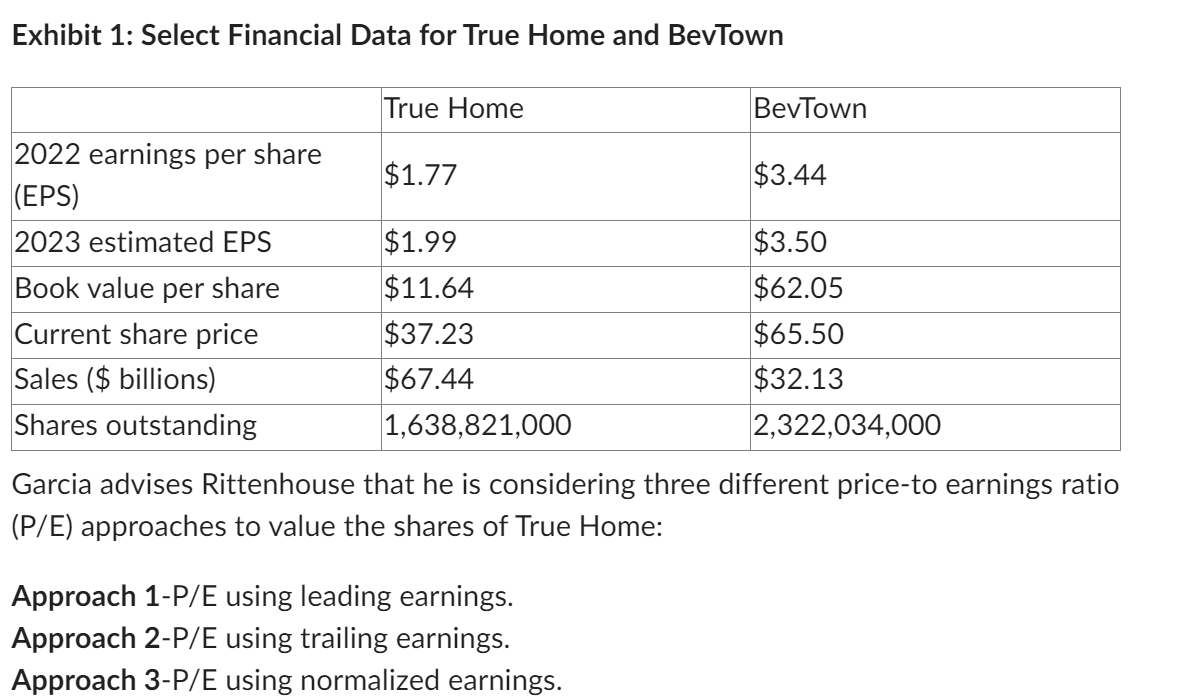

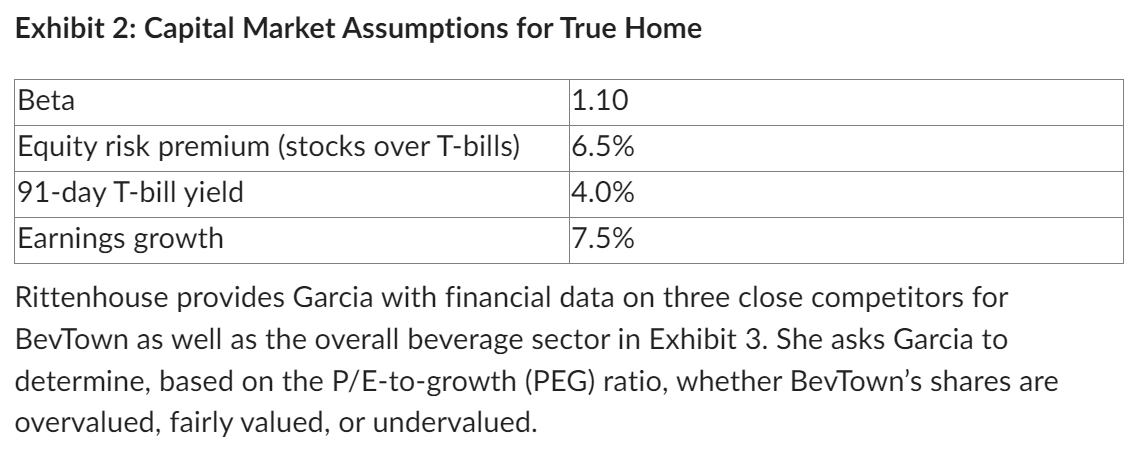

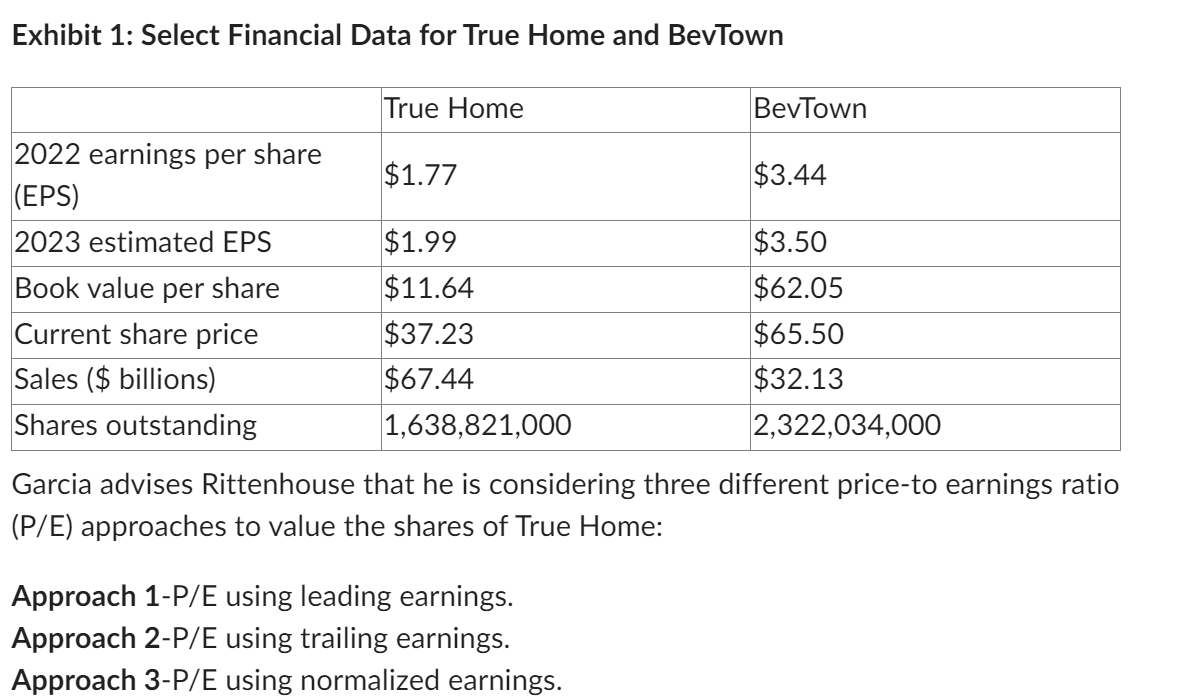

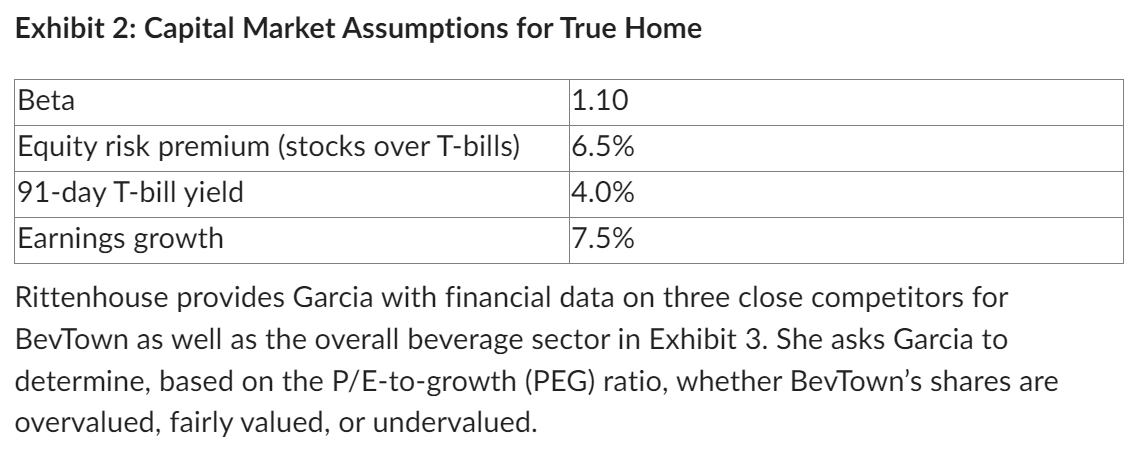

Miguel Garcia is updating research reports on two well-established consumer companies before first quarter 2023 earnings reports are released. - True Home is a major U.S. home builder. The home building industry is extremely cyclical; the industry was recently adversely affected by higher interest rates, rising inflation, and a decline in new home sales. - BevTown is a manufacturer and distributor of soft drinks and recently acquired major water bottling company to offer a broader product line. The acquisition will have a significant impact on BevTown's future results. His supervisor, Sharolyn Rittenhouse, has asked Garcia to use market-based valuations when updating the reports. Before approving Garcia's work, Rittenhouse wants to discuss the calculations and choices of ratios used in the valuation of True Home and BevTown. The data used by Garcia in his analysis are summarized in Exhibit 1. Exhibit 1: Select Financial Data for True Home and BevTown Garcia advises Rittenhouse that he is considering three different price-to earnings ratio (P/E) approaches to value the shares of True Home: Approach 1-P/E using leading earnings. Approach 2-P/E using trailing earnings. Approach 3-P/E using normalized earnings. Garcia tells Rittenhouse that he calculated the price-to-sales ratio (P/S) for True Home but chose not to use it in the valuation of the shares. Garcia states to Rittenhouse that it is more appropriate to use the P/E than the P/S because: Reason 1-P/S does not reflect differences in cost structures among different companies. Reason 2-Earnings are less easily manipulated by accounting methods than are sales. Reason 3-Surveys show P/E ranks first among price multiples used in market-based valuation. One of Garcia's co-workers, Martina Diaz, has gathered additional data for True Home which is shown in Exhibit 2. After Garcia brings this data to Rittenhouse's attention, Rittenhouse asks Garcia to also determine whether True Home is overvalued, fairly valued, or undervalued based on its justified price-to-book ratio (P/B). Exhibit 2: Capital Market Assumptions for True Home Rittenhouse provides Garcia with financial data on three close competitors for BevTown as well as the overall beverage sector in Exhibit 3. She asks Garcia to determine, based on the P/E-to-growth (PEG) ratio, whether BevTown's shares are overvalued, fairly valued, or undervalued. Based on the information in Exhibit 1 and Exhibit 2, Garcia would conclude that True Home's shares are based on justified P/B. overvalued fairly valued undervalued