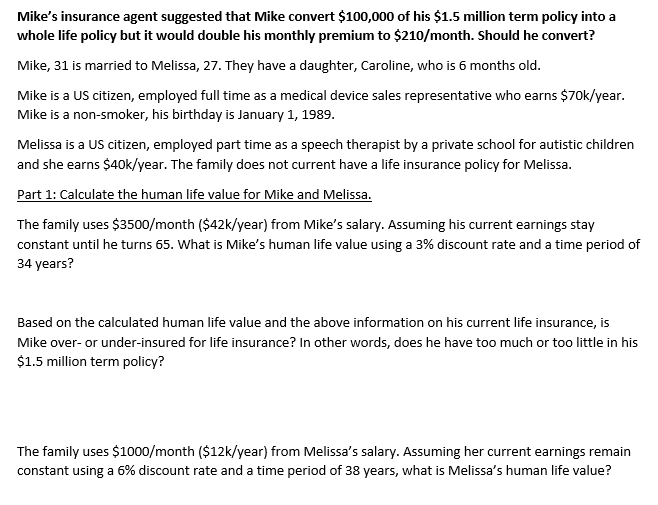

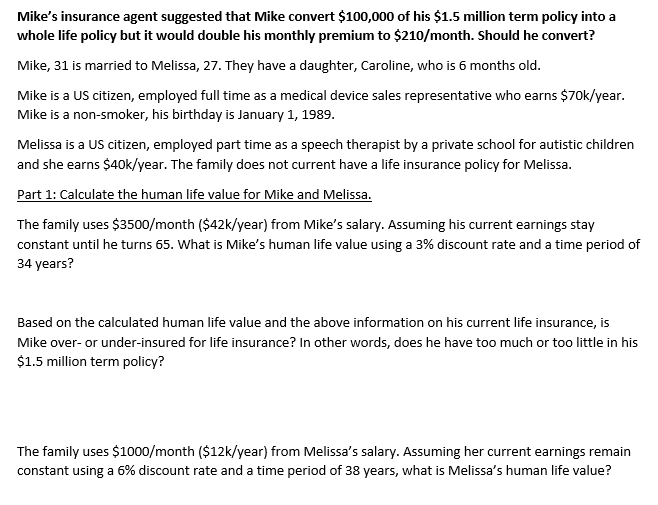

Mike's insurance agent suggested that Mike convert $100,000 of his $1.5 million term policy into a whole life policy but it would double his monthly premium to $210/month. Should he convert? Mike, 31 is married to Melissa, 27. They have a daughter, Caroline, who is 6 months old. Mike is a US citizen, employed full time as a medical device sales representative who earns $70k/year. Mike is a non-smoker, his birthday is January 1, 1989. Melissa is a US citizen, employed part time as a speech therapist by a private school for autistic children and she earns $40k/year. The family does not current have a life insurance policy for Melissa. Part 1: Calculate the human life value for Mike and Melissa. The family uses $3500/month ($42k/year) from Mike's salary. Assuming his current earnings stay constant until he turns 65. What is Mike's human life value using a 3% discount rate and a time period of 34 years? Based on the calculated human life value and the above information on his current life insurance, is Mike over- or under-insured for life insurance? In other words, does he have too much or too little in his $1.5 million term policy? The family uses $1000/month ($12k/year) from Melissa's salary. Assuming her current earnings remain constant using a 6% discount rate and a time period of 38 years, what is Melissa's human life value? Mike's insurance agent suggested that Mike convert $100,000 of his $1.5 million term policy into a whole life policy but it would double his monthly premium to $210/month. Should he convert? Mike, 31 is married to Melissa, 27. They have a daughter, Caroline, who is 6 months old. Mike is a US citizen, employed full time as a medical device sales representative who earns $70k/year. Mike is a non-smoker, his birthday is January 1, 1989. Melissa is a US citizen, employed part time as a speech therapist by a private school for autistic children and she earns $40k/year. The family does not current have a life insurance policy for Melissa. Part 1: Calculate the human life value for Mike and Melissa. The family uses $3500/month ($42k/year) from Mike's salary. Assuming his current earnings stay constant until he turns 65. What is Mike's human life value using a 3% discount rate and a time period of 34 years? Based on the calculated human life value and the above information on his current life insurance, is Mike over- or under-insured for life insurance? In other words, does he have too much or too little in his $1.5 million term policy? The family uses $1000/month ($12k/year) from Melissa's salary. Assuming her current earnings remain constant using a 6% discount rate and a time period of 38 years, what is Melissa's human life value