Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mike MacCloud had worked in the operations side of a winery for several years. Having built a strong knowledge of the art of making

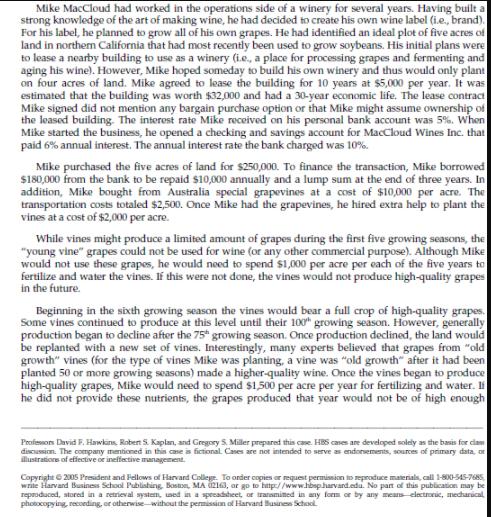

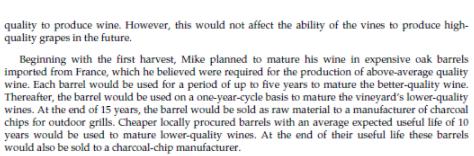

Mike MacCloud had worked in the operations side of a winery for several years. Having built a strong knowledge of the art of making wine, he had decided to create his own wine label (i.e., brand). For his label, he planned to grow all of his own grapes. He had identified an ideal plot of five acres of land in northem California that had most recently been used to grow soybeans. His initial plans were to lease a nearby building to use as a winery (i.e., a place for processing grapes and fermenting and aging his wine). However, Mike hoped someday to build his own winery and thus would only plant on four acres of land. Mike agreed to lease the building for 10 years at $5,000 per year. It was estimated that the building was worth $32,000 and had a 30-year economic life. The lease contract Mike signed did not mention any bargain purchase option or that Mike might assume ownership of the leased building. The interest rate Mike received on his personal bank account was 5%. When Mike started the business, he opened a checking and savings account for MacCloud Wines Inc. that paid 6% annual interest. The annual interest rate the bank charged was 10%. Mike purchased the five acres of land for $250,000. To finance the transaction, Mike borrowed $180,000 from the bank to be repaid $10,000 annually and a lump sum at the end of three years. In addition, Mike bought from Australia special grapevines at a cost of $10,000 per acre. The transportation costs totaled $2,500. Once Mike had the grapevines, he hired extra help to plant the vines at a cost of $2,000 per acre. While vines might produce a limited amount of grapes during the first five growing seasons, the "young vine" grapes could not be used for wine (or any other commercial purpose). Although Mike would not use these grapos, he would need to spend $1,000 per acre per each of the five years to fertilize and water the vines. If this were not done, the vines would not produce high-quality grapes in the future. Beginning in the sixth growing season the vines would bear a full crop of high-quality grapes. Some vines continued to produce at this level until their 100" growing season. However, generally production began to decline after the 75* growing season. Once production declined, the land would be replanted with a new set of vines. Interestingly, many experts believed that grapes from "old growth" vines (for the type of vines Mike was planting, a vine was "old growth" after it had been planted 50 or more growing seasons) made a higher-quality wine. Once the vines began to produce high-quality grapes, Mike would need to spend $1,500 per acre per year for fertilizing and water. I he did not provide these nutrients, the grapes produced that year would not be of high enough Profesons David F, Hawkins, Robert S. Kaplan, and Gregory S. Miler prepared this case. HBS cases are developed solely as the basis for clam discussion. The conpany mentioned in this case is fictional Cases are not intended to serve as endonsements, sources of primary data, or illustrations of effective or ineffective management Copyright 200S President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-80-S45-7685 write Harvand Business School Publishing, Boston, MA Z163, ar go to bttp://www.hbap.harvard.cdu. No pan of this publication may be reproduced, stored in a retrieval system, sed in a speeadsheet, or transmimed in any fom or by any means clectronie, medharical photocopying, recoeding, or otherwisewithout the permissian of Harvand Business School quality to produce wine. However, this would not affect the ability of the vines to produce high- quality grapes in the future. Beginning with the first harvest, Mike planned to mature his wine in expensive oak barrels imported from France, which he believed were required for the production of above-average quality wine. Each barrel would be used for a period of up to five years to mature the better-quality wine. Thereafter, the barrel would be used on a one-year-cycle basis to mature the vineyard's lower-quality wines. At the end of 15 years, the barrel would be sold as raw material to a manufacturer of charcoal chips for outdoor grills. Cheaper locally procured barrels with an average expected useful life of 10 years would be used to mature lower-quality wines. At the end of their useful life these barrels would also be sold to a charcoal-chip manufacturer.

Step by Step Solution

★★★★★

3.55 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer Step by Step Explanation Step 1 Accrual basis Accounting In accrual basis of accounting all t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started