Answered step by step

Verified Expert Solution

Question

1 Approved Answer

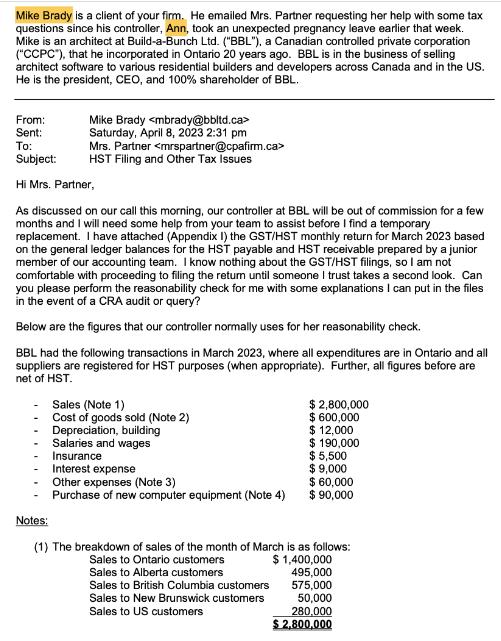

Mike Brady is a client of your firm. He emailed Mrs. Partner requesting her help with some tax questions since his controller, Ann, took

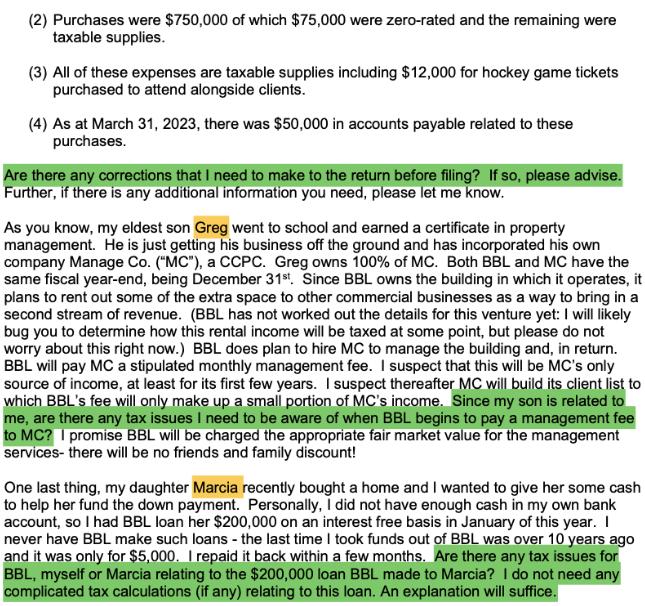

Mike Brady is a client of your firm. He emailed Mrs. Partner requesting her help with some tax questions since his controller, Ann, took an unexpected pregnancy leave earlier that week. Mike is an architect at Build-a-Bunch Ltd. ("BBL"), a Canadian controlled private corporation ("CCPC"), that he incorporated in Ontario 20 years ago. BBL is in the business of selling architect software to various residential builders and developers across Canada and in the US. He is the president, CEO, and 100% shareholder of BBL. From: Sent: To: Subject: Hi Mrs. Partner, Mike Brady Saturday, April 8, 2023 2:31 pm Mrs. Partner HST Filing and Other Tax Issues As discussed on our call this morning, our controller at BBL will be out of commission for a few months and I will need some help from your team to assist before I find a temporary replacement. I have attached (Appendix I) the GST/HST monthly return for March 2023 based on the general ledger balances for the HST payable and HST receivable prepared by a junior member of our accounting team. I know nothing about the GST/HST filings, so I am not comfortable with proceeding to filing the return until someone I trust takes a second look. Can you please perform the reasonability check for me with some explanations I can put in the files in the event of a CRA audit or query? Below are the figures that our controller normally uses for her reasonability check. BBL had the following transactions in March 2023, where all expenditures are in Ontario and all suppliers are registered for HST purposes (when appropriate). Further, all figures before are net of HST. Sales (Note 1) Cost of goods sold (Note 2) Depreciation, building Salaries and wages Insurance Interest expense Other expenses (Note 3) Purchase of new computer equipment (Note 4) $ 2,800,000 $ 600,000 $ 12,000 $ 190,000 $ 5,500 $9,000 $ 60,000 $ 90,000 Notes: (1) The breakdown of sales of the month of March is as follows: Sales to Ontario customers $1,400,000 Sales to Alberta customers Sales to British Columbia customers Sales to New Brunswick customers Sales to US customers 495,000 575,000 50,000 280,000 $2,800,000 (2) Purchases were $750,000 of which $75,000 were zero-rated and the remaining were taxable supplies. (3) All of these expenses are taxable supplies including $12,000 for hockey game tickets purchased to attend alongside clients. (4) As at March 31, 2023, there was $50,000 in accounts payable related to these purchases. Are there any corrections that I need to make to the return before filing? If so, please advise. Further, if there is any additional information you need, please let me know. As you know, my eldest son Greg went to school and earned a certificate in property management. He is just getting his business off the ground and has incorporated his own company Manage Co. ("MC"), a CCPC. Greg owns 100% of MC. Both BBL and MC have the same fiscal year-end, being December 31st. Since BBL owns the building in which it operates, it plans to rent out some of the extra space to other commercial businesses as a way to bring in a second stream of revenue. (BBL has not worked out the details for this venture yet: I will likely bug you to determine how this rental income will be taxed at some point, but please do not worry about this right now.) BBL does plan to hire MC to manage the building and, in return. BBL will pay MC a stipulated monthly management fee. I suspect that this will be MC's only source of income, at least for its first few years. I suspect thereafter MC will build its client list to which BBL's fee will only make up a small portion of MC's income. Since my son is related to me, are there any tax issues I need to be aware of when BBL begins to pay a management fee to MC? I promise BBL will be charged the appropriate fair market value for the management services- there will be no friends and family discount! One last thing, my daughter Marcia recently bought a home and I wanted to give her some cash to help her fund the down payment. Personally, I did not have enough cash in my own bank account, so I had BBL loan her $200,000 on an interest free basis in January of this year. I never have BBL make such loans - the last time I took funds out of BBL was over 10 years ago and it was only for $5,000. I repaid it back within a few months. Are there any tax issues for BBL, myself or Marcia relating to the $200,000 loan BBL made to Marcia? I do not need any complicated tax calculations (if any) relating to this loan. An explanation will suffice.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dear Mr Brady I appreciate you reaching out to our firm for assistance with your taxrelated inquiries I will address each of your questions and concer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started