Answered step by step

Verified Expert Solution

Question

1 Approved Answer

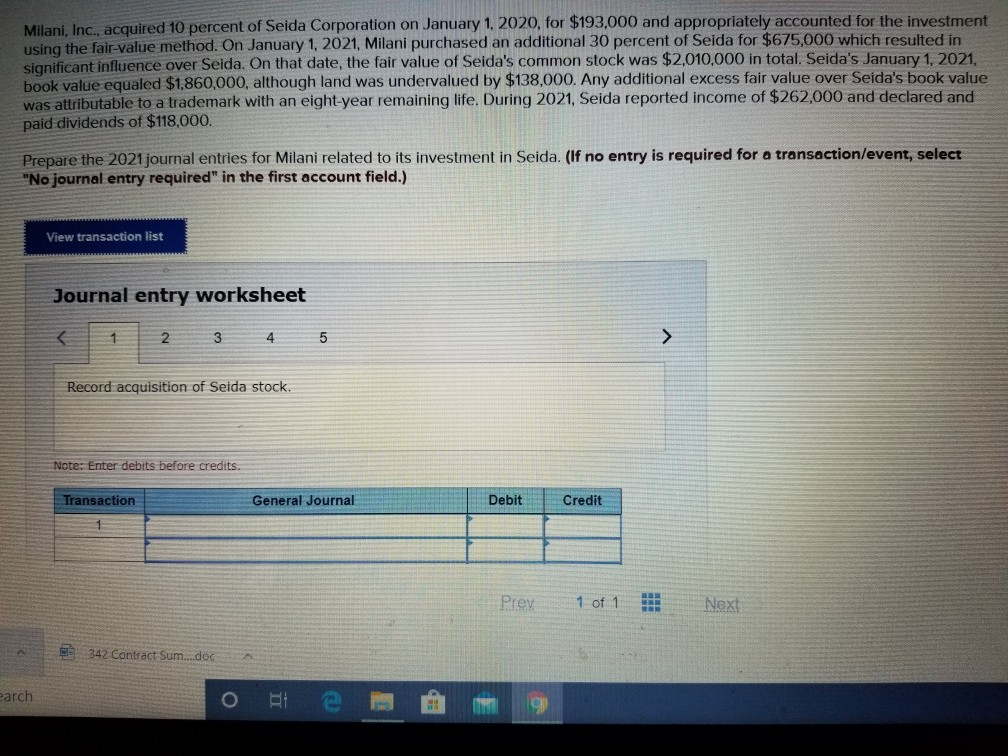

Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $193,000 and appropriately accounted for the investment using the fair-value method. On

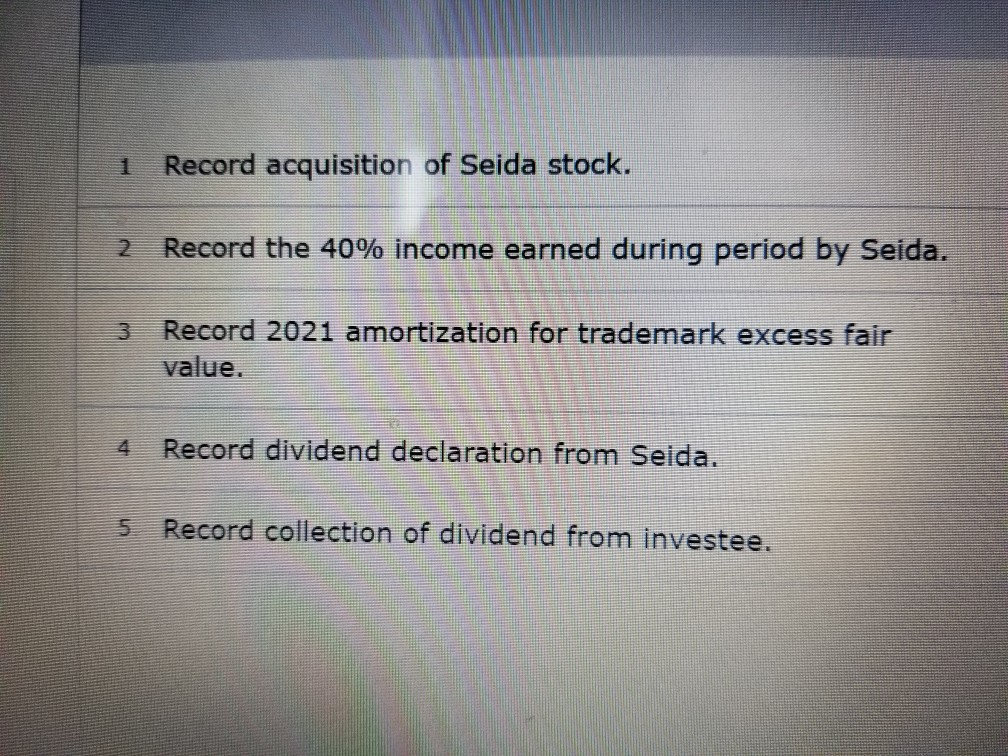

Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $193,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $675,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,010,000 in total. Seida's January 1, 2021, book value equaled $1.860,000, although land was undervalued by $138,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $262,000 and declared and paid dividends of $118,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record acquisition of Seida stock. Note: Enter debits before credits Transaction General Journal Debit Credit Prev 1 of 1 Next 342 Contract Sum.doc earch o BE 1 Record acquisition of Seida stock. Record the 40% income earned during period by Seida. 3 Record 2021 amortization for trademark excess fair value. Record dividend declaration from Seida. Record collection of dividend from investee

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started