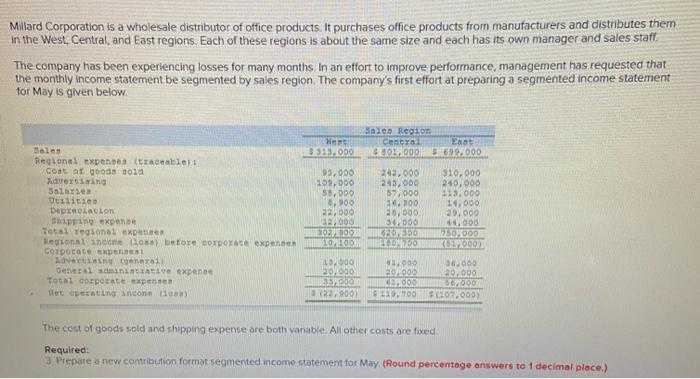

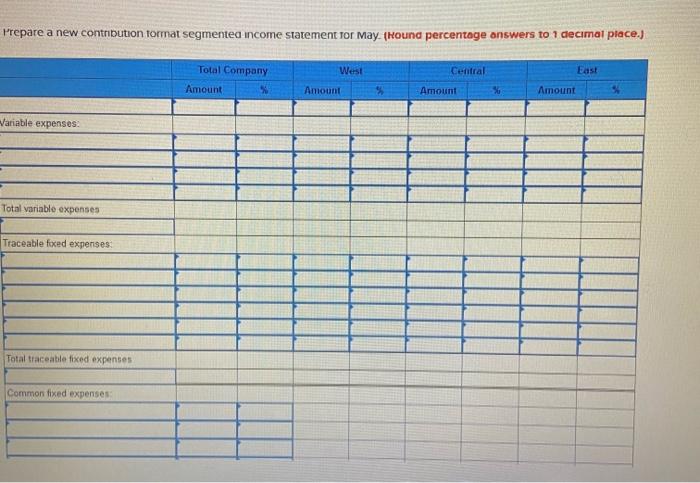

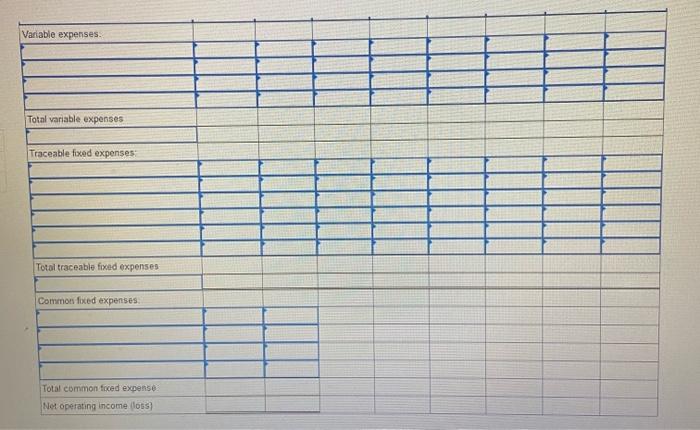

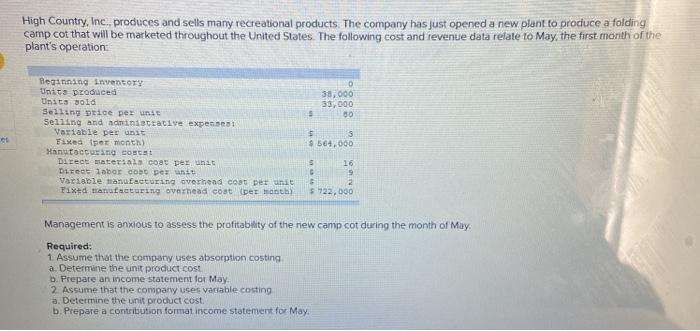

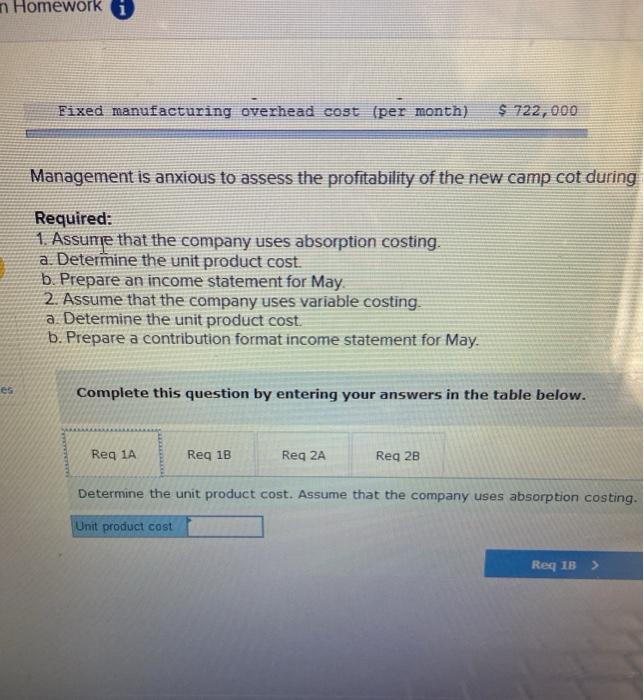

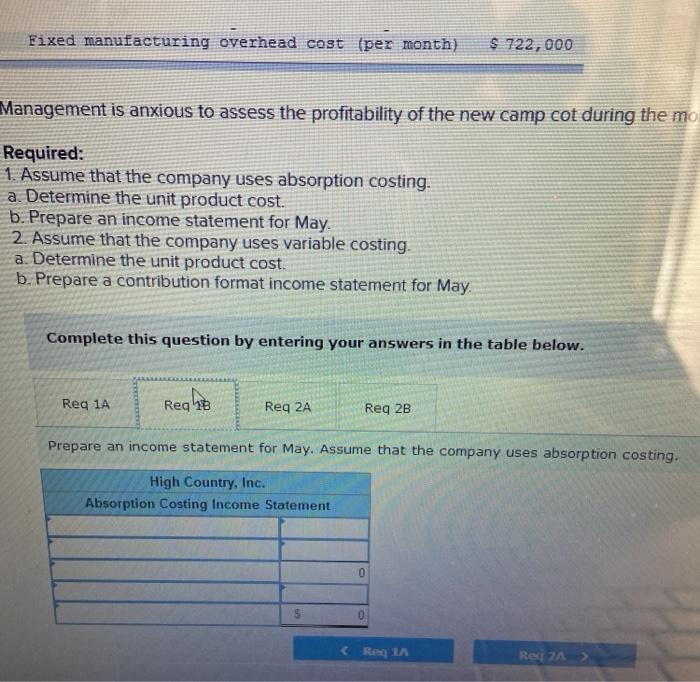

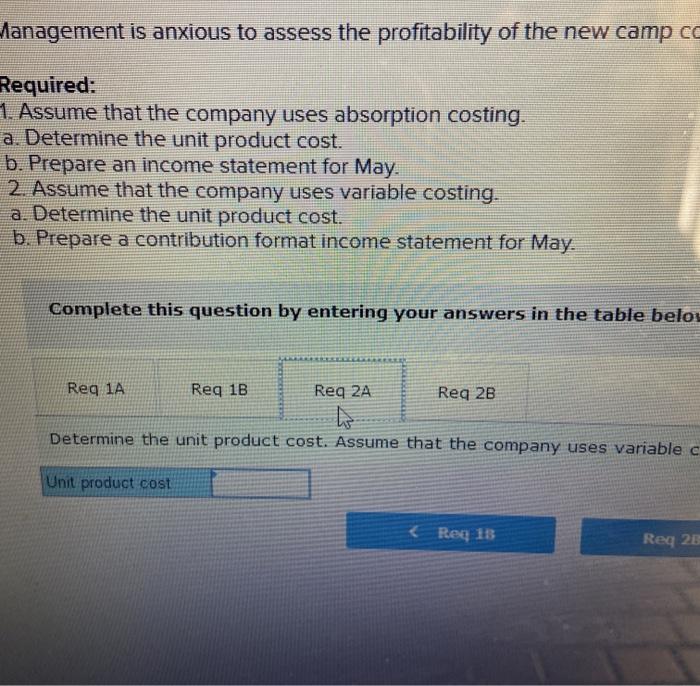

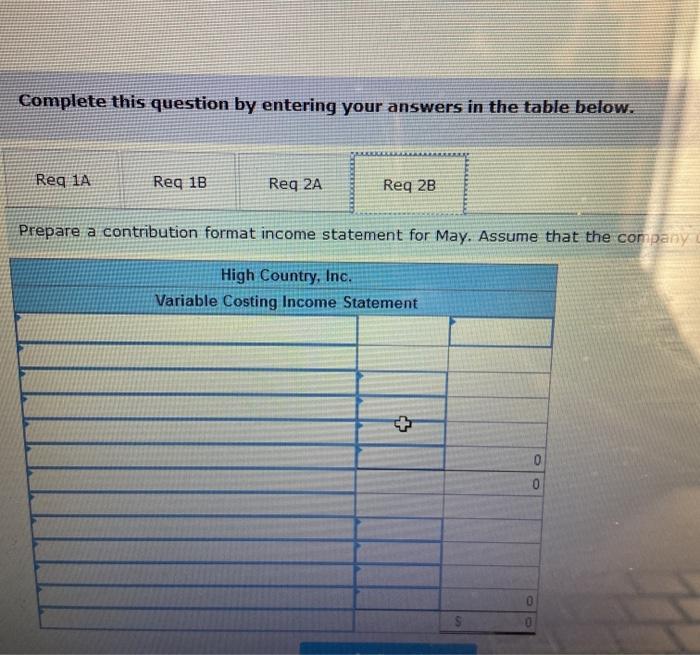

Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them In the West, Central and East regions. Each of these regions is about the same size and each has its own manager and sales staff The company has been experiencing losses for many months in an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Region Hea Central East $33.000 30.000 2699.000 Regional expens traceable) coat of goods 1010 Advertising Salaries Utilities Deprecation Shipping expens Total regional expe sont income out before corporate expenses Corporate expenses Advertisingai General Live expense Total corporate pe Het operating income 1) 23,000 109.000 55.000 0.900 22,000 12000 100 100 242,009 245.000 57000 16.100 20,000 30.000 GONDO 00 310,000 240.000 113.000 14.000 20.000 0.000 10000 10.000 200 350 12,9001 1.000 20H000 1000 19.700 36.000 20.000 36,000 $107.000) The cost of goods sold and shipping expense are both variable. All other costs are fixed Required: 3. Prepare a new contribution format segmented income statement for May (Round percentage answers to 1 decimal place.) Prepare a new contribution format segmented income statement for May (Hound percentage answers to 1 decimal place.) West Central East Total Company Amount Amount Amount Amount Variable expenses Total variable expenses Traceable fixed expenses Total traceable fixed expenses Common fixed expenses Variable expenses. Total variable expenses Traceable fixed expenses Total traceable fixed expenses Common fixed expenses Total common faced expense Net operating income (los) High Country, Inc. produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation 35,000 33,000 80 Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses Variable per unit Fixed per month Manutacturing costat Direct materials coa per unit Die labor CD per unit Variable manufacturing overhead coat per unit Fixed manufacturing overhead coat per month) 5 5 $ 564.000 5 16 5.722.000 Management is anxious to assess the profitability of the new camp cot during the month of May Required: 1. Assume that the company uses absorption costing a. Determine the unit product cost b. Prepare an income statement for May 2. Assume that the company uses variable costing a. Determine the unit product cost. b. Prepare a contribution format income statement for May n Homework Fixed manufacturing overhead cost (per month) $ 722,000 Management is anxious to assess the profitability of the new camp cot during Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for May 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for May. es Complete this question by entering your answers in the table below. Reg 1A Reg 1B Reg 2A Reg 2B Determine the unit product cost. Assume that the company uses absorption costing. Unit product cost Req 1B Fixed manufacturing overhead cost (per month) $ 722,000 Management is anxious to assess the profitability of the new camp cot during the moi Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for May Complete this question by entering your answers in the table below. Reg 1A Req2B Reg 2A Reg 2B Prepare an income statement for May. Assume that the company uses absorption costing. High Country, Inc. Absorption Costing Income Statement 0 0