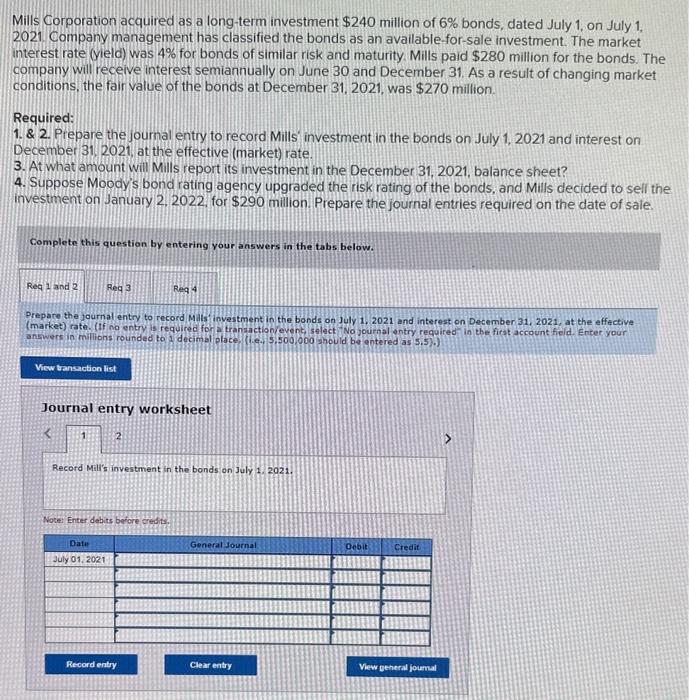

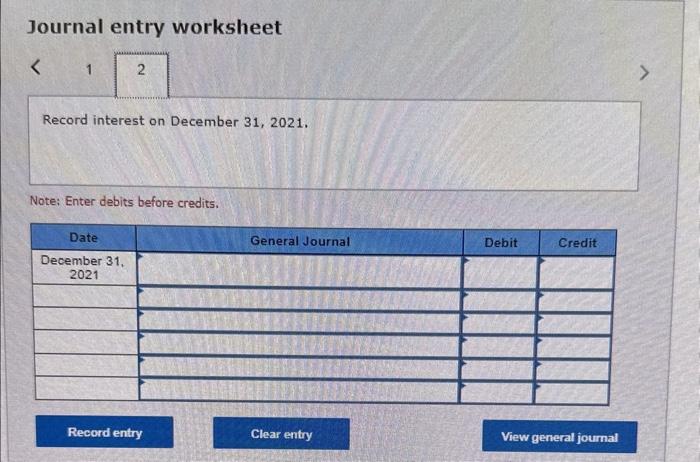

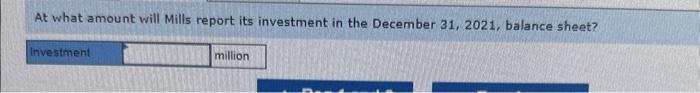

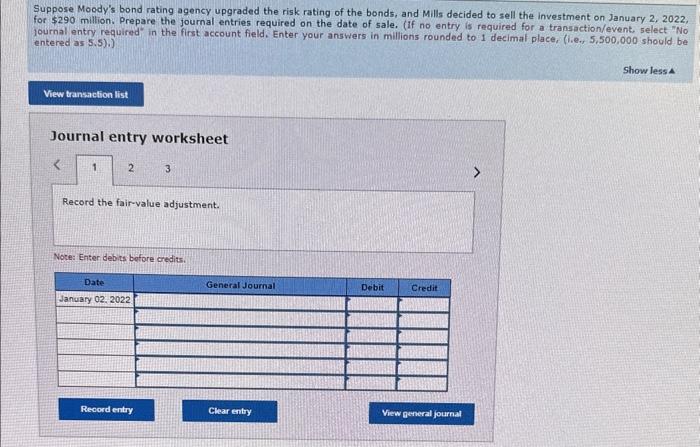

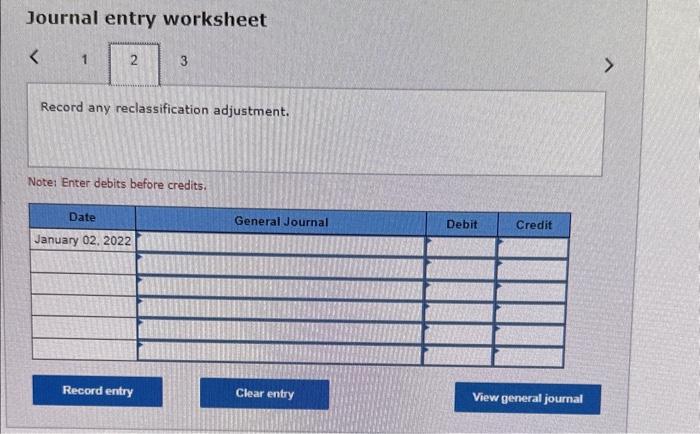

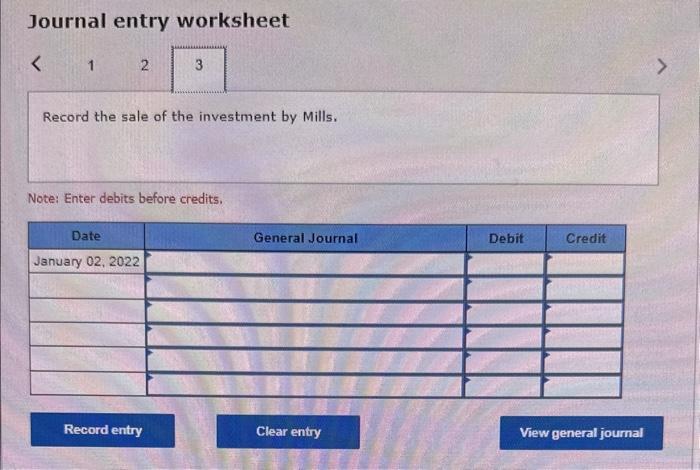

Mills Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1 , on July 1 , 2021. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 4% for bonds of similar risk and maturity. Mills paid $280 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $270 million. Required: 1. \& 2. Prepare the joumal entry to record Mills investment in the bonds on July 1,2021 and interest on December 31, 2021, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2021, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2. 2022, for $290 million. Prepare the journal entries required on the date of sale. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record Mats investment in the bonds on july 1, 2021 and interest on December 31 , 2021 , at the effective (market) rate. (tf no entry is required for a transactionseyent select No journal ontry required in the first account fieid. Enter your answers in millions rounded to 4 decimal place. (l.e. 5,500,000 should be entered as 5.5. 6 ) Journal entry worksheet 2 Record Mall's investment in the bonds on July 1., 2021. Note Enter debits bercre credits. Journal entry worksheet Record interest on December 31, 2021. Note: Enter debits before credits. At what amount will Mills report its investment in the December 31,2021 , balance sheet? Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2 , 2022 , for $290 million. Prepare the journal entries required on the date of sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) Show lessa Journal entry worksheet 23 Journal entry worksheet Record any reclassification adjustment. Notei Enter debits before credits. Journal entry worksheet 1 Record the sale of the investment by Mills. Note: Enter debits before credits