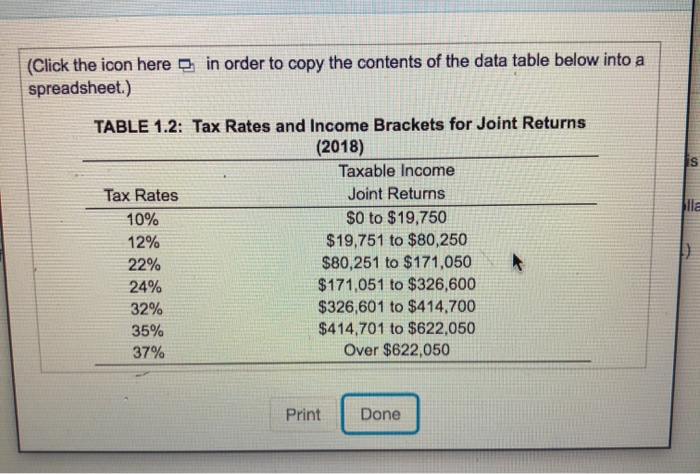

Mike and Julie Bedard are a working couple. They will faoint income tax retum. This year they have the following taxable income: 1. $121,000 from salary and wages (ordinary income). 2. $5,000 in interest income 3. $5,000 in dividend income. 4. 54.000 in profit from sale of a stock they purchased two years ago 5. $1,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 12. to work this problem a. How much will Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julle pay in federal income taxes on 3 above? (Note: Remember that dividend income is taxed differently than ordinary income) c. How much will Mike and Julie pay in federal income taxes on 4 above? d. How much will Mike and Julie pay in federal income taxes on above? a. The amount Miko and Julie will pay in federal income taxes on 2, their interest income, is SL (Round to the nearest dolar) b. The amount Mike and Julie will pay in federal income taxes on their dividend income, is (Round to the nearest dolar) (No Remember that dividend income is twed differently than ordinary income.) c. The amount Mke and Julie will pay in federal income taxes on 4, the profit from the sale of stock that they purchased two years ago, iss (Round to the nearest dollar) d. The amount Mike and Julie will pay in federal income taxes on 5, the profit on the sale of stock they purchased and sold the year, is (Round to the nearest dolar) (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) s TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2018) Taxable income Tax Rates Joint Returns 10% $0 to $19,750 12% $19,751 to $80,250 22% $80,251 to $171,050 24% $171,051 to $326,600 32% $326,601 to $414,700 35% $414,701 to $622,050 37% Over $622,050 D Print Done Mike and Julie Bedard are a working couple. They wil file a joint income tax rebum. This year they have the following taxable income: 1. $121,000 from salary and wages (ordinary income). 2. $5,000 in interest income 3. $5.000 in dividend income 4. 54.000 in profit from sale of a stock they purchased two years ago 5. $1,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 12. to work this problem a. How much will Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julie pay in federal income taxes on 3 above? (Note: Remember that dividend Income is towed differently than ordinary income) c. How much will Mike and Julle pay in federal income taxes on 4 above? d. How much wil Mike and Julie pay in federal income taxes on 5 above? 1. The amount Mike and Julie will pay in federal income taxes on 2, their interest income, is (Round to the nearest dollar) b. The amount Mike and Julie will pay in federal income taxes on 3, their dividend income, a. (Round to the nearest dollar) (Motor Romember that dividend income is taxed different than ordinary income) c. The amount Mike and Julie will pay in tederal income taxes on 4, the profit from the sale of stock that they purchased two years ago. Round to the nearest dolar) d. The amount Miko and Julio will pay in federal income taxes on 5, the profit on the sale of stock they purchased and told this year, i Round to the nearest dollar) Mike and Julie Bedard are a working couple. They will faoint income tax retum. This year they have the following taxable income: 1. $121,000 from salary and wages (ordinary income). 2. $5,000 in interest income 3. $5,000 in dividend income. 4. 54.000 in profit from sale of a stock they purchased two years ago 5. $1,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 12. to work this problem a. How much will Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julle pay in federal income taxes on 3 above? (Note: Remember that dividend income is taxed differently than ordinary income) c. How much will Mike and Julie pay in federal income taxes on 4 above? d. How much will Mike and Julie pay in federal income taxes on above? a. The amount Miko and Julie will pay in federal income taxes on 2, their interest income, is SL (Round to the nearest dolar) b. The amount Mike and Julie will pay in federal income taxes on their dividend income, is (Round to the nearest dolar) (No Remember that dividend income is twed differently than ordinary income.) c. The amount Mke and Julie will pay in federal income taxes on 4, the profit from the sale of stock that they purchased two years ago, iss (Round to the nearest dollar) d. The amount Mike and Julie will pay in federal income taxes on 5, the profit on the sale of stock they purchased and sold the year, is (Round to the nearest dolar) (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) s TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2018) Taxable income Tax Rates Joint Returns 10% $0 to $19,750 12% $19,751 to $80,250 22% $80,251 to $171,050 24% $171,051 to $326,600 32% $326,601 to $414,700 35% $414,701 to $622,050 37% Over $622,050 D Print Done Mike and Julie Bedard are a working couple. They wil file a joint income tax rebum. This year they have the following taxable income: 1. $121,000 from salary and wages (ordinary income). 2. $5,000 in interest income 3. $5.000 in dividend income 4. 54.000 in profit from sale of a stock they purchased two years ago 5. $1,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 12. to work this problem a. How much will Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julie pay in federal income taxes on 3 above? (Note: Remember that dividend Income is towed differently than ordinary income) c. How much will Mike and Julle pay in federal income taxes on 4 above? d. How much wil Mike and Julie pay in federal income taxes on 5 above? 1. The amount Mike and Julie will pay in federal income taxes on 2, their interest income, is (Round to the nearest dollar) b. The amount Mike and Julie will pay in federal income taxes on 3, their dividend income, a. (Round to the nearest dollar) (Motor Romember that dividend income is taxed different than ordinary income) c. The amount Mike and Julie will pay in tederal income taxes on 4, the profit from the sale of stock that they purchased two years ago. Round to the nearest dolar) d. The amount Miko and Julio will pay in federal income taxes on 5, the profit on the sale of stock they purchased and told this year, i Round to the nearest dollar)