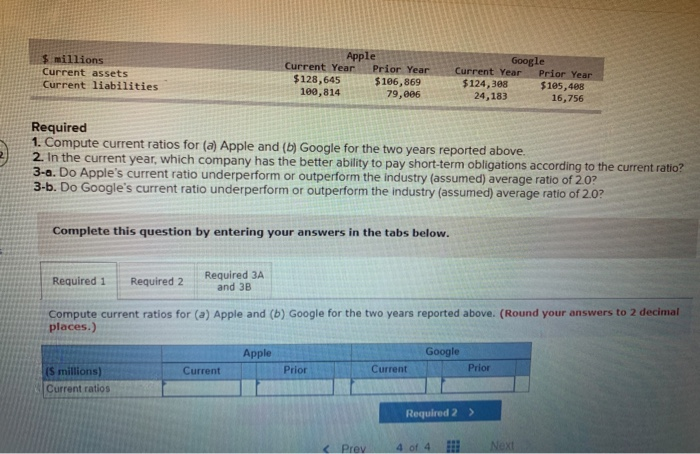

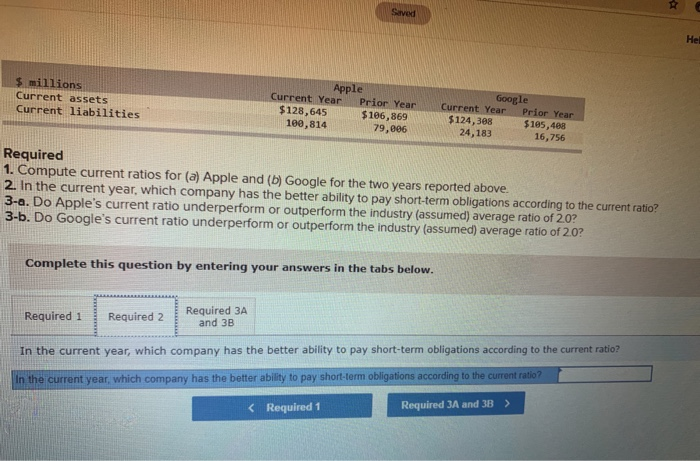

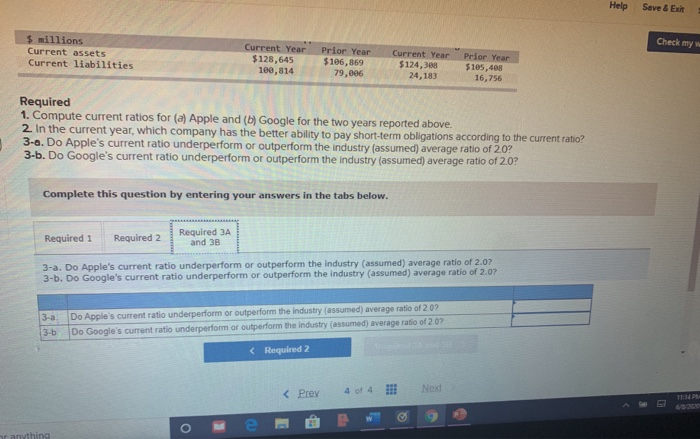

$ millions Current assets Current liabilities Apple Current Year Prior Year $128,645 $196,869 109,814 79,086 Google Current Year Prior Year $124,388 $105,488 24,183 16,756 Required 1. Compute current ratios for (a) Apple and (b) Google for the two years reported above. 2. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? 3-a. Do Apple's current ratio underperform or outperform the industry (assumed) average ratio of 2.0? 3-b. Do Google's current ratio underperform or outperform the industry (assumed) average ratio of 2.0? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A and 3B Compute current ratios for (a) Apple and (b) Google for the two years reported above. (Round your answers to 2 decimal places.) Apple Google (5 millions) Current Prior Current Prior Current ratios Required 2 > Prey 4 of 4 !!! Next Saved He $ millions Current assets Current liabilities Apple Current Year Prior Year $128,645 $196,869 180,814 79,006 Google Current Year Prior Year $ 124,388 $185,488 24,183 16,756 Required 1. Compute current ratios for (a) Apple and (b) Google for the two years reported above. 2. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? 3-a. Do Apple's current ratio underperform or outperform the industry (assumed) average ratio of 2.0? 3-b. Do Google's current ratio underperform or outperform the industry (assumed) average ratio of 2.0? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A and 3B In the current year, which company has the better ability to pay short-term obligations according to the current ratio? In the current year, which company has the better ability to pay short-term obligations according to the current ratio? Help Save & Exit Check my $ millions Current assets Current liabilities Current Year $128,645 100,814 Prior Year $196,869 79,096 Current Year $124,38 24,183 Prior Year $105,408 16,756 Required 1. Compute current ratios for (a) Apple and (b) Google for the two years reported above. 2. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? 3-a. Do Apple's current ratio underperform or outperform the industry (assumed) average ratio of 20? 3-b. Do Google's current ratio underperform or outperform the industry (assumed) average ratio of 2.0? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A and 3B 3-a. Do Apple's current ratio underperform or outperform the industry (assumed) average ratio of 2.07 3-b. Do Google's current ratio underperform or outperform the industry (assumed) average ratio of 2.07 3-a 13-b Do Apple's current ratio underperform or outperform the industry (assumed) average ratio of 2.0? Do Google's current ratio underperform or outperform the industry (assumed) average ratio of 2.0?