Answered step by step

Verified Expert Solution

Question

1 Approved Answer

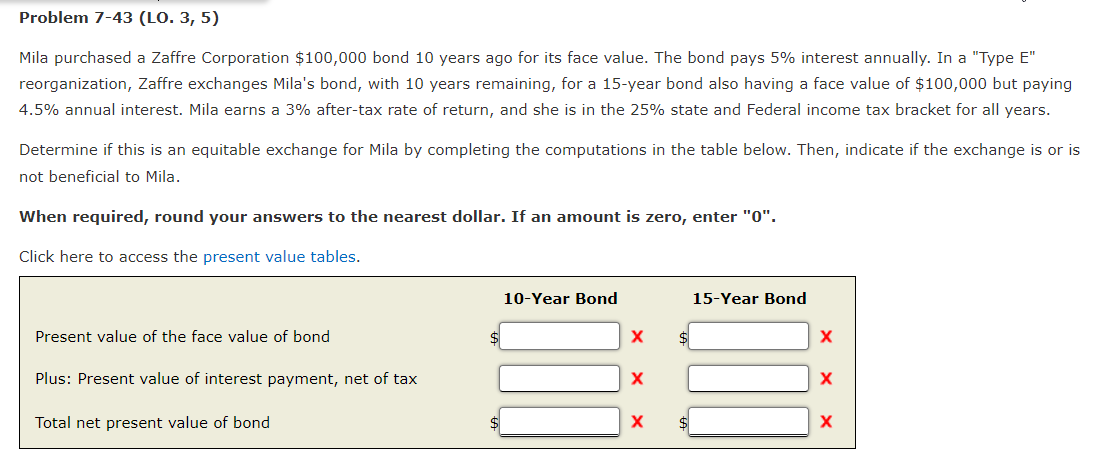

Mila purchased a Zaffre Corporation $ 1 0 0 , 0 0 0 bond 1 0 years ago for its face value. The bond pays

Mila purchased a Zaffre Corporation $ bond years ago for its face value. The bond pays interest annually. In a "Type E reorganization, Zaffre exchanges Mila's bond, with years remaining, for a year bond also having a face value of $ but paying annual interest. Mila earns a aftertax rate of return, and she is in the state and Federal income tax bracket for all years.

Determine if this is an equitable exchange for Mila by completing the computations in the table below. Then, indicate if the exchange is or is not beneficial to Mila.

When required, round your answers to the nearest dollar. If an amount is zero, enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started