Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mike lives for two periods: (1) working life and (2) retirement. In his working life, his income is $100,000, while in retirement he will

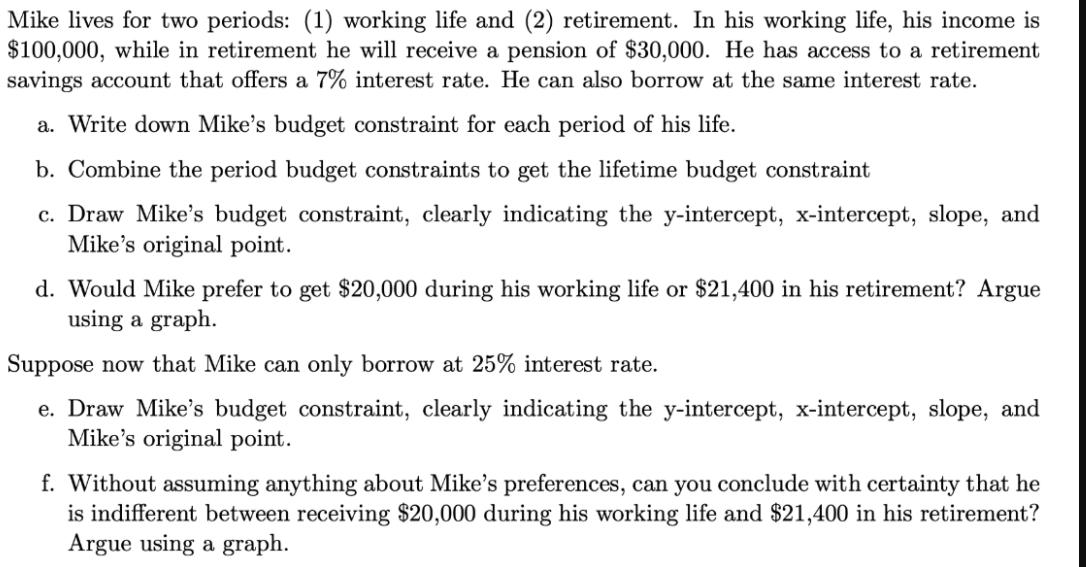

Mike lives for two periods: (1) working life and (2) retirement. In his working life, his income is $100,000, while in retirement he will receive a pension of $30,000. He has access to a retirement savings account that offers a 7% interest rate. He can also borrow at the same interest rate. a. Write down Mike's budget constraint for each period of his life. b. Combine the period budget constraints to get the lifetime budget constraint c. Draw Mike's budget constraint, clearly indicating the y-intercept, x-intercept, slope, and Mike's original point. d. Would Mike prefer to get $20,000 during his working life or $21,400 in his retirement? Argue using a graph. Suppose now that Mike can only borrow at 25% interest rate. e. Draw Mike's budget constraint, clearly indicating the y-intercept, x-intercept, slope, and Mike's original point. f. Without assuming anything about Mike's preferences, can you conclude with certainty that he is indifferent between receiving $20,000 during his working life and $21,400 in his retirement? Argue using a graph.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Mikes budget constraint for each period of his life can be represented as follows 1 Working life budget constraint Income Y1 Consumption during work...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started