a bighof 80 per cent ty November. Since the product of these was seven per cunt, le figured that seven per cent of 300,000, or 21,000 people, would be included in the predisposed huse for the month of April. He thon predicted that, of this buse, one in twenty would visit the stere. He was the roomh of April, 1,050 individuals from the local population would visite. In addr- toll, James essed that 120 tourists would visit the Slace each month. The predicted seasonality factor, the awareness factor and projected monthly sales are listed in Exhibit 2 The fianchiser also provide the Udderlies with frequency of purchase dato, broken down by product, hased on the experience and Vancouver. Only 10 percent of all individuals this entered the store left wiobaking any purchase of the remaining 90 per ceni, 65 per cent purchased only ice cream, 10 per cont purchased only arcoil product and 25 percent purchased both James estimated that the average expet- ditures per customer would be two dollars for socce and $20 for retbil Using this methodology, James estimusted year one (Ap.1995 to March 31, 1990) and year twin (April 1, 1996 to March 31, 1997) retail ales to be $320,450 W 542052 respectively loo ercam sales were projected to be $82,400 and 5:39.384 i Cirst years FRANCHISE REQUIREMENTS herecline had sell developed stuse design standards and specifications, which incluid what itens weit Se old. For example, the franchiser preseribed that a specifie Toronto-based Anterior design firm dmw the store plans according to SL slandards. Also, all retail merchandise and ice cream product had to be sourced through the franchise, and the lee cream had to be served in a certain way, machading weighing each cone before it was served. James considered Gable very open-minded about my suggestion and always willing to negotiate in good faith. The restrictions were moant ma quality control on the products that bore the same. James was assured that the franchisor would be very supportive throughout the start-up prooess. Besides supplying James with market Information, the franchiser would also equlp him with manuala and systema that proved to be effective at the other locations, plus source equipment and fixtures for the store. Also, a team from PEI would help set up the store, train the staff and solve any inilinl probleme. The franchise fee was $60,000 due upon signing the agreement. James knew that this fee, an asset, could be amortized on a straight-line basis over 10 years. The agreement also stipulated a royalty of eight per cent of sales, as well as a requirement thint the Udderlies spend at least two per cent of sales on local advertising. FINANCING The Udderlies used their fleste meeting with Paul MacNeil, an account manager with the Confederation Bank, to build support for the city concept. They presented MacNeil with the preliminary market research, their Tevenue projections, pholos of the store in PE1, and a mail-orcher catalogue. MacNeil was generally opti- mistie about both the idea and his ability to work with the Udderlics. MacNeil was also cognizant that the Caniederstion Bank hnd yet to build a strong customer base in the London area and was looking to secure more clients to establish a better presence. At the second moeting, the Udderlies informed MacNeil tlet they hud received a verbal offer from the franchiser le negotiate a deal. In addition, they had chosen a site for the store and had begun negotiating a lease with the owner. The chosen location was an Richmond Row, on the corner of Richmond Sired and Central Arenas, across from Victoria Park. Richmond Row contained a mmber of unique upscale retail Wres just north of the downtown anca. Victoria Park featured a number of free concerts in the summer and a popular quldeer skating rink open to the public in this winter. James expressed his concem that tuning was crilical since the whole deal was contingent on the financing, and he would seen be receiving written offers from boty fuis perspective landlord and the franchiser. All this second meeting, James also provided MacNeil will costs estimates. Start-up costs would include $160,000 for equipment md leasehold improvements which would be depreciated on a straight line basis over 10 years. Opening inntilory, including ice cream, would be $100,000 and all payables were due to the franchiser on a net 30-day basis. Iemes cstimated average in culory, far die next two years, to be about the same amount. Other starlap costs, such as training and other administrative costs, mould total $25,000 and could be expenses in the first year. Projected variable costs were 54 per cent of sales for it cream and 68 per cent of retail sales and included labour. Operating costs, including the manager's salary and real, would be $7,000 per month and the Udderlies would receive a management fee of $500 per month Operating costs would likely increase with intlation, which was cutimated to be duce per cent, but Cow's prices would not. The tax rate was projected to be 22 per cent. James anticipated maintaining a minimum cash balance of approximately $5.000. MacNeil outlined his initial thoughts to the Uddevies. The Udderlies would have to provide a significant amount of collateral and he would need to include several loan covers to any agreement. However, the Udderlies would likely quality for a federal program which encouraged small business start-ups while limiting down-ide risk. Specifically, the Canadian Federal Government made loans to start up suall businesses, under the Small Business Laans Act, as part of its mandate to encourage cutecpencurs to develop enterprises. The Ontario Provincial Government had www ventures loan program which tended to offer small amounts of funding econuing to Muenchendwantages of using these programs were that there would be lewer ta lateral and covenant requirements and the rest rate on these loans was typically in the prime nus per cent range. Currently, the printer the rate at which the Bank's best customers could borrow, was seven per cent Principale-puyment would take 10 years, with one-cents of the original loan and teach yet sining at the end of the first year Mine leil could nomage the whole loan process for this Parl An Assessment of the Firm and its Cash Needs Udderlies, Including any term facility secured from the two levels of goverment, and awy operating Yine of credit received from the Confederation Bank. The Udderlies felt that, given their life cycle stage, they could invest all of their liquid sets, about $150,000, but had to limit the collateral. Given the various stnet-up costs and initial inventory requirements, the Udderlies estimated the need for $160,000 in term loan francing, as well as in operating loan to meet seasonal and other short-term needs. It was anticipated that peak seasonal financing needs would oceur between January and Morch. ECONOMIC OUTLOOK The province of Quebec was scheduled to have a general election in the fall of 1994. The Parti Qubcois, a political party whose platform centered on Quebec's secession from Canada, wos ahead in the popularity pols. This, along with the fact that Canada had the highest per capita debt levcis among the major industri- alized countries, had made foreigners leery of investing in Canada. The result was a Canadian dollar that was experiencing increased volatility relative to other currencies and that required intervention by the Bank of Canada to protect its value by increasing sliort-term interest rates. The effect on the bond market was a neticeable widening of the Canada-U.S. istuiest rates spread to about 1.50 por cent from 1.15 per cent in April 1994 Canadian economic indicators were showing increasing streepth on the domestic from as retail sales were -12 1.3 per ecet in bott: February and March of 1994 over the previous month. These results were partly off le by a weaker trade performance. Nevetlicles, rcal gross domestic prexuet (GDP) increased by 0.5 per cent in March and by diree per cent in the first quarter of 1994 over the same period a year previously. The inflation environment remained very good with the annual consumer price iadca (CPD) increasing only by 0.2 per cent and wuge selements averaging wp0.5 per cent during the first three months of the year over the sonte period a year earlier. DECISION The Udderlies were passionate about the franchising idea. Thucy both loved ice cream and found to be unique and ceiling. They considered the comequence tuned out to be simply a fud The costs that the Udderlice wood Incur to start up the store were significant, and the store waald need to geticent TOCOMIC, over number of years to guarantee that the loans were covered. They were confident that was not simply a fod since the ice cream was of very good quality and the retail line was a social satice and was, ther- focc. perpetually renewable. The Udderlics know that the ice cream might to moderately cikcal and was certainly seasonal, despite the franchiser's Delive development of products aimed at smoothing revenge flow, and spendered how that would affect their ability to repay any lonne in order to prepare for his next moeing with MacNeil, James needed to calentate their cual needs and can down to develop proforma Bancial statemenis. Exhibit 1 SELECTED MARKET RESEARCH 1993 Population Ave. Annual Growth Rate Per Caplla Income Per Capita Retail Sales Huron County Parth County Oxford County Middlesex County (includes London Elgin County Lamblon County 60,200 71,200 95,600 387,300 1.03% 0.95% 1.62% 2.21% $ 14,600 18,100 16,400 19,000 $5,200 5,700 5,800 5,700 77,300 130 400 1.36% 0.65% 15,700 18.200 5,800 8,500 Number of Individuals in the Labour Force, Ontario, 1991 Number of Individuals in the Labour Force, London, 1991 Families in Private Houseboks, Total, Londen, 1993.. Total Supermarkets and Grocery Retail Sales, Canada, 1993 Tourian Expenditure on Food and Beverage, London, 1989 Estimated Number of Tourists, London, 1993. 5,511,233 169.245 102,935 $14.4 babien $59.4 million 300,000 SourcesThe London Vloes and Conversion Bundy, The Financial Post, Stad Canada Exhibit 2 ESTIMATED SEASONALITY AND AWARENESS FACTORS AND FORECASTED MONTHLY SALES Sales Month April 1995 May June July August Seplember October November December January 1996 February March Seasonality 0.70 0.85 0.95 1.00 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 Awareness 0.1 0.2 0.3 0.4 0.6 0.6 0.7 0.8 0.8 0.8 $ 9,288 21,148 34,808 48,470 60,350 43,718 42,530 29,462 29,482 24,710 24,710 34 214 0.8 0.8 $ 402,850 Total (liscal year 1995-96) April 1996 -- May June July Augus! September October November December 0.70 0.85 0.95 1.00 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 0.8 0.6 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 67.478 81,734 91,238 95,990 96,990 57,974 48,470 29,462 29,462 24.710 24.710 34.21 January 1997 February March $681-436 Total (liscal year 1996-97) ncial Forecast Case.pdf Download Print ETUN Case = els In September 1994, James and Serena Udderlie were preparing a loan application to a London, Ontario branch of the Confederation Bank of Canada. The Udderlies were requesting a $160,000 term loan, in addition to an operating loan, for the potential opening of CL ice cream and clothing franchise in London. The Udderlies had a considerable amount of marketing research and cost estimates, and in order to complete the application, they needed to develop proforma income statements and balance sheets for the stores first two years of operation. They also planned to review carefully the qualitative characteris tics of their idea in order to assess the chances of success of a franchise in London. The Udderlies also wondered what collateral, if any, they would be able to provide the banks to secure against a loan, and what other terms the bank might deem nccessary. HISTORY OF GL CL began in 1983 on Prince Edward Island (P.E.1.), Canada, as a single outlet producing and selling ice cream made from a time-honoured family recipe. However, the clothing with whimsical imagery that the staff wore as uniforms began attracting attention and the company soon expanded to include a retail line, which was 75 to 80 items deep by 1995. The retail line, which included such items as t-shirts, sweatshirts, pins and mooing cookie jars, was subsequently offered by mail order in 1991.C began der the supervision of Professor Steve Foster setely to pro ustaleither effective or in takich listing with the opening of a store in Vancouver, British Columbin in 1993, and later opened stores in Punk Clty, Umb and Whistler, British Columbia CL sold only premium ice cream, with ingredients that included dairy fresh crown, sugar, fresh eggs and puro vanilln. Also, the ice cream included very little of the air found in most commercial ice creams to Increase volume. All loe cream was served in a fresh waffle conc made at the ice cream counter in full view of the customers. When customers ordered their conte, they often selected from colourful names such as Customers were treated to a complete experience at CL. The staff were very friendly and were will- Ing to give customers a sample before they decided on an ice cream flavour. All stores were innovatively deo- crated to incinde clocks displaying both the local and PB.I. time, as well as an ice crearn menu shaped as a cow with a swinging tongue. But most important to the experience were the clothing items with witty satir. jal designs and captions. Cllg founder, Cobie Gable, still managed the company in July 1994. The company's creative director, Marc Gallant, a well-known PE1. artist, had recently passed away. While Gable was responsible for most of the business decisions that had brought t His success, Gailant was to crentive person behind the art work on the whimsical clothing. Gallant's creativity, inspired by his fasciialion with cows, was preserved by siv- ing many of his preliminary designs in ner that could easily be manipulated by his creative team to develop new designs JAMES AND SERENA UDDERLIE James Udderlic was the Dirdar of Market Development in the limployee Benefits Division of the Provincial Life Insurance Company. He completed hia MBA from the Western Business School in 1983 and joined Provincial in the same year. Although successful and haply in his current position, au James noted, being citepreneur is in the back of the mind of most business school graduates." Serena Udderlio was a spe- educatinn Ichcher who was curitntly volunteering the dny a week while managing their three children Hime, inchading the youngest child who had not yet entered public school. Serena planned on reluming tu werk full-time once their ungest child was in school. She received a Bachelor of Ans, Bachelor art Education and a Master of Education from the University of Western Ortado, and was the gold medalist while opening the Master's degree. Serena, like Ist husband was excited to open up a furnily business Ddderlies tequired that any business they waited would neicher alleet James commitment la Provincial Life mor their commitment to their family. While James and Serena accepted dual changes would TIesary to the family routine, hey did not want their children to sullur because or the business and discussed it will hear before making a final decision. The Calderlics were made the fusion about the commitment they would have to make to the venture, but they anticipated that if they were to hire a full-time person to manage their investment in the eme regalement could be kept to manageable level. They Febreir regularne bemel in London since the duce locations, the tentative behen of the sore, Provincial Lilet and would only be a short distance from cache Jmnes and Serena planted to conne, wit ench was so pekarthe business. James would be responsible for strelcgie plein. Go and general mancato Seren would take care of hiring the stall and marketing they wont bodiake duns meeting with their manager on a weekly basis to keep labs on the western reviewing thing tower and an emotious. THE IDEA "The idea for the Ludhise came about wheeled Yamily was camping en El in the summer 1992. At that the wanase ce cream that caught in atention Windrucktes was the wholesamunal of the layout the depicted a young boy wear mg clothing with the distinctive at and leaving fun eniglie cream. Later their neighbours the campsite said they cijele more y Misine and see the liderlles visited the store themselves, they were greatly impressed i Cewexperiene. lit part, they noticed the dressing clothing and is displays, duard and has been opened Drevent modification. Enable Editing 44 Part 1 An Assessment of the Fire the store's layout, the friendliness of the staff and most importantly, the delicious ice cream. After the Udderlies inquired about franchising. a company representative told them that the first company franchise was to open later that summer in Vancouver, Baltish Columbia and that no other franchises were being con- sidered. The representative advised the Udderlies that if they were to write a letter outlining their desire to own a franchise, the company wondd get back to them. The Uddedlies had a strong conviction that the uc L's concept would work in London The first decision the Uddedlies had to make wat whether or not to invest time examining the feasibility of a franchise before taking the idea to a financial institution for possible financing. It was not wait the summer of 1994 that the Udderlies decided to write to dla tepresentatives, at which time they received a favourable response inviting them to visit the company in PEL James travelod alone to PE.I. in July 1994 and spent three days meeting with the franchiser and learning more about the company. During this time, it became obvious to James that while was a profitable business, a franchisco hnd to want more than just profit from owning a store. The company's core values included a strong persuasion for quality and creativ ity that made owning a store an expensive proposition. It was believed that only by following these values would a store have all the elements necessary for it to be successfiol. MARKET RESEARCH James brouglu with him te P.E.1. some preliminary market research that he had gathered from Statistics Canada, the Conference Board of Canada and the Convention Bureau of London. He felt that it was in this area that his MBA helped him most be knew lire to differentiate the important information from the intelevant as well as how to deal will incomplete taket information. From the research, he gathered two lesy pieces of information: Aggregate spending on take-out food in the London area and an estimate of the albumber of visitors to Londra, The information in Exhibit 1 was meant to give Jamesa Buse of how many potential Le crustomers existed and the extent of their buying power. He focused on the counties around London James figured that his largel segment would include tourists, local employed families, and local non- married-employed individuals not the age of 16. He believed that employment was an important duracteristic of his target segment since the price point would be grecalca thanic average price in the industry The population of London in 1994 was approximately 300,000. Using information he received from the franchiser, anses figured that local monthly visits would be the product of both the specific month and the degree of local awareness of the store. Fur comple, in the store's first month of operation, targeted for April 1995, he predicted that the seasonality" factor would be 20 person, presus a high of 100 percent in July and the acness Factor 10 percent, versus a bighof 80 per cent ty November. Since the product of these was seven per cunt, le figured that seven per cent of 300,000, or 21,000 people, would be included in the predisposed huse for the month of April. He thon predicted that, of this buse, one in twenty would visit the stere. He was the roomh of April, 1,050 individuals from the local population would visite. In addr- toll, James essed that 120 tourists would visit the Slace each month. The predicted seasonality factor, the awareness factor and projected monthly sales are listed in Exhibit 2 The fianchiser also provide the Udderlies with frequency of purchase dato, broken down by product, hased on the experience and Vancouver. Only 10 percent of all individuals this entered the store left wiobaking any purchase of the remaining 90 per ceni, 65 per cent purchased only ice cream, 10 per cont purchased only arcoil product and 25 percent purchased both James estimated that the average expet- ditures per customer would be two dollars for socce and $20 for retbil Using this methodology, James estimusted year one (Ap.1995 to March 31, 1990) and year twin (April 1, 1996 to March 31, 1997) retail ales to be $320,450 W 542052 respectively loo ercam sales were projected to be $82,400 and 5:39.384 i Cirst years FRANCHISE REQUIREMENTS herecline had sell developed stuse design standards and specifications, which incluid what itens weit Se old. For example, the franchiser preseribed that a specifie Toronto-based Anterior design firm dmw the store plans according to SL slandards. Also, all retail merchandise and ice cream product had to be sourced through the franchise, and the lee cream had to be served in a certain way, machading weighing each cone before it was served. James considered Gable very open-minded about my suggestion and always willing to negotiate in good faith. The restrictions were moant ma quality control on the products that bore the same. James was assured that the franchisor would be very supportive throughout the start-up prooess. Besides supplying James with market Information, the franchiser would also equlp him with manuala and systema that proved to be effective at the other locations, plus source equipment and fixtures for the store. Also, a team from PEI would help set up the store, train the staff and solve any inilinl probleme. The franchise fee was $60,000 due upon signing the agreement. James knew that this fee, an asset, could be amortized on a straight-line basis over 10 years. The agreement also stipulated a royalty of eight per cent of sales, as well as a requirement thint the Udderlies spend at least two per cent of sales on local advertising. FINANCING The Udderlies used their fleste meeting with Paul MacNeil, an account manager with the Confederation Bank, to build support for the city concept. They presented MacNeil with the preliminary market research, their Tevenue projections, pholos of the store in PE1, and a mail-orcher catalogue. MacNeil was generally opti- mistie about both the idea and his ability to work with the Udderlics. MacNeil was also cognizant that the Caniederstion Bank hnd yet to build a strong customer base in the London area and was looking to secure more clients to establish a better presence. At the second moeting, the Udderlies informed MacNeil tlet they hud received a verbal offer from the franchiser le negotiate a deal. In addition, they had chosen a site for the store and had begun negotiating a lease with the owner. The chosen location was an Richmond Row, on the corner of Richmond Sired and Central Arenas, across from Victoria Park. Richmond Row contained a mmber of unique upscale retail Wres just north of the downtown anca. Victoria Park featured a number of free concerts in the summer and a popular quldeer skating rink open to the public in this winter. James expressed his concem that tuning was crilical since the whole deal was contingent on the financing, and he would seen be receiving written offers from boty fuis perspective landlord and the franchiser. All this second meeting, James also provided MacNeil will costs estimates. Start-up costs would include $160,000 for equipment md leasehold improvements which would be depreciated on a straight line basis over 10 years. Opening inntilory, including ice cream, would be $100,000 and all payables were due to the franchiser on a net 30-day basis. Iemes cstimated average in culory, far die next two years, to be about the same amount. Other starlap costs, such as training and other administrative costs, mould total $25,000 and could be expenses in the first year. Projected variable costs were 54 per cent of sales for it cream and 68 per cent of retail sales and included labour. Operating costs, including the manager's salary and real, would be $7,000 per month and the Udderlies would receive a management fee of $500 per month Operating costs would likely increase with intlation, which was cutimated to be duce per cent, but Cow's prices would not. The tax rate was projected to be 22 per cent. James anticipated maintaining a minimum cash balance of approximately $5.000. MacNeil outlined his initial thoughts to the Uddevies. The Udderlies would have to provide a significant amount of collateral and he would need to include several loan covers to any agreement. However, the Udderlies would likely quality for a federal program which encouraged small business start-ups while limiting down-ide risk. Specifically, the Canadian Federal Government made loans to start up suall businesses, under the Small Business Laans Act, as part of its mandate to encourage cutecpencurs to develop enterprises. The Ontario Provincial Government had www ventures loan program which tended to offer small amounts of funding econuing to Muenchendwantages of using these programs were that there would be lewer ta lateral and covenant requirements and the rest rate on these loans was typically in the prime nus per cent range. Currently, the printer the rate at which the Bank's best customers could borrow, was seven per cent Principale-puyment would take 10 years, with one-cents of the original loan and teach yet sining at the end of the first year Mine leil could nomage the whole loan process for this Parl An Assessment of the Firm and its Cash Needs Udderlies, Including any term facility secured from the two levels of goverment, and awy operating Yine of credit received from the Confederation Bank. The Udderlies felt that, given their life cycle stage, they could invest all of their liquid sets, about $150,000, but had to limit the collateral. Given the various stnet-up costs and initial inventory requirements, the Udderlies estimated the need for $160,000 in term loan francing, as well as in operating loan to meet seasonal and other short-term needs. It was anticipated that peak seasonal financing needs would oceur between January and Morch. ECONOMIC OUTLOOK The province of Quebec was scheduled to have a general election in the fall of 1994. The Parti Qubcois, a political party whose platform centered on Quebec's secession from Canada, wos ahead in the popularity pols. This, along with the fact that Canada had the highest per capita debt levcis among the major industri- alized countries, had made foreigners leery of investing in Canada. The result was a Canadian dollar that was experiencing increased volatility relative to other currencies and that required intervention by the Bank of Canada to protect its value by increasing sliort-term interest rates. The effect on the bond market was a neticeable widening of the Canada-U.S. istuiest rates spread to about 1.50 por cent from 1.15 per cent in April 1994 Canadian economic indicators were showing increasing streepth on the domestic from as retail sales were -12 1.3 per ecet in bott: February and March of 1994 over the previous month. These results were partly off le by a weaker trade performance. Nevetlicles, rcal gross domestic prexuet (GDP) increased by 0.5 per cent in March and by diree per cent in the first quarter of 1994 over the same period a year previously. The inflation environment remained very good with the annual consumer price iadca (CPD) increasing only by 0.2 per cent and wuge selements averaging wp0.5 per cent during the first three months of the year over the sonte period a year earlier. DECISION The Udderlies were passionate about the franchising idea. Thucy both loved ice cream and found to be unique and ceiling. They considered the comequence tuned out to be simply a fud The costs that the Udderlice wood Incur to start up the store were significant, and the store waald need to geticent TOCOMIC, over number of years to guarantee that the loans were covered. They were confident that was not simply a fod since the ice cream was of very good quality and the retail line was a social satice and was, ther- focc. perpetually renewable. The Udderlics know that the ice cream might to moderately cikcal and was certainly seasonal, despite the franchiser's Delive development of products aimed at smoothing revenge flow, and spendered how that would affect their ability to repay any lonne in order to prepare for his next moeing with MacNeil, James needed to calentate their cual needs and can down to develop proforma Bancial statemenis. Exhibit 1 SELECTED MARKET RESEARCH 1993 Population Ave. Annual Growth Rate Per Caplla Income Per Capita Retail Sales Huron County Parth County Oxford County Middlesex County (includes London Elgin County Lamblon County 60,200 71,200 95,600 387,300 1.03% 0.95% 1.62% 2.21% $ 14,600 18,100 16,400 19,000 $5,200 5,700 5,800 5,700 77,300 130 400 1.36% 0.65% 15,700 18.200 5,800 8,500 Number of Individuals in the Labour Force, Ontario, 1991 Number of Individuals in the Labour Force, London, 1991 Families in Private Houseboks, Total, Londen, 1993.. Total Supermarkets and Grocery Retail Sales, Canada, 1993 Tourian Expenditure on Food and Beverage, London, 1989 Estimated Number of Tourists, London, 1993. 5,511,233 169.245 102,935 $14.4 babien $59.4 million 300,000 SourcesThe London Vloes and Conversion Bundy, The Financial Post, Stad Canada Exhibit 2 ESTIMATED SEASONALITY AND AWARENESS FACTORS AND FORECASTED MONTHLY SALES Sales Month April 1995 May June July August Seplember October November December January 1996 February March Seasonality 0.70 0.85 0.95 1.00 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 Awareness 0.1 0.2 0.3 0.4 0.6 0.6 0.7 0.8 0.8 0.8 $ 9,288 21,148 34,808 48,470 60,350 43,718 42,530 29,462 29,482 24,710 24,710 34 214 0.8 0.8 $ 402,850 Total (liscal year 1995-96) April 1996 -- May June July Augus! September October November December 0.70 0.85 0.95 1.00 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 0.8 0.6 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 67.478 81,734 91,238 95,990 96,990 57,974 48,470 29,462 29,462 24.710 24.710 34.21 January 1997 February March $681-436 Total (liscal year 1996-97)