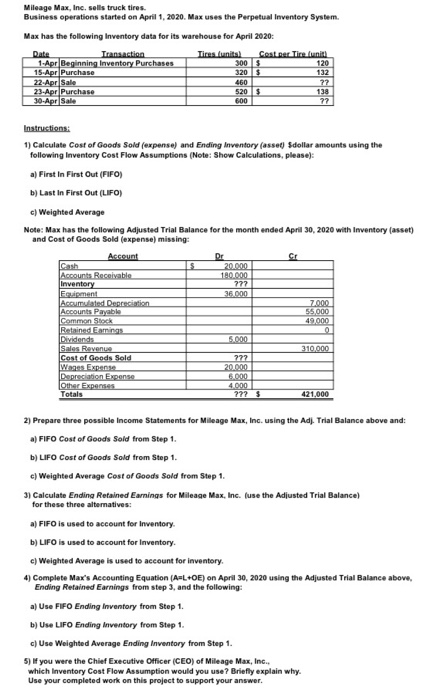

Mileage Max, Inc. sells truck tires Business operations started on April 1, 2020. Max uses the Perpetual Inventory System Max has the following Inventory data for its warehouse for April 2020: Rate Transaction 1-Apr Beginning inventory Purchase 19 Apr Purchase 22-Apr Sale 23-Apd Purchase 30 Apr Se Instructions: 1) Calculate Cost of Goods Sold expense) and Ending Inventory fasse Sdollar amounts using the following Inventory Cost Flow Assumptions (Note: Show Calculations, please a) First In First Out (FIFO) b) Last In First Out (LIFO) c) Weighted Average Note: Max has the following Adjusted Trial Balance for the month ended April 30, 2020 with Inventory (asset) and Cost of Goods Sold expense) missing cash 20.000 180.000 Accounts Receivable Equipment ARRumulated Depreciation Accounts Payable Common Stock Retained Eaming Dividende Sales Reven Cost of Goods Sold Wages Expense Depreciation Expense Other Expe 510001 20.000 6.000 4000 2) Prepare three possible income Statements for Mileage Max, Inc. using the Adj. Trial Balance above and a) FIFO Cost of Goods Sold from Step 1. b) LIFO Cost of Goods Sold from Step 1. c) Weighted Average Cost of Goods Sold from Step 1. 3) Calculate Ending Retained Earnings for Mileage Max, Inc. use the Adjusted Trial Balance) for these three alternatives a FIFO is used to account for Inventory. b) LIFO is used to account for inventory c) Weighted Average is used to account for inventory 4 Complete Max's Accounting Equation (ALE) on April 30, 2020 using the Adjusted Trial Balance above Ending Retained Earnings from step 3. and the following al Use FIFO Ending Inventory from Step 1. b) Use LIFO Ending Inventory from Step 1. c) Use Weighted Average Ending Inventory from Step 1. 5) you were the Chief Executive Officer (CEO) of Mileage Max, Inc.. which Inventory Cost Flow Assumption would you use? Briefly explain why. Use your completed work on this project to support your answer Mileage Max, Inc. sells truck tires Business operations started on April 1, 2020. Max uses the Perpetual Inventory System Max has the following Inventory data for its warehouse for April 2020: Rate Transaction 1-Apr Beginning inventory Purchase 19 Apr Purchase 22-Apr Sale 23-Apd Purchase 30 Apr Se Instructions: 1) Calculate Cost of Goods Sold expense) and Ending Inventory fasse Sdollar amounts using the following Inventory Cost Flow Assumptions (Note: Show Calculations, please a) First In First Out (FIFO) b) Last In First Out (LIFO) c) Weighted Average Note: Max has the following Adjusted Trial Balance for the month ended April 30, 2020 with Inventory (asset) and Cost of Goods Sold expense) missing cash 20.000 180.000 Accounts Receivable Equipment ARRumulated Depreciation Accounts Payable Common Stock Retained Eaming Dividende Sales Reven Cost of Goods Sold Wages Expense Depreciation Expense Other Expe 510001 20.000 6.000 4000 2) Prepare three possible income Statements for Mileage Max, Inc. using the Adj. Trial Balance above and a) FIFO Cost of Goods Sold from Step 1. b) LIFO Cost of Goods Sold from Step 1. c) Weighted Average Cost of Goods Sold from Step 1. 3) Calculate Ending Retained Earnings for Mileage Max, Inc. use the Adjusted Trial Balance) for these three alternatives a FIFO is used to account for Inventory. b) LIFO is used to account for inventory c) Weighted Average is used to account for inventory 4 Complete Max's Accounting Equation (ALE) on April 30, 2020 using the Adjusted Trial Balance above Ending Retained Earnings from step 3. and the following al Use FIFO Ending Inventory from Step 1. b) Use LIFO Ending Inventory from Step 1. c) Use Weighted Average Ending Inventory from Step 1. 5) you were the Chief Executive Officer (CEO) of Mileage Max, Inc.. which Inventory Cost Flow Assumption would you use? Briefly explain why. Use your completed work on this project to support your