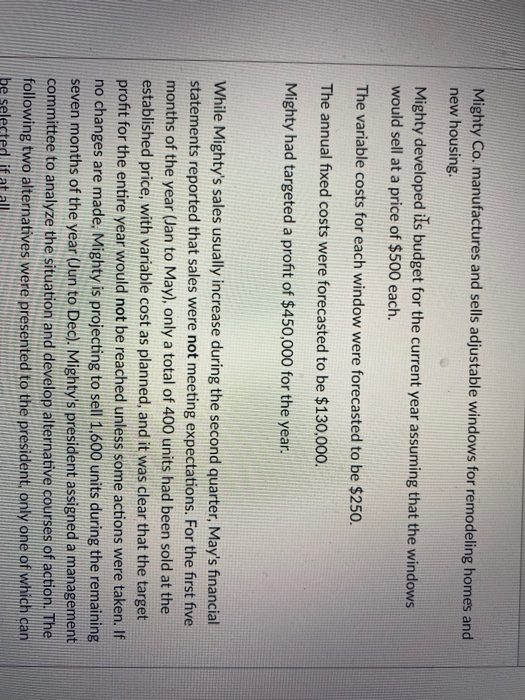

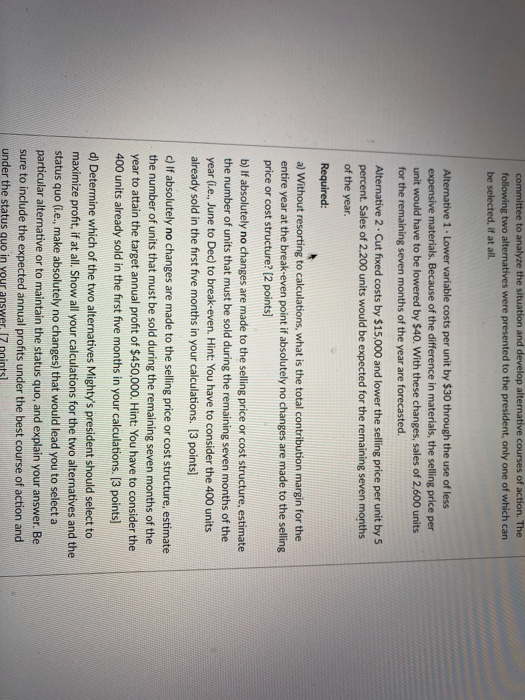

Mighty Co. manufactures and sells adjustable windows for remodeling homes and new housing. Mighty developed ils budget for the current year assuming that the windows would sell at a price of $500 each. The variable costs for each window were forecasted to be $250. The annual fixed costs were forecasted to be $130,000. Mighty had targeted a profit of $450,000 for the year. While Mighty's sales usually increase during the second quarter, May's financial statements reported that sales were not meeting expectations. For the first five months of the year (Jan to May), only a total of 400 units had been sold at the established price, with variable cost as planned, and it was clear that the target profit for the entire year would not be reached unless some actions were taken. If no changes are made. Mighty is projecting to sell 1.600 units during the remaining seven months of the year (Jun to Dec). Mighty's president assigned a management committee to analyze the situation and develop alternative courses of action. The following two alternatives were presented to the president, only one of which can ected if be se committee to analyze the situation and develop alternative courses of action. The following two alternatives were presented to the president, only one of which can be selected, if at all. Alternative 1. Lower variable costs per unit by $30 through the use of less expensive materials. Because of the difference in materials, the selling price per unit would have to be lowered by $40. With these changes, sales of 2,600 units for the remaining seven months of the year are forecasted. Alternative 2. Cut fixed costs by $15,000 and lower the selling price per unit by 5 percent. Sales of 2,200 units would be expected for the remaining seven months of the year. Required: a) Without resorting to calculations, what is the total contribution margin for the entire year at the break-even point if absolutely no changes are made to the selling price or cost structure? (2 points) b) If absolutely no changes are made to the selling price or cost structure, estimate the number of units that must be sold during the remaining seven months of the year (ie. June to Dec) to break-even. Hint: You have to consider the 400 units already sold in the first five months in your calculations. [3 points) c) If absolutely no changes are made to the selling price or cost structure, estimate the number of units that must be sold during the remaining seven months of the year to attain the target annual profit of $450,000. Hint: You have to consider the 400 units already sold in the first five months in your calculations. [3 points) d) Determine which of the two alternatives Mighty's president should select to maximize profit, if at all. Show all your calculations for the two alternatives and the status quo (i.e., make absolutely no changes) that would lead you to select a particular alternative or to maintain the status quo, and explain your answer. Be sure to include the expected annual profits under the best course of action and under the status quo in you answer. 17 points)