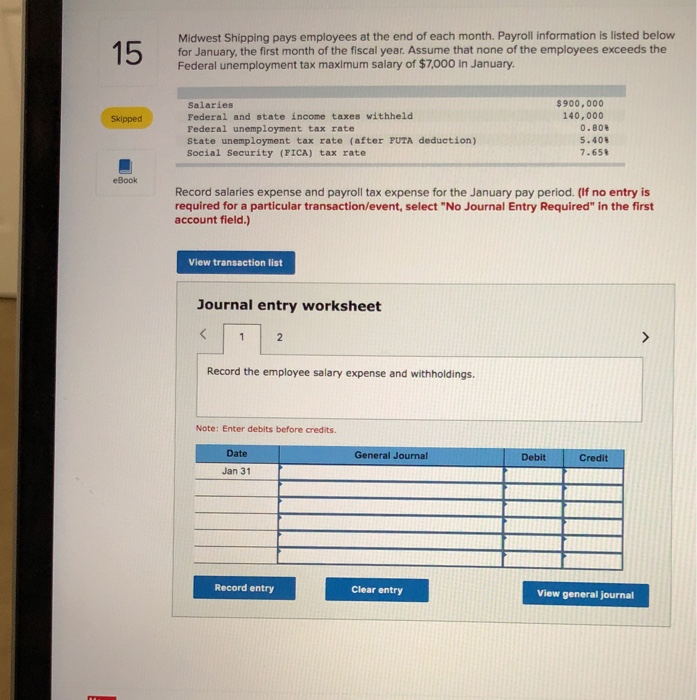

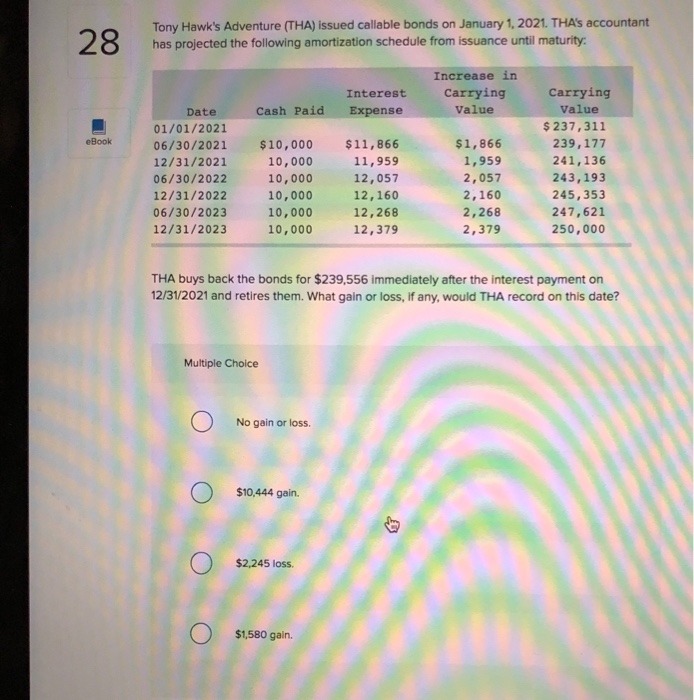

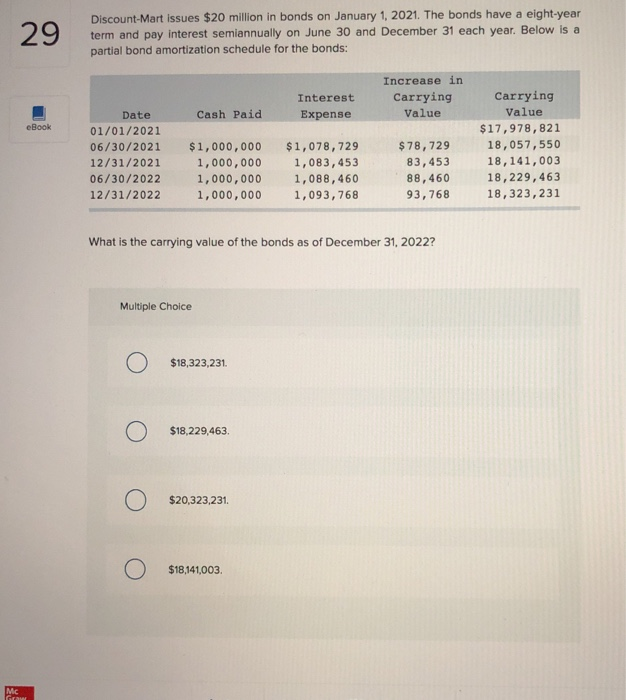

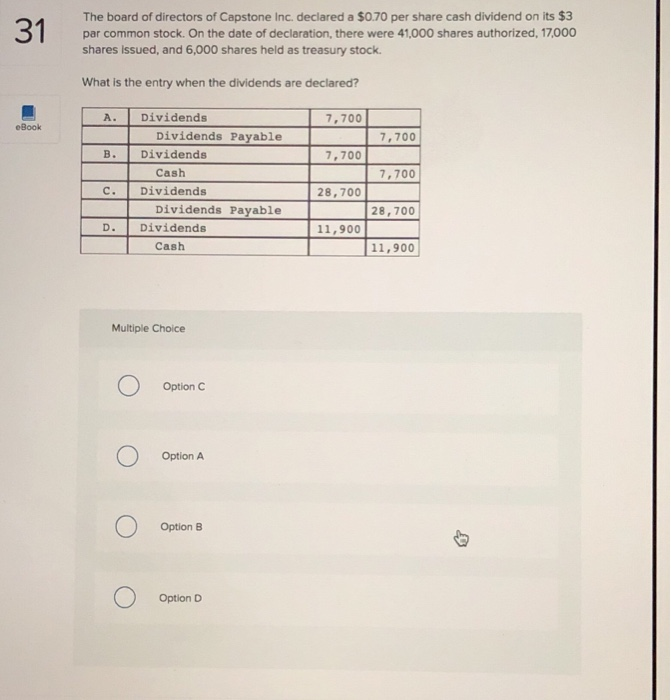

Midwest Shipping pays employees at the end of each month. Payroll information is listed below for January, the first month of the fiscal year. Assume that none of the employees exceeds the Federal unemployment tax maximum salary of $7,000 in January $900,000 140,000 Salaries Federal and state income taxes withheld Federal unemployment tax rate State unemployment tax rate (after PUTA deduction) Social Security (FICA) tax rate Skipped 0.80% 5.40% 7.65% eBook Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the employee salary expense and withholdings. Note: Enter debits before credits Date Debit Credit General Journal Jan 31 Record entry Clear entry View general journal Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity Increase in Carrying Value Carrying Value $ 237,311 Interest Cash Paid Expense Date 01/01/2021 eBook 06/30/2021 $10,000 11,866$1,866 239,177 1,959 2,057 2,160 2,268 2,379 241,136 243,193 245,353 247,621 250,000 10,000 10,000 11,959 12,057 12,160 12,268 12,379 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 10,000 10,000 10,000 THA buys back the bonds for $239,556 immediately after the interest payment on 12/31/2021 and retires them. What gain or loss, if any, would THA record on this date? Multiple Choice No gain or loss. $10,444 gain. $2,245 loss $1,580 gain. Discount-Mart issues $20 million in bonds on January 1, 2021. The bonds have a eight-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds: Increase in Interest Carrying Carrying Value Value $17,978,821 Cash Paid Expense Date eBook 01/01/2021 06/30/2021 1,000,000 $1,078,729 78,729 18,057,550 18,141,003 18,229,463 18,323,231 83,453 88,460 93,768 12/31/2021 1,000,000 1,083,453 06/30/2022 1,000,000 1,088,460 12/31/2022 1,000,000 1,093,768 What is the carrying value of the bonds as of December 31, 2022? Multiple Choice $18,323,231 $18,229,463 $20,323,231 $18,141,003 The board of directors of Capstone Inc. declared a $O.70 per share cash dividend on its $3 par common stock. On the date of declaration, there were 41,000 shares authorized, 17,000 shares issued, and 6,000 shares held as treasury stock What is the entry when the dividends are declared? A. Dividends 7,700 eBook Dividends Payable 7,700 B. Dividends 7,700 Cash 7,700 C. Dividends 28,700 Dividends Payable 28,700 11,900 D. Dividends Cash 11,900 Multiple Choice Option C Option A Option B Option D