Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Mighty Machinery Company subscribes to the Healthy Family Medical Organization. Monthly insurance premiums are: employee without dependents, $350; employee with one dependent, $450;

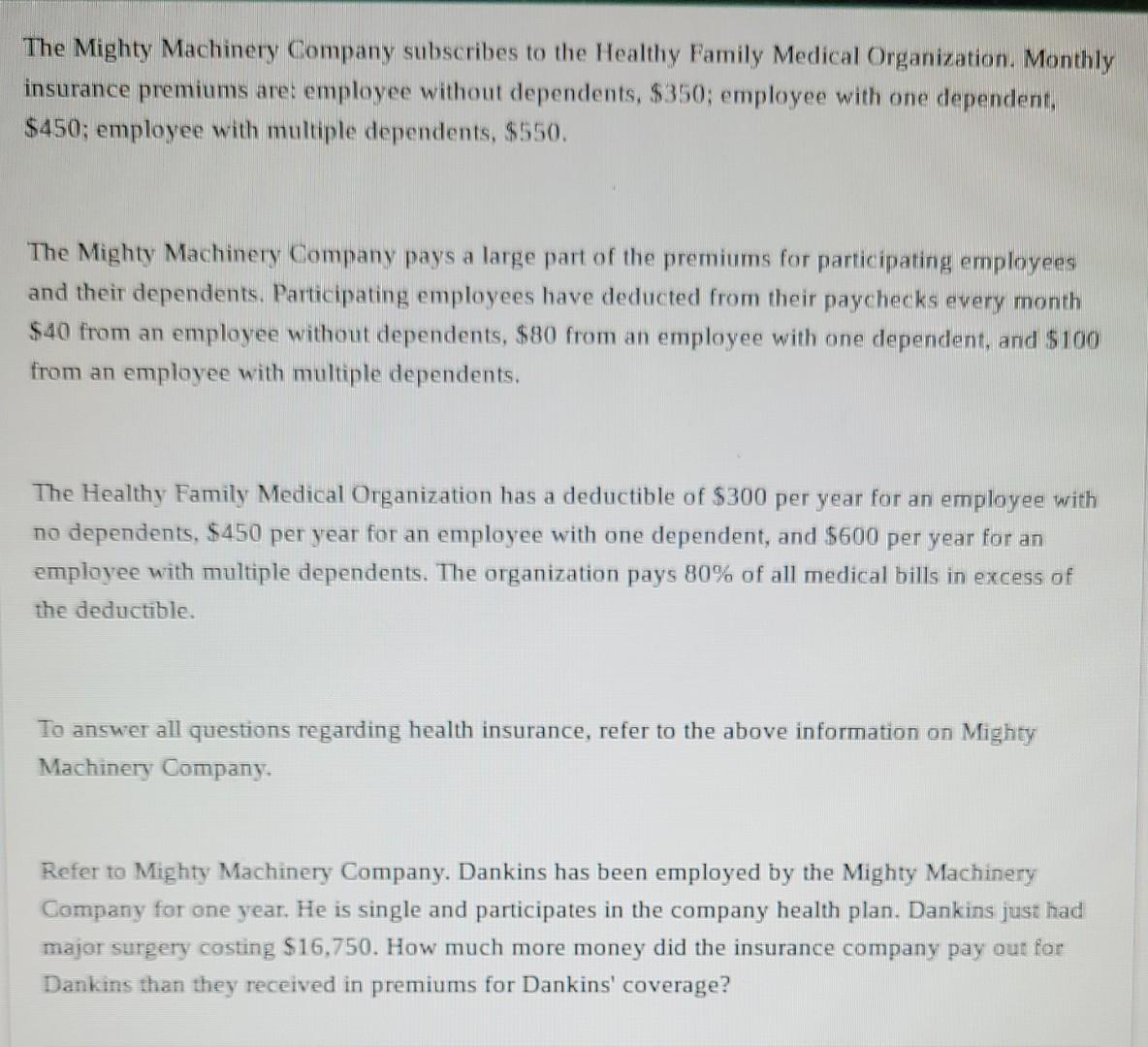

The Mighty Machinery Company subscribes to the Healthy Family Medical Organization. Monthly insurance premiums are: employee without dependents, $350; employee with one dependent, $450; employee with multiple dependents, $550. The Mighty Machinery Company pays a large part of the premiums for participating employees and their dependents. Participating employees have deducted from their paychecks every month $40 from an employee without dependents, $80 from an employee with one dependent, and $100 from an employee with multiple dependents. The Healthy Family Medical Organization has a deductible of $300 per year for an employee with no dependents, $450 per year for an employee with one dependent, and $600 per year for an employee with multiple dependents. The organization pays 80% of all medical bills in excess of the deductible. To answer all questions regarding health insurance, refer to the above information on Mighty Machinery Company. Refer to Mighty Machinery Company. Dankins has been employed by the Mighty Machinery Company for one year. He is single and participates in the company health plan. Dankins just had major surgery costing $16,750. How much more money did the insurance company pay out for Dankins than they received in premiums for Dankins' coverage?

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

alculation of Dankins claim amount from Healthy Family organization Amout of Insur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started