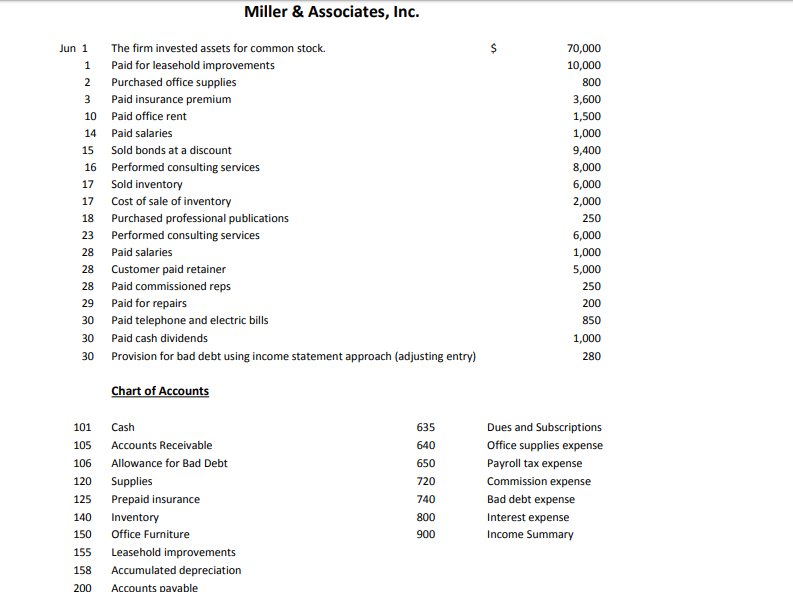

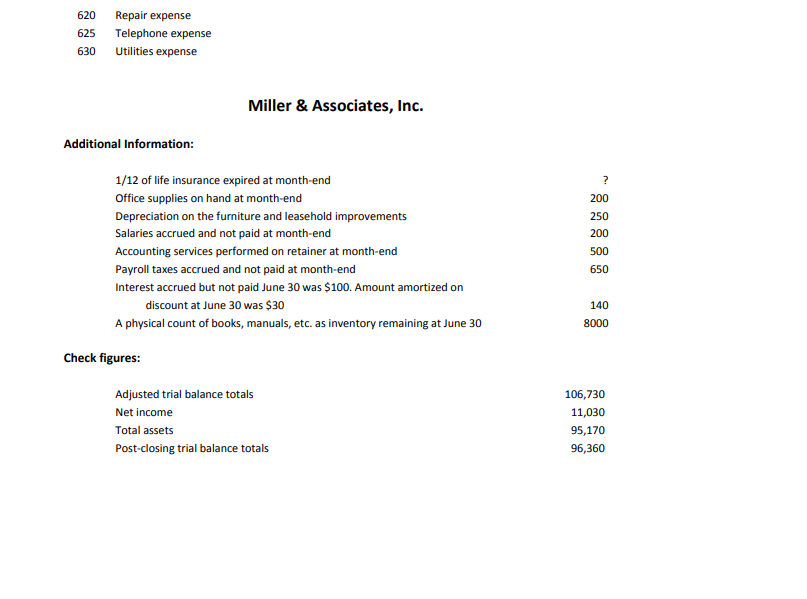

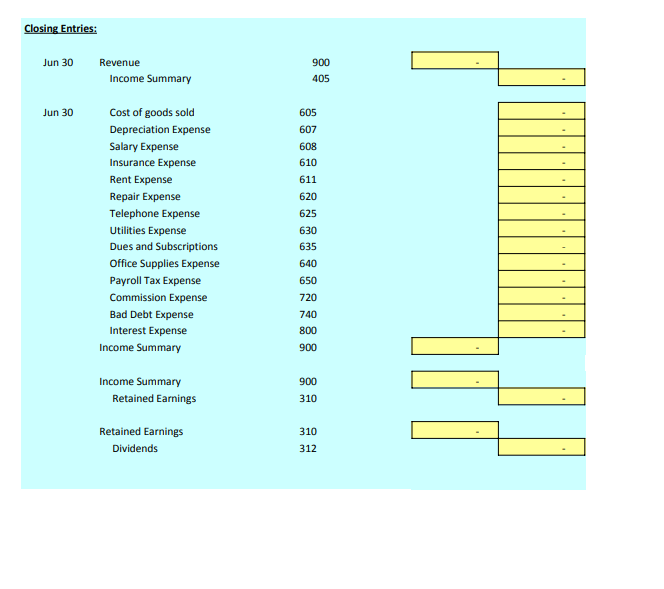

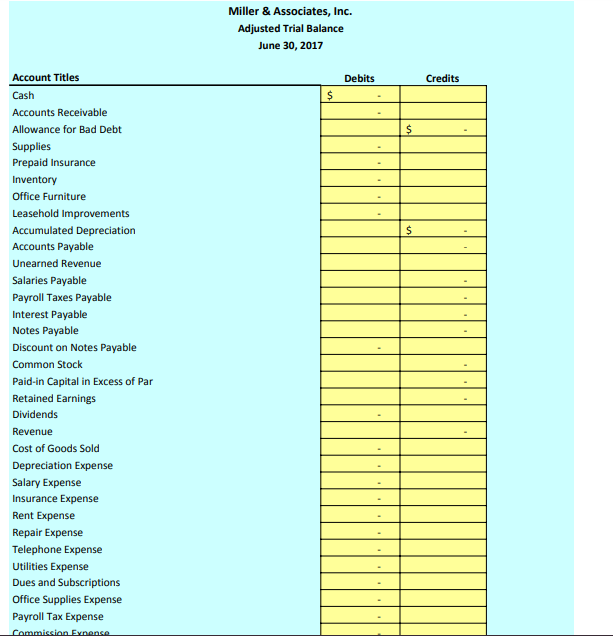

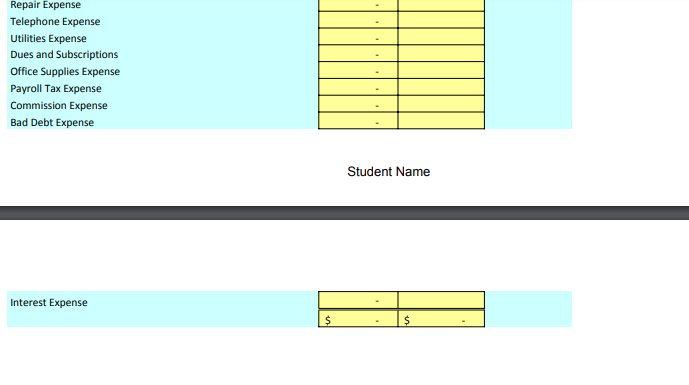

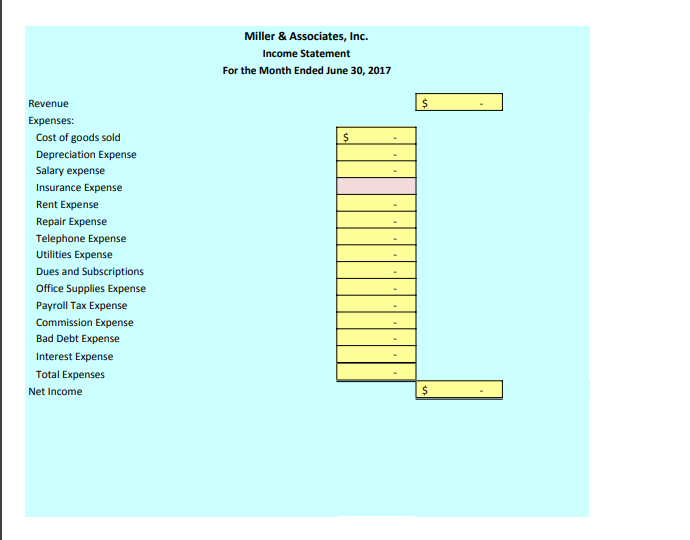

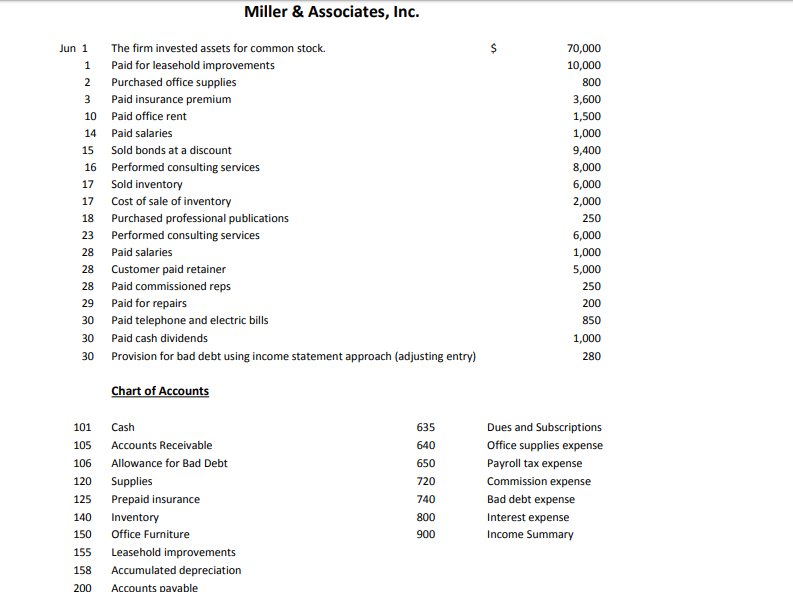

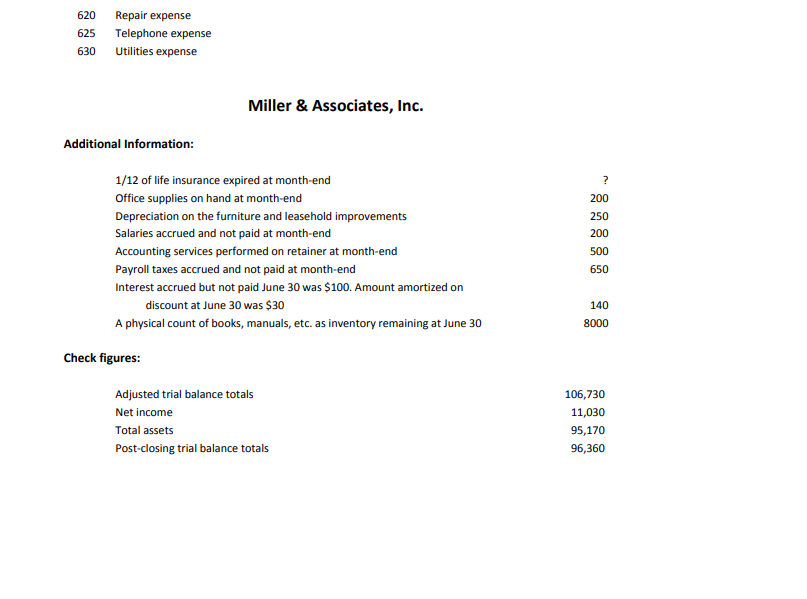

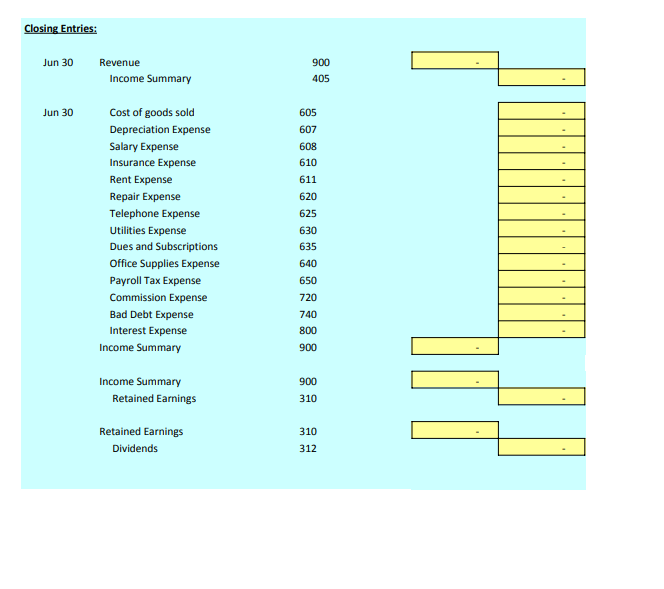

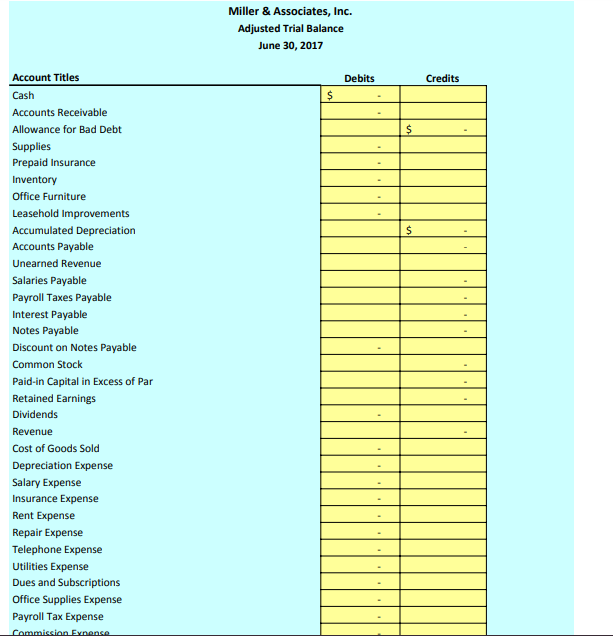

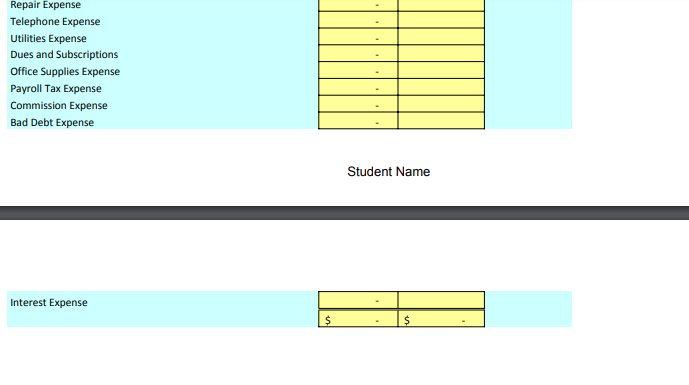

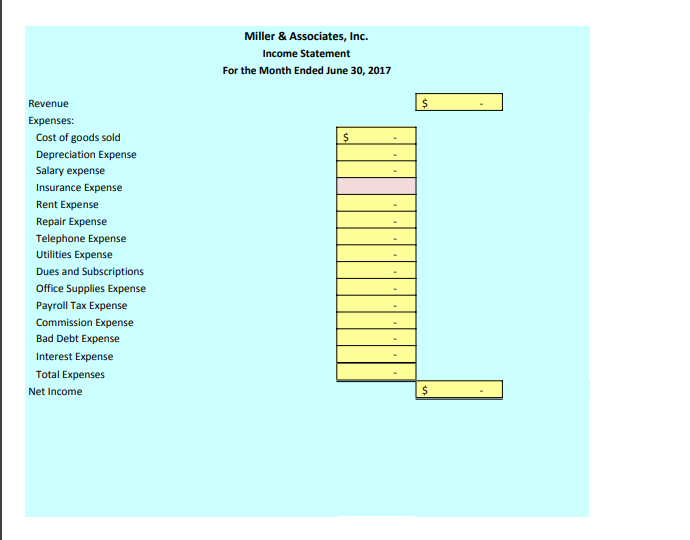

Miller & Associates, Inc. $ 70,000 10,000 800 3,600 Jun 1 The firm invested assets for common stock. 1 Paid for leasehold improvements 2 Purchased office supplies 3 Paid insurance premium 10 Paid office rent 14 Paid salaries 15 Sold bonds at a discount 16 Performed consulting services 17 Sold inventory 17 Cost of sale of inventory 18 Purchased professional publications 23 Performed consulting services 28 Paid salaries 28 Customer paid retainer 28 Paid commissioned reps 29 Paid for repairs 30 Paid telephone and electric bills 30 Paid cash dividends 30 Provision for bad debt using income statement approach (adjusting entry) 1,500 1,000 9,400 8,000 6,000 2,000 250 6,000 1,000 5,000 250 200 850 1,000 280 Chart of Accounts 101 105 106 120 125 140 150 155 158 200 Cash Accounts Receivable Allowance for Bad Debt Supplies Prepaid insurance Inventory Office Furniture Leasehold improvements Accumulated depreciation Accounts payable 635 640 650 720 740 800 900 Dues and Subscriptions Office supplies expense Payroll tax expense Commission expense Bad debt expense Interest expense Income Summary Closing Entries: Jun 30 Revenue Income Summary 900 405 Jun 30 605 607 608 610 611 Cost of goods sold Depreciation Expense Salary Expense Insurance Expense Rent Expense Repair Expense Telephone Expense Utilities Expense Dues and Subscriptions Office Supplies Expense Payroll Tax Expense Commission Expense Bad Debt Expense Interest Expense Income Summary 620 625 630 635 640 650 720 740 800 900 900 Income Summary Retained Earnings TET 310 310 Retained Earnings Dividends 312 Miller & Associates, Inc. Adjusted Trial Balance June 30, 2017 Debits Credits $ $ $ Account Titles Cash Accounts Receivable Allowance for Bad Debt Supplies Prepaid Insurance Inventory Office Furniture Leasehold Improvements Accumulated Depreciation Accounts Payable Unearned Revenue Salaries Payable Payroll Taxes Payable Interest Payable Notes Payable Discount on Notes Payable Common Stock Paid-in Capital in Excess of Par Retained Earnings Dividends Revenue Cost of Goods Sold Depreciation Expense Salary Expense Insurance Expense Rent Expense Repair Expense Telephone Expense Utilities Expense Dues and Subscriptions Office Supplies Expense Payroll Tax Expense Commission Sense Repair Expense Telephone Expense Utilities Expense Dues and Subscriptions Office Supplies Expense Payroll Tax Expense Commission Expense Bad Debt Expense Student Name Interest Expense $ $ Miller & Associates, Inc. $ 70,000 10,000 800 3,600 Jun 1 The firm invested assets for common stock. 1 Paid for leasehold improvements 2 Purchased office supplies 3 Paid insurance premium 10 Paid office rent 14 Paid salaries 15 Sold bonds at a discount 16 Performed consulting services 17 Sold inventory 17 Cost of sale of inventory 18 Purchased professional publications 23 Performed consulting services 28 Paid salaries 28 Customer paid retainer 28 Paid commissioned reps 29 Paid for repairs 30 Paid telephone and electric bills 30 Paid cash dividends 30 Provision for bad debt using income statement approach (adjusting entry) 1,500 1,000 9,400 8,000 6,000 2,000 250 6,000 1,000 5,000 250 200 850 1,000 280 Chart of Accounts 101 105 106 120 125 140 150 155 158 200 Cash Accounts Receivable Allowance for Bad Debt Supplies Prepaid insurance Inventory Office Furniture Leasehold improvements Accumulated depreciation Accounts payable 635 640 650 720 740 800 900 Dues and Subscriptions Office supplies expense Payroll tax expense Commission expense Bad debt expense Interest expense Income Summary Closing Entries: Jun 30 Revenue Income Summary 900 405 Jun 30 605 607 608 610 611 Cost of goods sold Depreciation Expense Salary Expense Insurance Expense Rent Expense Repair Expense Telephone Expense Utilities Expense Dues and Subscriptions Office Supplies Expense Payroll Tax Expense Commission Expense Bad Debt Expense Interest Expense Income Summary 620 625 630 635 640 650 720 740 800 900 900 Income Summary Retained Earnings TET 310 310 Retained Earnings Dividends 312 Miller & Associates, Inc. Adjusted Trial Balance June 30, 2017 Debits Credits $ $ $ Account Titles Cash Accounts Receivable Allowance for Bad Debt Supplies Prepaid Insurance Inventory Office Furniture Leasehold Improvements Accumulated Depreciation Accounts Payable Unearned Revenue Salaries Payable Payroll Taxes Payable Interest Payable Notes Payable Discount on Notes Payable Common Stock Paid-in Capital in Excess of Par Retained Earnings Dividends Revenue Cost of Goods Sold Depreciation Expense Salary Expense Insurance Expense Rent Expense Repair Expense Telephone Expense Utilities Expense Dues and Subscriptions Office Supplies Expense Payroll Tax Expense Commission Sense Repair Expense Telephone Expense Utilities Expense Dues and Subscriptions Office Supplies Expense Payroll Tax Expense Commission Expense Bad Debt Expense Student Name Interest Expense $ $