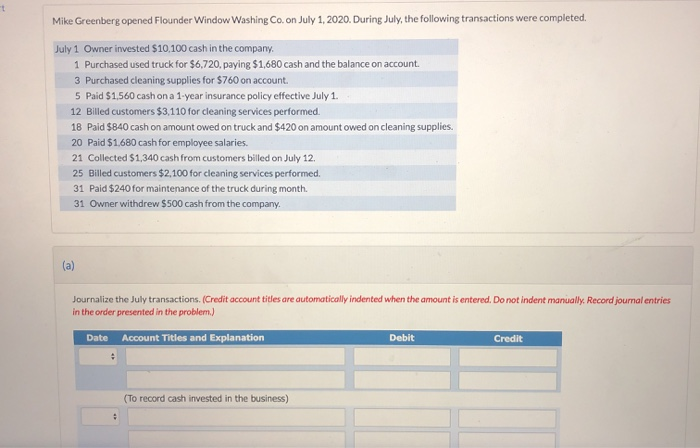

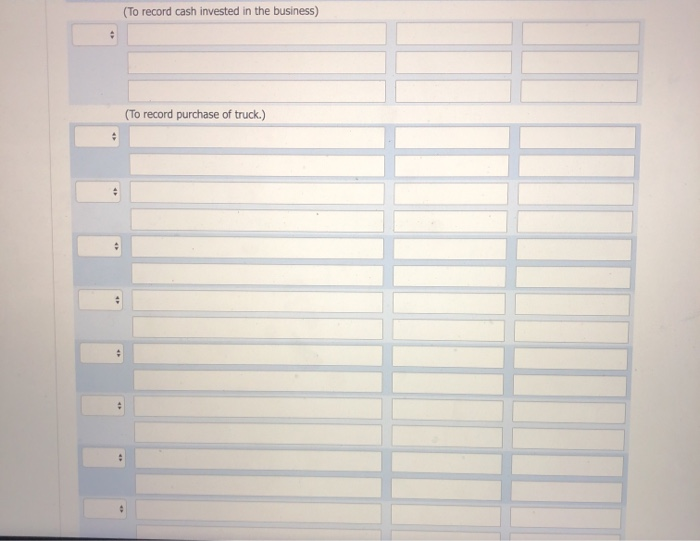

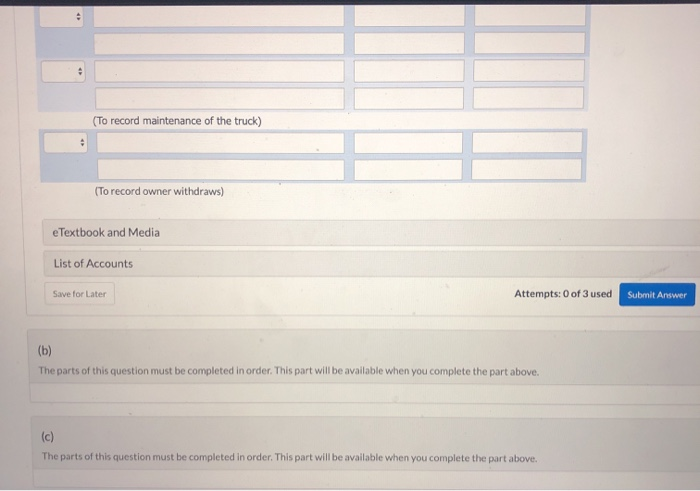

Mike Greenberg opened Flounder Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $10,100 cash in the company. 1 Purchased used truck for $6,720, paying $1,680 cash and the balance on account. 3 Purchased cleaning supplies for $760 on account. 5 Paid $1.560 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,110 for cleaning services performed. 18 Paid $840 cash on amount owed on truck and $420 on amount owed on cleaning supplies. 20 Paid $1,680 cash for employee salaries. 21 Collected $1,340 cash from customers billed on July 12. 25 Billed customers $2,100 for cleaning services performed. 31 Paid $240 for maintenance of the truck during month 31 Owner withdrew $500 cash from the company. Journalize the July transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record cash invested in the business) (To record cash invested in the business) (To record purchase of truck.) (To record maintenance of the truck) (To record owner withdraws) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. (81) The parts of this question must be completed in order. This part will be available when you complete the part above, (82) The parts of this question must be completed in order. This part will be available when you complete the part above. (82) The parts of this question must be completed in order. This part will be available when you complete the part above. (93) The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above.