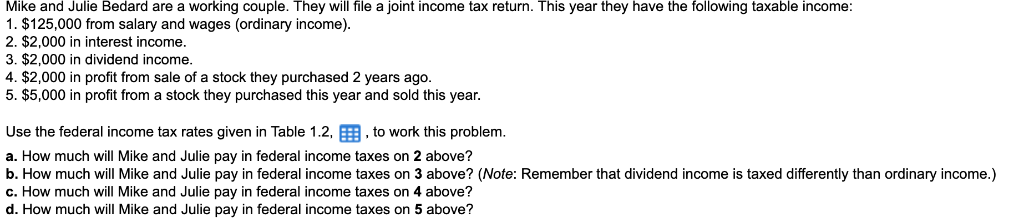

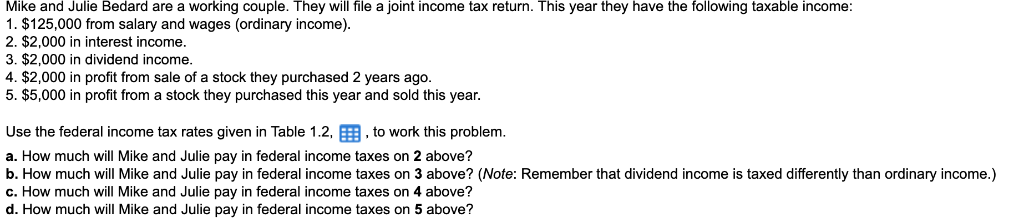

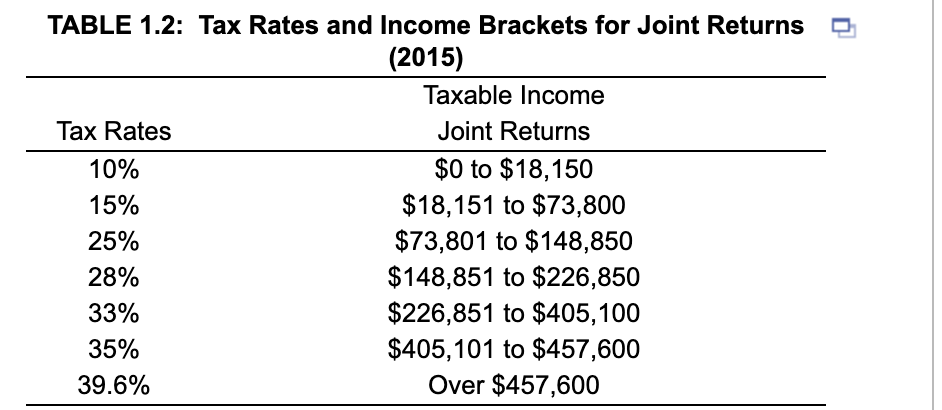

Mike and Julie Bedard are a working couple. They will file a joint income tax return. This year they have the following taxable income: 1. $125,000 from salary and wages (ordinary income) 2. $2,000 in interest income 3. $2,000 in dividend income 4. $2,000 in profit from sale of a stock they purchased 2 years ago. 5. $5,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 1.2, EEBto work this problem a. How much will Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julie pay in federal income taxes on 3 above? (Note: Remember that dividend income is taxed differently than ordinary income.) c. How much will Mike and Julie pay in federal income taxes on 4 above? d. How much will Mike and Julie pay in federal income taxes on 5 above? TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2015) Taxable Income Tax Rates Joint Returns $0 to $18,150 $18,151 to $73,800 10% 15% $73,801 to $148,850 25% $148,851 to $226,850 $226,851 to $405,100 $405,101 to $457,600 Over $457,600 28% 33% 35% 39.6% Mike and Julie Bedard are a working couple. They will file a joint income tax return. This year they have the following taxable income: 1. $125,000 from salary and wages (ordinary income) 2. $2,000 in interest income 3. $2,000 in dividend income 4. $2,000 in profit from sale of a stock they purchased 2 years ago. 5. $5,000 in profit from a stock they purchased this year and sold this year. Use the federal income tax rates given in Table 1.2, EEBto work this problem a. How much will Mike and Julie pay in federal income taxes on 2 above? b. How much will Mike and Julie pay in federal income taxes on 3 above? (Note: Remember that dividend income is taxed differently than ordinary income.) c. How much will Mike and Julie pay in federal income taxes on 4 above? d. How much will Mike and Julie pay in federal income taxes on 5 above? TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2015) Taxable Income Tax Rates Joint Returns $0 to $18,150 $18,151 to $73,800 10% 15% $73,801 to $148,850 25% $148,851 to $226,850 $226,851 to $405,100 $405,101 to $457,600 Over $457,600 28% 33% 35% 39.6%