Question

Milliken uses a digitally controlled dyer for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for

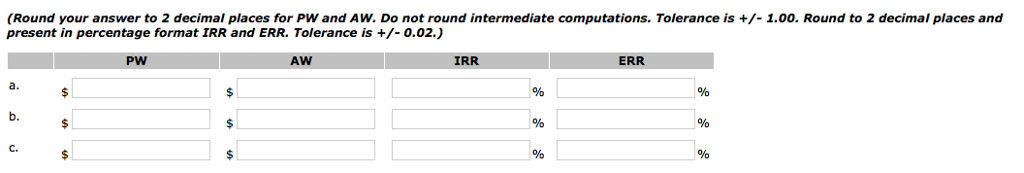

Milliken uses a digitally controlled dyer for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for $300,000. It is expected to last 8 years and has a salvage value of $30,000. Increased before tax cash flow due to this dyer is $85,000 per year. Milliken's tax rate is 40%, and the after-tax MARR is 12%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR after 8 years. Use straight-line depreciation (no half-year convention). Use MACRS-GDS and state the appropriate property class. Use double declining balance depreciation (no half-year convention, no switching).

PW=present worth

AW = annual worth

ERR = economic rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started