Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mike received the following income during the 2021 taxable year: Gross income, Philippines Gross income, Canada Business expenses, Philippines Business expenses, Canada Interest on

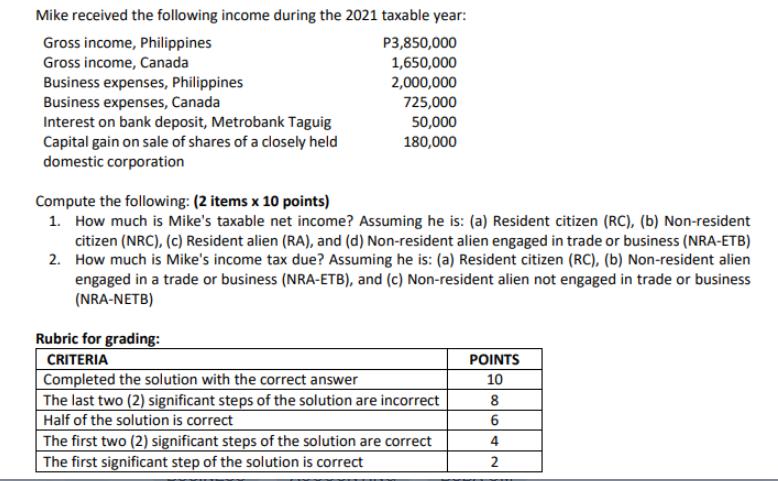

Mike received the following income during the 2021 taxable year: Gross income, Philippines Gross income, Canada Business expenses, Philippines Business expenses, Canada Interest on bank deposit, Metrobank Taguig Capital gain on sale of shares of a closely held domestic corporation Compute the following: (2 items x 10 points) P3,850,000 1,650,000 2,000,000 725,000 50,000 180,000 1. How much is Mike's taxable net income? Assuming he is: (a) Resident citizen (RC), (b) Non-resident citizen (NRC), (c) Resident alien (RA), and (d) Non-resident alien engaged in trade or business (NRA-ETB) 2. How much is Mike's income tax due? Assuming he is: (a) Resident citizen (RC), (b) Non-resident alien engaged in a trade or business (NRA-ETB), and (c) Non-resident alien not engaged in trade or business (NRA-NETB) Rubric for grading: CRITERIA Completed the solution with the correct answer The last two (2) significant steps of the solution are incorrect Half of the solution is correct The first two (2) significant steps of the solution are correct The first significant step of the solution is correct POINTS 10 8 6 4 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started