Question

Mike has a debt $X and he pays monthly payments $R to repay this debt. At first, the interest rate for this debt is j12=

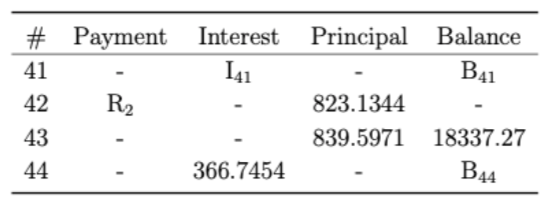

Mike has a debt $X and he pays monthly payments $R to repay this debt. At first, the interest rate for this debt is j12= 12%. After making 25 regular monthly payments, he missed the next 5 payments (If Mike doesn't miss those five payments, then right after he makes the last payment of those 5 missing ones, the outstanding balance of this loan would be $22954.889). After that, the bank forced him to renegotiate the loan at a new rate j12=k%, and he continued paying monthly payment for the rest of this loan using a different payment R2 at the time when the 31th payment should normally be made.He records a amortization schedule for this debt and you are given part of his amortization schedule below:

(a) Assume that interest I should round to the closest 0.01 decimal, fill in the blankbelow, show your calculation process for each of them (if any):

New interest rate k:

R2:

B41:

B44:

I41:

(b) Do Mike has a final concluding payment for this loan? If not, please indicate whatis the time that he would pay the final payment. If so, please apply the balloon method and indicate what is the time that he would pay the final payment.

(c) Please calculate the original monthly payment R

(d) Please calculate the principal of the debt X

(e) What is the buyers equity and sellers equity at the time when Mike makes his 10th monthly payment?

(f) Assume that Mike paid the 5 missing payments on time, and the interest rate doesnt change (as there is no missing payments). How many full payments does Mike need to make to fully cover this loan. What is the concluding payment for this loan if we apply the drop payment method?

# Payment Interest 141 Principal Balance B41 823.1344 - 839.5971 18337.27 R2 366.7454 B44 # Payment Interest 141 Principal Balance B41 823.1344 - 839.5971 18337.27 R2 366.7454 B44Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started