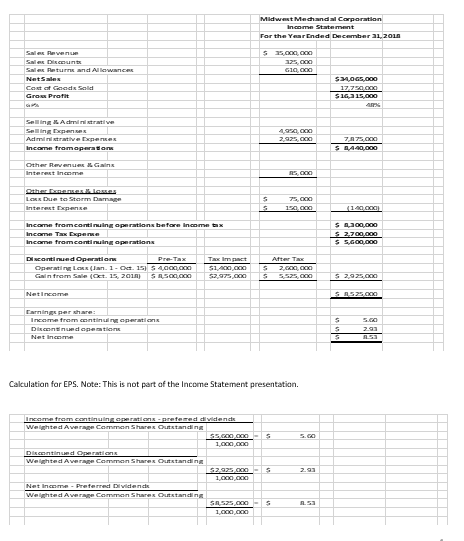

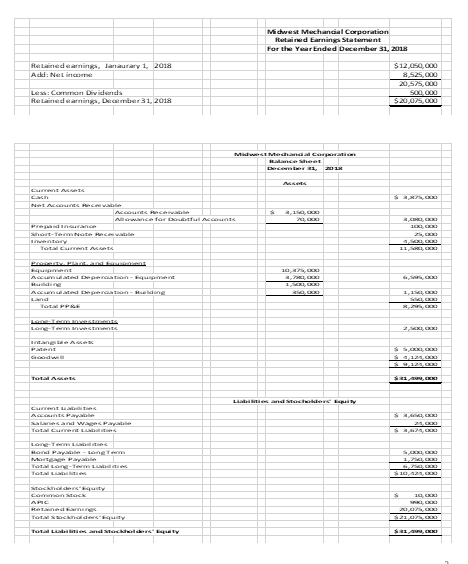

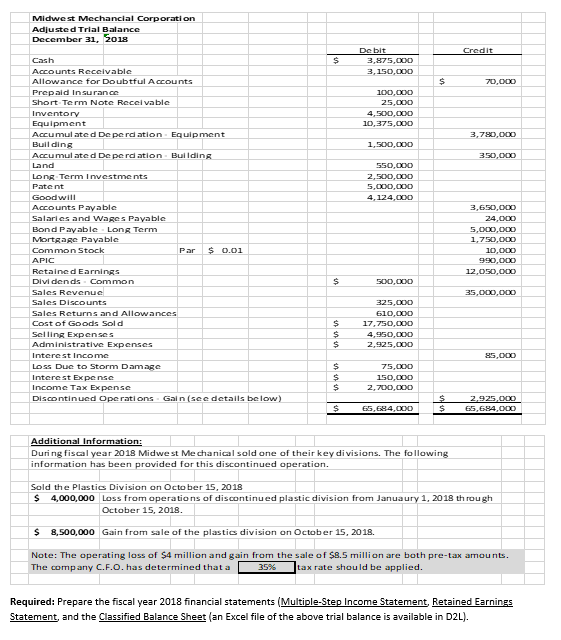

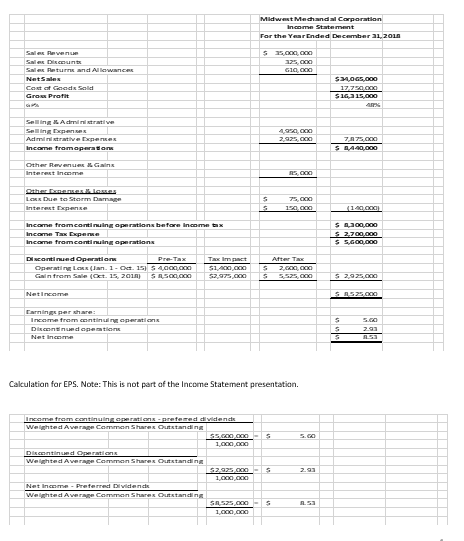

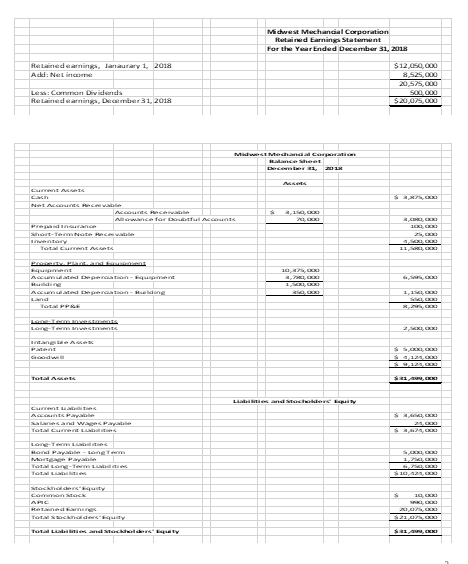

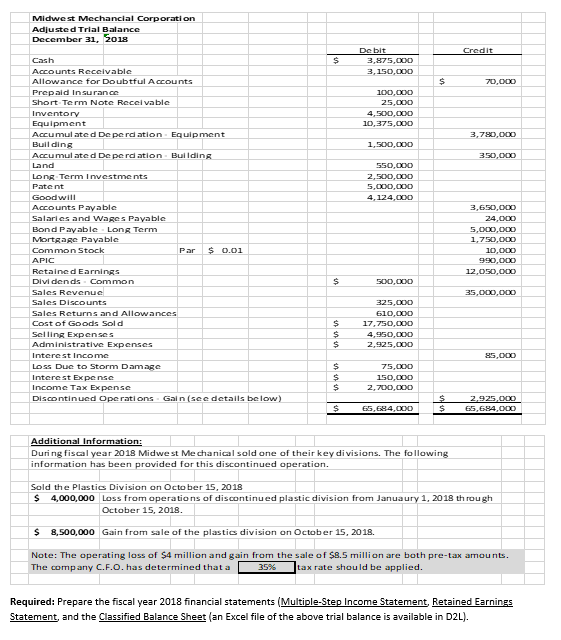

Midwest Mechandal Corporation Income Statement For the Year Ended December 31, 2016 S 35.000 125,00 G10,000 Salven Sales Discount Sales Returns and Allowance Notes Cart of Solid Gro Profit SY.OG5,000 17730 GRO SIG 15.000 Song An Selling Expen Administrative Expres Income fromoperation 4.950 xx 2,925,000 ZA XXI S 0,4-40,000 Other Ravanu Interest Income RS,000 Other EU LAL Lor Due to Storm Damage Interest Expense S s 75, 120.000 (1,40.000 S0.000 5 2.700,000 S 5.600,000 Income from continuing operation before Income tax Income Tax Expense Income from continuing operations Discontinued Operation ProTax Taclmnet Operating Laran 1. ON 15 S 400C CCC $1,400.000 Gain from Sale (Oct. 15, 2011) S50000 After TA S 2.ccxx 5 5525, Net Income S 525.000 Earnings per share: Income from continuing operations Dicendone Net Income S S Calculation for EPS. Note: This is not part of the income Statement presentation. S.CO Income from continuing operations pratomed dividende Weighted Average Common Shares Outstanding SS.COOOOO 1.000.000 Discontinued Operations Weighted Average Common Shares Outstanding 52.925 000 S 1 000 000 Net Income - Preferred Dividence Weighted Average Common Saree Outstanding SR525.000-S 1.000.000 2.93 RSS Michwest Mechancial Corporation Retired Earning Statement For the Year Ended December 31, 2018 Retained earning, January 1, 2018 Ackl: Net $12,050,00 85.000 20.5A 500,000 $200,000 Less Communion Dividenda Ret Lined earning. Det er 31, 2018 A CA 34 XXX XX) XXX SNOW TOT CE A 11XX Arumulatial aran 2, XX Acceder La TOTIPPA XX KA, KARI XXXX $ 6,129, XX CELT and Way XXXX) |tal Parpattle - eneram ME Paya |tars i -Team Les 2002, XX quity ARE 5 16 XX) MERR ARRI danes Midwest Mechancial Corporation Adjusted Trial Balance December 31, 2018 Credit $ De bit 3,875,000 3,150,000 $ 70,000 100,000 25,000 4,500,000 10,375,000 3,780,000 1,500,000 350,000 550.000 2,500,000 5,000,000 4,124,000 Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Insurance Short Term Note Receivable Inventory Equipment Accumulated Deperdation Equipment Building Accumulated Deperdation Building Land Long Term Investments Patent Goodwill Accounts Payable Salaries and Wages Payable Bond Payable Long Term Mortgage Payable Common Stock Par $ 0.01 APIC Retained Earnings Dividends Common Sales Revenue Sales Discounts Sales Returns and Allowances Cost of Goods Sold Selling Expenses Administrative Expenses Interest Income Loss Due to Storm Damage Interest Expense Income Tax Expense Discontinued Operations Gain (see details below) 3,650,000 24,000 5,000,000 1,750,000 10,000 990,000 12,050,000 $ 500,000 35,000,000 $ $ $ 325.000 610,000 17,750,000 4,950,000 2,925,000 85,000 $ $ $ 75,000 150,000 2,700,000 $ 65,684,000 $ 2.925,000 65,684,000 Additional Information: During fiscal year 2018 Midwest Mechanical sold one of their key divisions. The following information has been provided for this discontinued operation. Sold the Plastic Division on October 15, 2018 $ 4,000,000 Loss from operations of discontinued plastic division from January 1, 2018 through October 15, 2018 $ 8,500,000 Gain from sale of the plastic division on October 15, 2018. Note: The operating loss of $4 million and gain from the sale of $8.5 million are both pre-tax amounts. The company C.F.O. has determined that a 35% tax rate should be applied. Required: Prepare the fiscal year 2018 financial statements (Multiple-Step Income Statement, Retained Earnings Statement, and the Classified Balance Sheet (an Excel file of the above trial balance is available in D2L)