Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mild Traders sells goods on behalf of Take-it Traders and earns a commission of 10% based on revenue for that specific financial period. During the

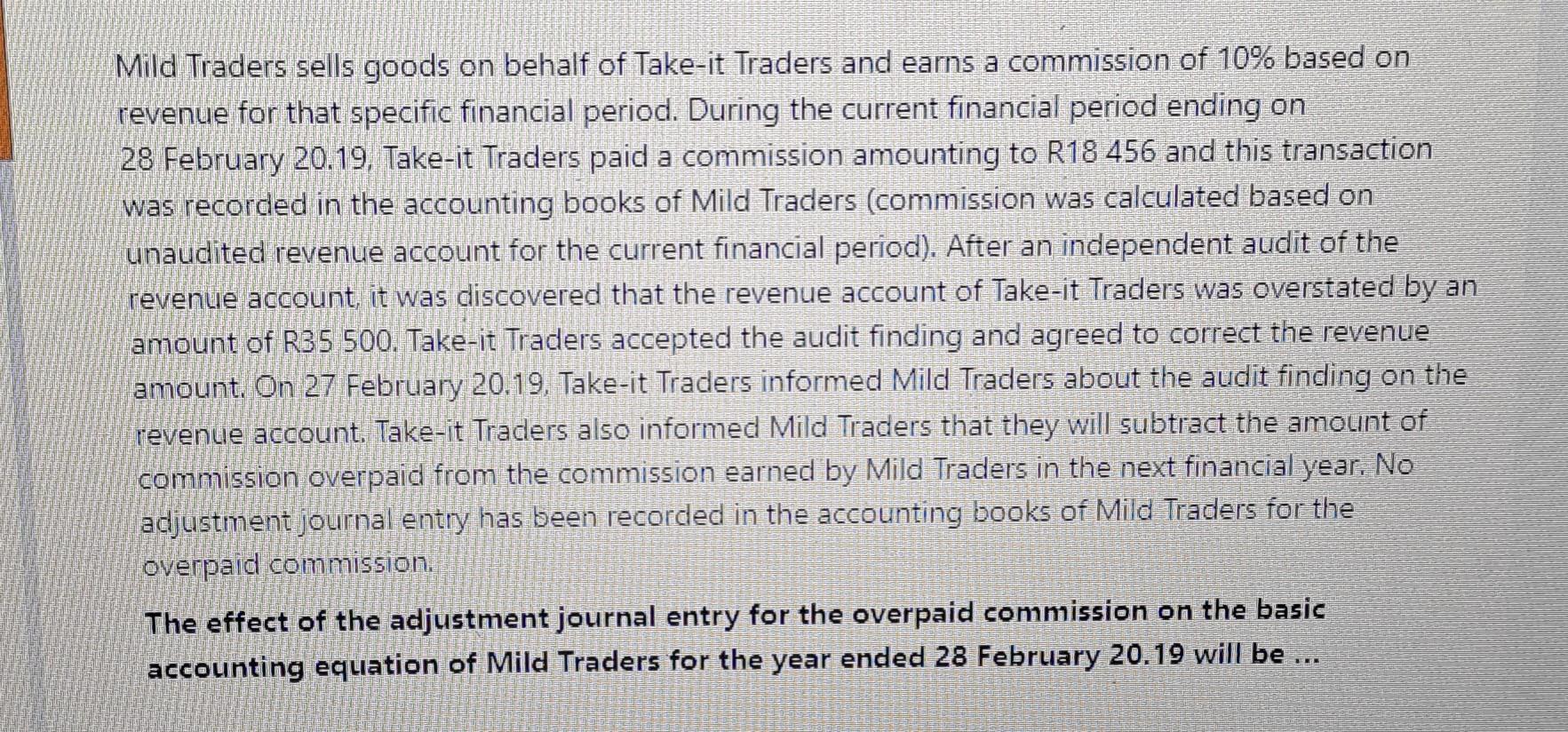

Mild Traders sells goods on behalf of Take-it Traders and earns a commission of 10% based on revenue for that specific financial period. During the current financial period ending on 28 February 20.19, Take-it Traders paid a commission amounting to R18 456 and this transaction was recorded in the accounting books of Mild Traders (commission was calculated based on unaudited revenue account for the current financial period). After an independent audit of the revenue account, it was discovered that the revenue account of Take-it Traders was overstated by an amount of R35 500. Take-it Traders accepted the audit finding and agreed to correct the revenue amount. On 27 February 20.19, Take-it Traders informed Mild Traders about the audit finding on the revenue account. Take-it Traders also informed Mild Traders that they will subtract the amount of commission overpaid from the commission earned by Mild Traders in the next financial year. No adjustment journal entry has been recorded in the accounting books of Mild Traders for the overpaid commission. The effect of the adjustment journal entry for the overpaid commission on the basic accounting equation of Mild Traders for the year ended 28 February 20.19 will be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started