Answered step by step

Verified Expert Solution

Question

1 Approved Answer

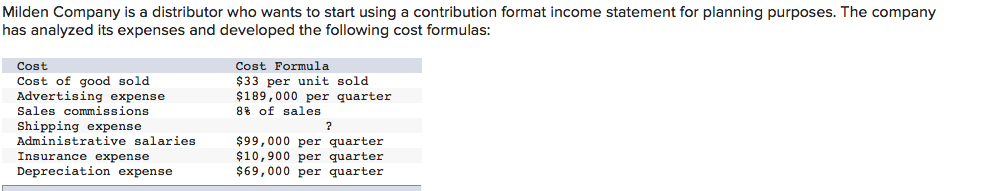

Milden Company is a distributor who wants to start using a contribution format income statement for planning purposes. The company has analyzed its expenses and

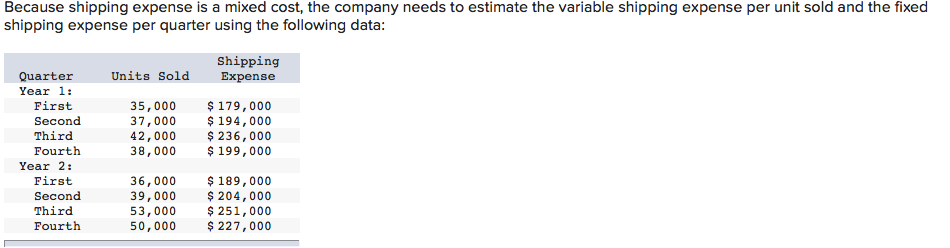

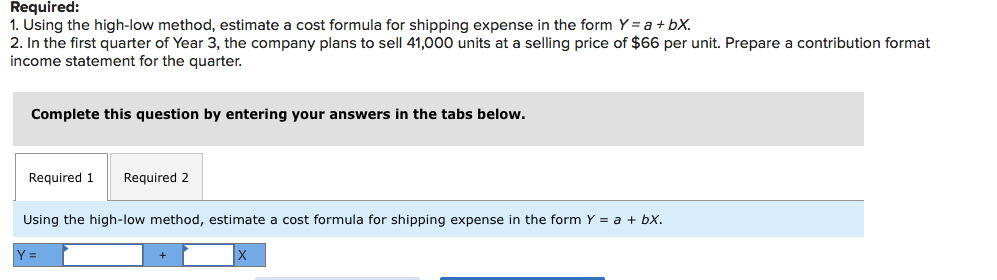

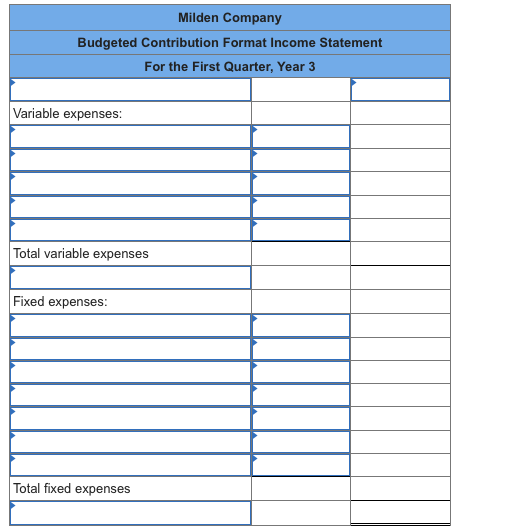

Milden Company is a distributor who wants to start using a contribution format income statement for planning purposes. The company has analyzed its expenses and developed the following cost formulas: Cost Cost of good sold Advertising expense Sales commissions Shipping expense Administrative salaries Insurance expense Depreciation expense Cost Formula $33 per unit sold $189,000 per quarter 8% of sales ? $99,000 per quarter $10,900 per quarter $69,000 per quarter Because shipping expense is a mixed cost, the company needs to estimate the variable shipping expense per unit sold and the fixed shipping expense per quarter using the following data: Units Sold Shipping Expense Quarter Year 1: First Second Third Fourth Year 2: First Second Third Fourth 35,000 37,000 42,000 38,000 $ 179,000 $ 194,000 $ 236,000 $ 199,000 36,000 39,000 53,000 50,000 $ 189,000 $ 204,000 $ 251,000 $ 227,000 Required: 1. Using the high-low method, estimate a cost formula for shipping expense in the form Y = a +bX. 2. In the first quarter of Year 3, the company plans to sell 41,000 units at a selling price of $66 per unit. Prepare a contribution format income statement for the quarter. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Using the high-low method, estimate a cost formula for shipping expense in the form Y = a + bx. Y = + X Milden Company Budgeted Contribution Format Income Statement For the First Quarter, Year 3 Variable expenses: Total variable expenses Fixed expenses: Total fixed expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started