Answered step by step

Verified Expert Solution

Question

1 Approved Answer

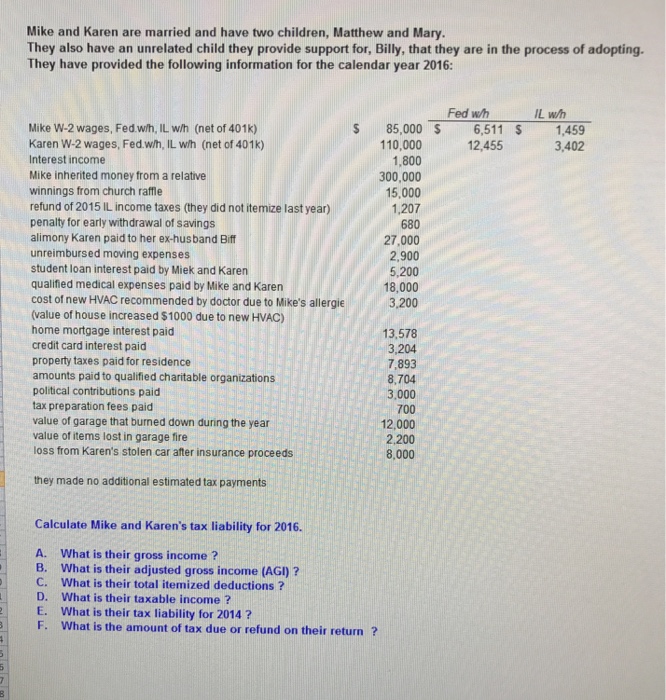

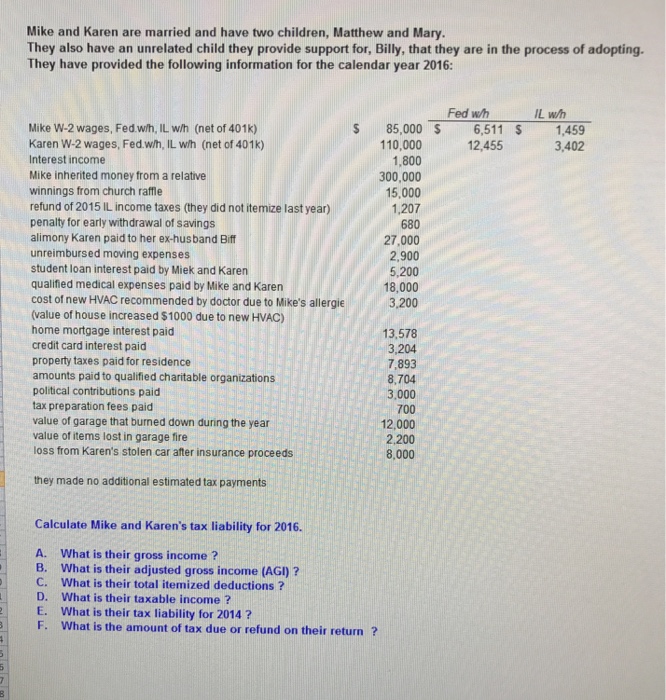

Mike and Karen are married and have two children, Matthew and Mary. They also have an unrelated child they provide support for, Billy, that they

Mike and Karen are married and have two children, Matthew and Mary. They also have an unrelated child they provide support for, Billy, that they are in the process of adopting. They have provided the following information for the calendar year 2016: Mike W-2 wages, Fed w/h.IL w/h (net of 401k) $ 85,000 Fed w/h IL w/h $ 6, 511 $ 1, 459 Karen W-2wages, Fed w/h, IL w/h (net of 401k) 110,000 12, 455 3, 402 Interest income 1, 800 Mike inherited money from a relative 300,000 winnings from church raffle 15,000 refund of 2015IL income taxes (they did not itemize last year) 1, 207 penalty for early withdrawal of savings 680 alimony Karen paid to her ex-husband Biff 27,000 unreimbursed moving expenses 2, 900 student loan interest paid by Mike and Karen 5, 200 qualified medical expenses paid by Mike and Karen 18,000 cost of new HVAC recommended by doctor due to Mike's allergic 3, 200 (value of house increased $1000 due to new HVAC) home mortgage interest paid 13, 578 credit card interest paid 3, 204 property taxes paid for residence 7, 893 amounts paid to qualified charitable organizations 8, 704 political contributions paid 3,000 tax preparation fees paid 700 value of garage that burned down during the year 12,000 value of items lost in garage fire 2, 200 loss from Karen's stolen car after insurance proceeds 8,000 they made no additional estimated tax payments Calculate Mike and Karen's tax liability for 2016. What is their gross income ? What is their adjusted gross income (AGI) ? What is their total itemized deductions ? What is their taxable income ? What is their tax liability for 2014 ? What is the amount of tax due or refund on their return ? Mike and Karen are married and have two children, Matthew and Mary. They also have an unrelated child they provide support for, Billy, that they are in the process of adopting. They have provided the following information for the calendar year 2016: Mike W-2 wages, Fed w/h.IL w/h (net of 401k) $ 85,000 Fed w/h IL w/h $ 6, 511 $ 1, 459 Karen W-2wages, Fed w/h, IL w/h (net of 401k) 110,000 12, 455 3, 402 Interest income 1, 800 Mike inherited money from a relative 300,000 winnings from church raffle 15,000 refund of 2015IL income taxes (they did not itemize last year) 1, 207 penalty for early withdrawal of savings 680 alimony Karen paid to her ex-husband Biff 27,000 unreimbursed moving expenses 2, 900 student loan interest paid by Mike and Karen 5, 200 qualified medical expenses paid by Mike and Karen 18,000 cost of new HVAC recommended by doctor due to Mike's allergic 3, 200 (value of house increased $1000 due to new HVAC) home mortgage interest paid 13, 578 credit card interest paid 3, 204 property taxes paid for residence 7, 893 amounts paid to qualified charitable organizations 8, 704 political contributions paid 3,000 tax preparation fees paid 700 value of garage that burned down during the year 12,000 value of items lost in garage fire 2, 200 loss from Karen's stolen car after insurance proceeds 8,000 they made no additional estimated tax payments Calculate Mike and Karen's tax liability for 2016. What is their gross income ? What is their adjusted gross income (AGI) ? What is their total itemized deductions ? What is their taxable income ? What is their tax liability for 2014 ? What is the amount of tax due or refund on their return

Mike and Karen are married and have two children, Matthew and Mary. They also have an unrelated child they provide support for, Billy, that they are in the process of adopting. They have provided the following information for the calendar year 2016: Mike W-2 wages, Fed w/h.IL w/h (net of 401k) $ 85,000 Fed w/h IL w/h $ 6, 511 $ 1, 459 Karen W-2wages, Fed w/h, IL w/h (net of 401k) 110,000 12, 455 3, 402 Interest income 1, 800 Mike inherited money from a relative 300,000 winnings from church raffle 15,000 refund of 2015IL income taxes (they did not itemize last year) 1, 207 penalty for early withdrawal of savings 680 alimony Karen paid to her ex-husband Biff 27,000 unreimbursed moving expenses 2, 900 student loan interest paid by Mike and Karen 5, 200 qualified medical expenses paid by Mike and Karen 18,000 cost of new HVAC recommended by doctor due to Mike's allergic 3, 200 (value of house increased $1000 due to new HVAC) home mortgage interest paid 13, 578 credit card interest paid 3, 204 property taxes paid for residence 7, 893 amounts paid to qualified charitable organizations 8, 704 political contributions paid 3,000 tax preparation fees paid 700 value of garage that burned down during the year 12,000 value of items lost in garage fire 2, 200 loss from Karen's stolen car after insurance proceeds 8,000 they made no additional estimated tax payments Calculate Mike and Karen's tax liability for 2016. What is their gross income ? What is their adjusted gross income (AGI) ? What is their total itemized deductions ? What is their taxable income ? What is their tax liability for 2014 ? What is the amount of tax due or refund on their return ? Mike and Karen are married and have two children, Matthew and Mary. They also have an unrelated child they provide support for, Billy, that they are in the process of adopting. They have provided the following information for the calendar year 2016: Mike W-2 wages, Fed w/h.IL w/h (net of 401k) $ 85,000 Fed w/h IL w/h $ 6, 511 $ 1, 459 Karen W-2wages, Fed w/h, IL w/h (net of 401k) 110,000 12, 455 3, 402 Interest income 1, 800 Mike inherited money from a relative 300,000 winnings from church raffle 15,000 refund of 2015IL income taxes (they did not itemize last year) 1, 207 penalty for early withdrawal of savings 680 alimony Karen paid to her ex-husband Biff 27,000 unreimbursed moving expenses 2, 900 student loan interest paid by Mike and Karen 5, 200 qualified medical expenses paid by Mike and Karen 18,000 cost of new HVAC recommended by doctor due to Mike's allergic 3, 200 (value of house increased $1000 due to new HVAC) home mortgage interest paid 13, 578 credit card interest paid 3, 204 property taxes paid for residence 7, 893 amounts paid to qualified charitable organizations 8, 704 political contributions paid 3,000 tax preparation fees paid 700 value of garage that burned down during the year 12,000 value of items lost in garage fire 2, 200 loss from Karen's stolen car after insurance proceeds 8,000 they made no additional estimated tax payments Calculate Mike and Karen's tax liability for 2016. What is their gross income ? What is their adjusted gross income (AGI) ? What is their total itemized deductions ? What is their taxable income ? What is their tax liability for 2014 ? What is the amount of tax due or refund on their return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started