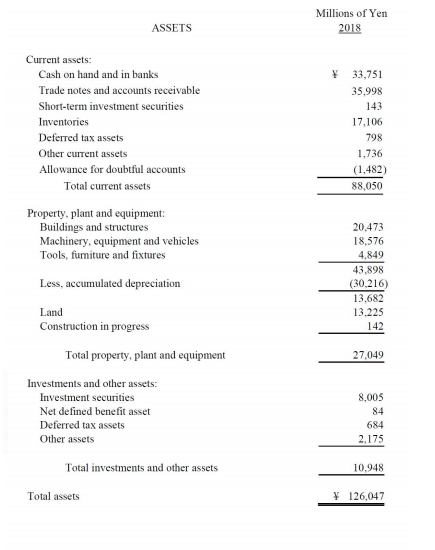

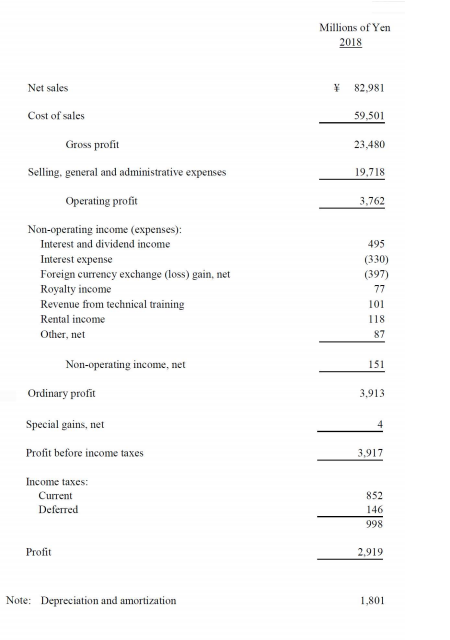

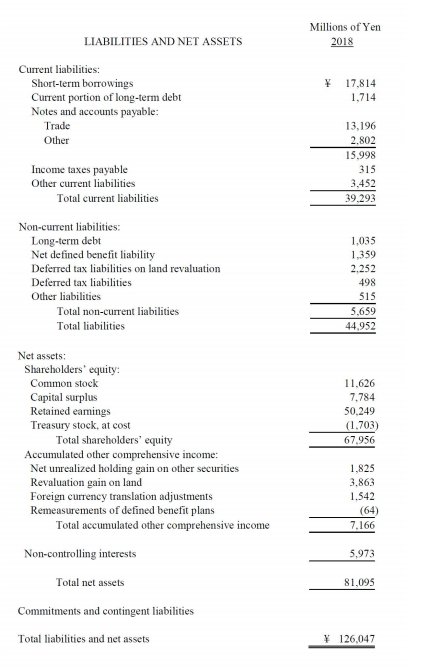

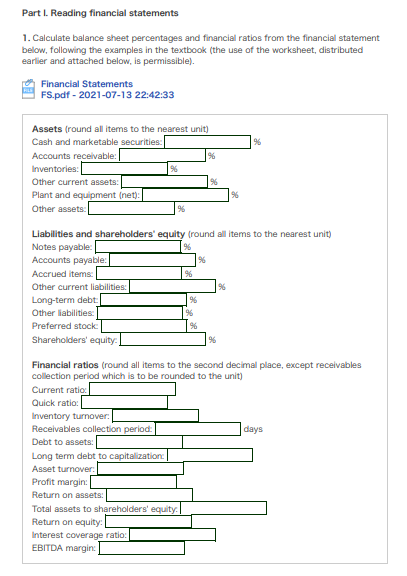

Millions of Yen ASSETS 2018 Current assets: Cash on hand and in banks V 33,751 Trade notes and accounts receivable 35.998 Short-term investment securities 143 Inventories 17,106 Deferred tax assets 798 Other current assets 1,736 Allowance for doubtful accounts (1,482) Total current assets 88.050 Property, plant and equipment: Buildings and structures 20.473 Machinery, equipment and vehicles 18,576 Tools, furniture and fixtures 4.849 43,898 Less, accumulated depreciation (30,216) 13.682 Land 13.225 Construction in progress 142 Total property, plant and equipment 27.049 Investments and other assets: Investment securities 8,005 Net defined benefit asset 84 Deferred tax assets 684 Other assets 2.175 Total investments and other assets 10.948 Total assets Y 126,047Millions of Yen 2018 Net sales 82,981 Cost of sales 59.501 Gross profit 23,480 Selling, general and administrative expenses 19.718 Operating profit 3.762 Non-operating income (expenses): Interest and dividend income 495 Interest expense (330) Foreign currency exchange (loss) gain, net (397) Royalty income 77 Revenue from technical training 101 Rental income 118 Other, net 87 Non-operating income, net 151 Ordinary profit 3.913 Special gains, net 4 Profit before income taxes 3,917 Income taxes: Current 852 Deferred 146 998 Profit 2.919 Note: Depreciation and amortization 1,801Millions of Yen LIABILITIES AND NET ASSETS 2018 Current liabilities: Short-term borrowings Y 17.814 Current portion of long-term debt 1,714 Notes and accounts payable: Trade 13,196 Other 2.802 15.998 Income taxes payable 315 Other current liabilities 3.452 Total current liabilities 39.293 Non-current liabilities: Long-term debt 1,035 Net defined benefit liability 1,359 Deferred tax liabilities on land revaluation 2,252 Deferred tax liabilities 498 Other liabilities 515 Total non-current liabilities 5.659 Total liabilities 44.952 Net assets: Shareholders* equity: Common stock 11,626 Capital surplus 7.784 Retained earnings 50.249 Treasury stock, at cost (1.703) Total shareholders' equity 67.956 Accumulated other comprehensive income: Net unrealized holding gain on other securities 1,825 Revaluation gain on land 3.863 Foreign currency translation adjustments 1.542 Remeasurements of defined benefit plans (64) Total accumulated other comprehensive income 7,166 Non-controlling interests 5.973 Total net assets 81.095 Commitments and contingent liabilities Total liabilities and net assets Y 126,047Part I. Reading financial statements 1. Calculate balance sheet percentages and financial ratios from the financial statement below, following the examples in the textbook (the use of the worksheet, distributed earlier and attached below, is permissible). Financial Statements FS.pdf - 2021-07-13 22:42:33 Assets (round all items to the nearest unit] Cash and marketable securities: Accounts receivable: Inventories: Other current assets: Plant and equipment (net): Other assets: Liabilities and shareholders' equity (round all items to the nearest unit) Notes payable: Accounts payable: Accrued items: Other current liabilities: Long-term debt Other liabilities Preferred stock: Shareholders' equity:] Financial ratios (round all items to the second decimal place, except receivables collection period which is to be rounded to the unit) Current ratio. Quick ratio: Inventory turnover: Receivables collection period: days Debt to assets: Long term debt to capitalization: Asset turnover: Profit margin: Return on assets: Total assets to shareholders' equity. Return on equity: Interest coverage ratio: EBITDA margin:worksheet FinancialratiosWS.xlex - 2021-04-19 19:47:50 2. Give three features that stand out in the financial statement of this firm: /course_806746_query_960653_1p1?refresh=6OF55760 3. If the firm's share price was 800 yen (65.5 million shares outstanding) and dividends of 10 yen per share, would you recommend buying the share? 100 Yes 200 No Briefly explain why you think so