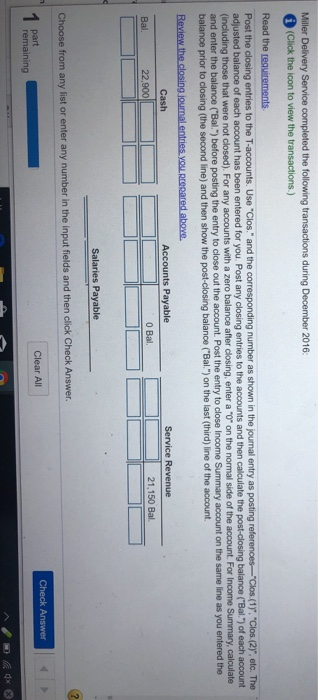

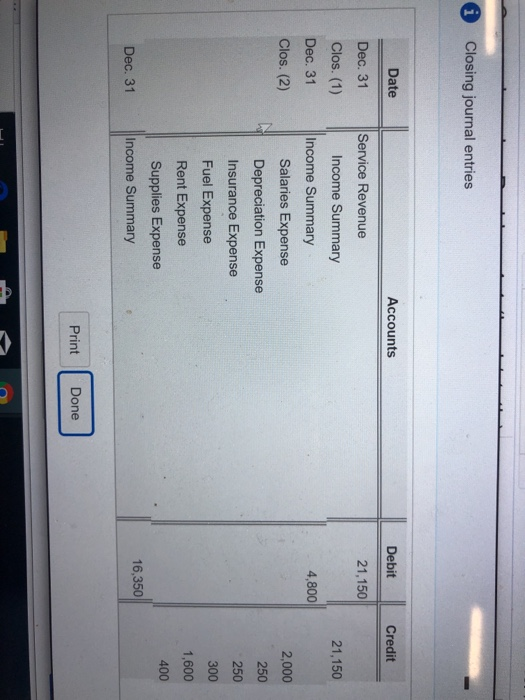

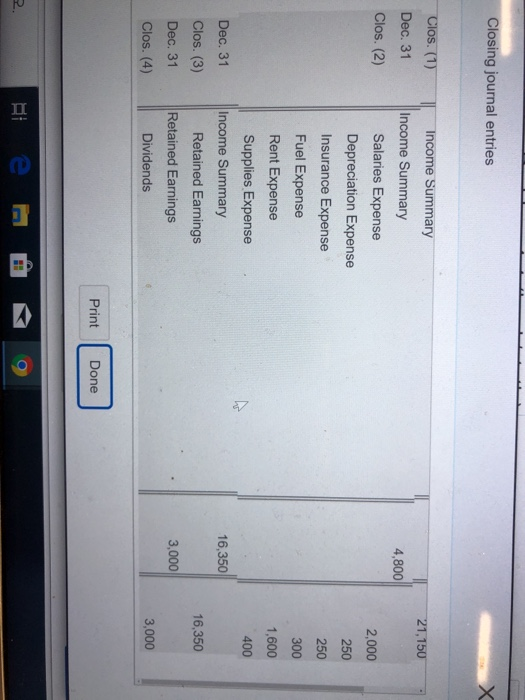

Miller Delivery Service completed the following transactions during December 2016 i (Click the icon to view the transactions.) Read the requirements Post the closing entries to the T-accounts. Use "Clos" and the corresponding number as shown in the journal entry as posting references"Clos(1). "Clos(2)", etc. The adjusted balance of each account has been entered for you. Post any closing entries to the accounts and then calculate the post-closing balance ("Bal") of each account (including those that were not closed). For any accounts with a zero balance after closing, enter a "0" on the normal side of the account. For Income Summary, calculate and enter the balance ("Bal.") before posting the entry to close out the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing the second line) and then show the post-closing balance ("Bal.") on the last (third) line of the account. Review the closing journal entries. You Rocared above Cash Bal. 22,900 Accounts Payable Service Revenue O Bal. 21,150 Bal. Salaries Payable Choose from any list or enter any number in the input fields and then click Check Answer. Check Answer Clear All part remaining i Closing journal entries Date Accounts Debit Credit 21,150 21,150 Dec. 31 Clos. (1) Dec. 31 Clos. (2) 4,800 2,000 250 Service Revenue Income Summary Income Summary Salaries Expense Depreciation Expense Insurance Expense Fuel Expense Rent Expense Supplies Expense Income Summary 250 300 1,600 400 Dec. 31 16,350 Print Print Done Done A Closing journal entries 21,150 Clos. (1) Dec. 31 Clos. (2) 4,800 Income Summary Income Summary Salaries Expense Depreciation Expense Insurance Expense Fuel Expense Rent Expense Supplies Expense Income Summary Retained Earnings Retained Earnings Dividends 2,000 250 250 300 1,600 400 16,350 16,350 Dec. 31 Clos. (3) Dec. 31 Clos. (4) 3,000 3,000 Print [Done Print Done Miller Delivery Service completed the following transactions during December 2016: (Click the icon to view the transactions.) Read the requirements. Review the closing.journal entries you prepared above Cash Accounts Payable Bal. 22,900 O Bal. Service Revenue 21,150 Bal. Salaries Payable 1,000 Bal. Choose from any list or enter any number in the input fields and then click Check Answer. part Clear All remaining Miller Delivery Service completed the following transactions during December 2016: (Click the icon to view the transactions.) Read the requirements Accounts Receivable 1,350 Unearned Revenue 500 Bal Salaries Expense . 2,000 Bal. Bal. Depreciation Expense-Truck Office Supplies 100 Common Stock 30,000 Bal. Bal. Bal. 250 Choose from any list or enter any number in the input fields and then click Check Answer. 1 part Clear All Miller Delivery Service completed the following transactions during December 2016: i (Click the icon to view the transactions.) Read the requirements Insurance Expense Prepaid Insurance 750 Retained Earnings 0 Bal Bal. Bal. 250 Truck 20,000 Dividends 3,000 Fuel Expense 300 Bal. Bal. Bal. Choose from any list or enter any number in the input fields and then click Check Answer. Clear All part remaining LLLL Income Summary Accumulated Depreciation-Truck 250 Bal. Rent Expense 1,600 Bal. Supplies Expense Bal. 400 Choose from any list or enter any number in the input fields and then click Check Answer. Clear All 1 part remaining