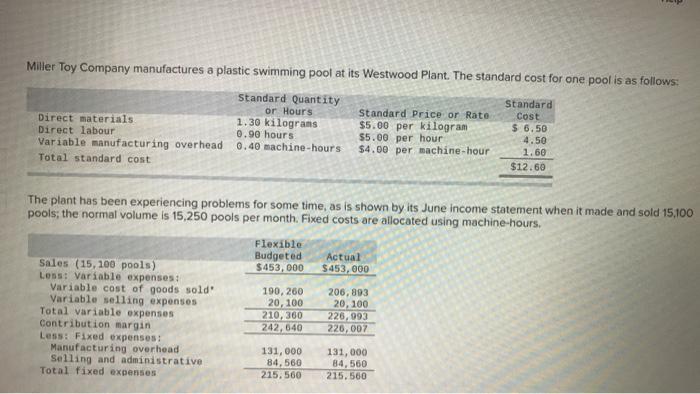

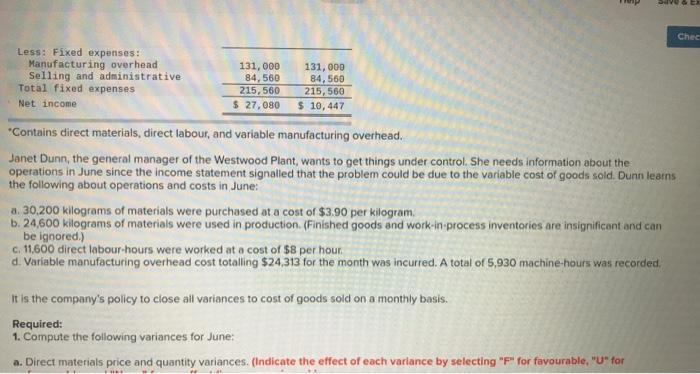

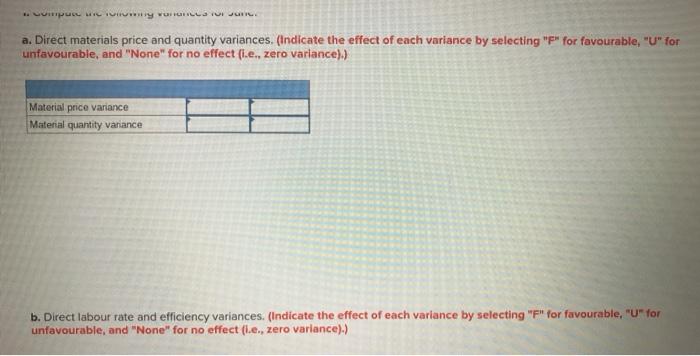

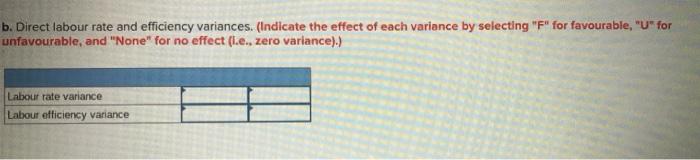

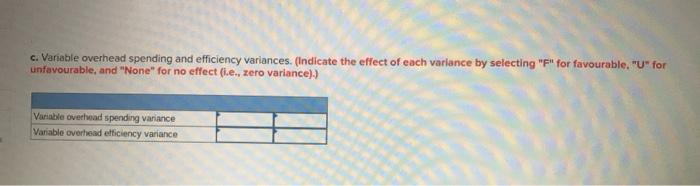

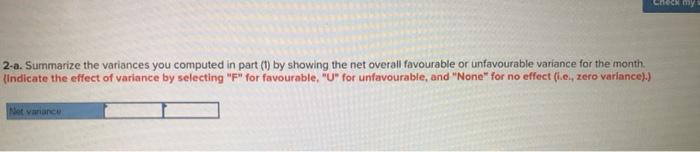

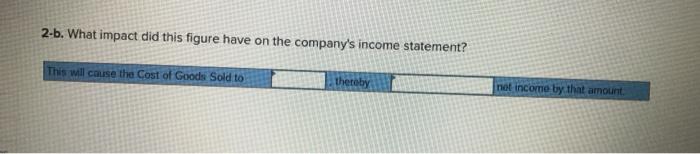

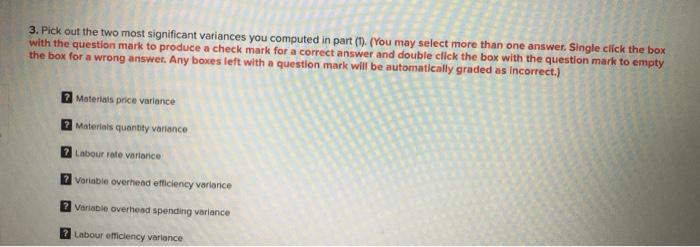

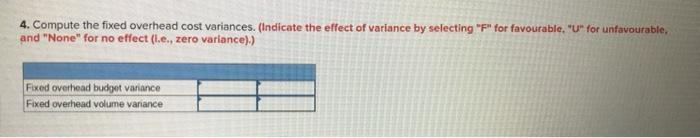

Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The standard cost for one pool is as follows: Standard Quantity Standard or Hours Standard Price or Rato Cost Direct materials 1.30 kilograms $5.00 per kilogram $ 6.50 Direct labour 0.90 hours 55.00 per hour 4.50 Variable manufacturing over head 0.40 machine-hours $4.00 per machine-hour 1.60 Total standard cost $12.60 The plant has been experiencing problems for some time, as is shown by its June income statement when it made and sold 15,100 pools; the normal volume is 15,250 pools per month. Fixed costs are allocated using machine hours. Flexible Budgeted $453,000 Actual $453,000 Sales (15,100 pools) Less: Variable expenses Variable cost of goods sold' Variable selling expenses Total variable expenses Contribution margin Less: Fixed expenses Manufacturing overhead Selling and administrative Total fixed expenses 190, 260 20, 100 210, 360 242, 640 206,893 20, 100 226,993 220,007 131,000 84,560 215.560 131,000 84,560 215,560 Save Chec 84,560 Less: Fixed expenses: Manufacturing overhead 131,000 131,000 Selling and administrative 84,560 Total fixed expenses 215,560 215, 560 Net income $ 27,080 $ 10, 447 Contains direct materials, direct labour, and variable manufacturing overhead. Janet Dunn, the general manager of the Westwood Plant, wants to get things under control. She needs information about the operations in June since the income statement signalled that the problem could be due to the variable cost of goods sold. Dunn learns the following about operations and costs in June a. 30,200 kilograms of materials were purchased at a cost of $3.90 per kilogram b. 24,600 kilograms of materials were used in production (Finished goods and work in process inventories are insignificant and can be ignored.) c. 11.600 direct labour-hours were worked at a cost of $8 per hour d. Variable manufacturing overhead cost totalling $24,313 for the month was incurred. A total of 5,930 machine-hours was recorded It is the company's policy to close all variances to cost of goods sold on a monthly basis. Required: 1. Compute the following variances for June: a. Direct materials price and quantity variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for irpur ICI ORILLS TUI JUR a. Direct materials price and quantity variances, (Indicate the effect of each variance by selecting "P" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance):) Material price variance Material quantity variance b. Direct labour rate and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect i.e., zero variance).) b. Direct labour rate and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (l.e., zero variance).) Labour rate variance Labour efficiency variance c. Variable overhead spending and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable. "U" for unfavourable, and "None" for no effect (ie, zero variance)) Variable overhead spending variance Variable overhead efficiency variance Shemy 2-a. Summarize the variances you computed in part (1) by showing the net overall favourable or unfavourable variance for the month. {Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (ie, zero variance).) Net van 2-b. What impact did this figure have on the company's income statement? This will cause the cost of Goods Sold to thereby net income by that amount 3. Pick out the two most significant variances you computed in part (1). (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Materials price variance Materials quantity variance Labout rate variance Variable overhead efficiency variance 2 Variable overhead spending variance 2 Labour efficiency variance 4. Compute the fixed overhead cost variances. (Indicate the effect of variance by selecting "F" for favourable. "U" for unfavourable. and "None" for no effect (l.e., zero variance)) Fixed overhead budget variance Fixed overhead volume variance