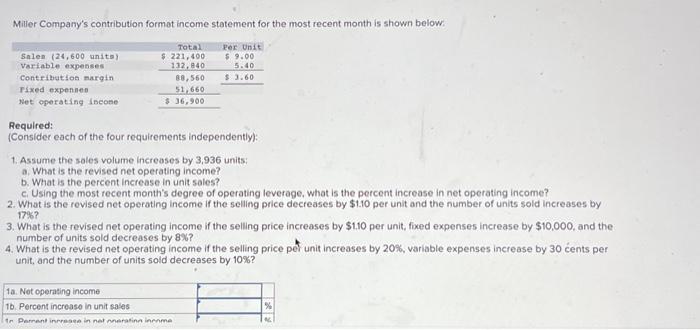

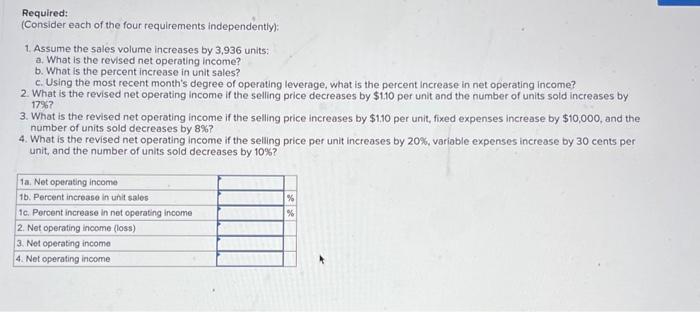

Miller Company's contribution format income statement for the most recent month is shown below: Required: (Consider each of the four requirements independently): 1. Assume the soles volume increases by 3,936 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the seling price decreases by $1.10 per unit and the number of units sold increases by 17% ? 3. What is the revised net operating income if the selling price increases by $1.10 per unit, fixed expenses increase by $10,000, and the number of units sold decreases by 8% ? 4. What is the revised net operating income if the selling price pel unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 10% ? Required: (Consider each of the four requirements independently): 1. Assume the sales volume increases by 3,936 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the selling price decreases by $1.10 per unit and the number of units sold increases by 17%? 3. What is the revised net operating income if the selling price increases by $1,10 per unit, fixed expenses increase by $10,000, and the number of units sold decreases by 8% ? 4. What is the revised net operating income if the seling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 10% ? Miller Company's contribution format income statement for the most recent month is shown below: Required: (Consider each of the four requirements independently): 1. Assume the soles volume increases by 3,936 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the seling price decreases by $1.10 per unit and the number of units sold increases by 17% ? 3. What is the revised net operating income if the selling price increases by $1.10 per unit, fixed expenses increase by $10,000, and the number of units sold decreases by 8% ? 4. What is the revised net operating income if the selling price pel unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 10% ? Required: (Consider each of the four requirements independently): 1. Assume the sales volume increases by 3,936 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the selling price decreases by $1.10 per unit and the number of units sold increases by 17%? 3. What is the revised net operating income if the selling price increases by $1,10 per unit, fixed expenses increase by $10,000, and the number of units sold decreases by 8% ? 4. What is the revised net operating income if the seling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 10%