Question

Millsborough Limited list of balances year ended December 31,2012 1 Rent expense owing as at December 31,2012$2,000 2 Rental income for 2013 received in 2012

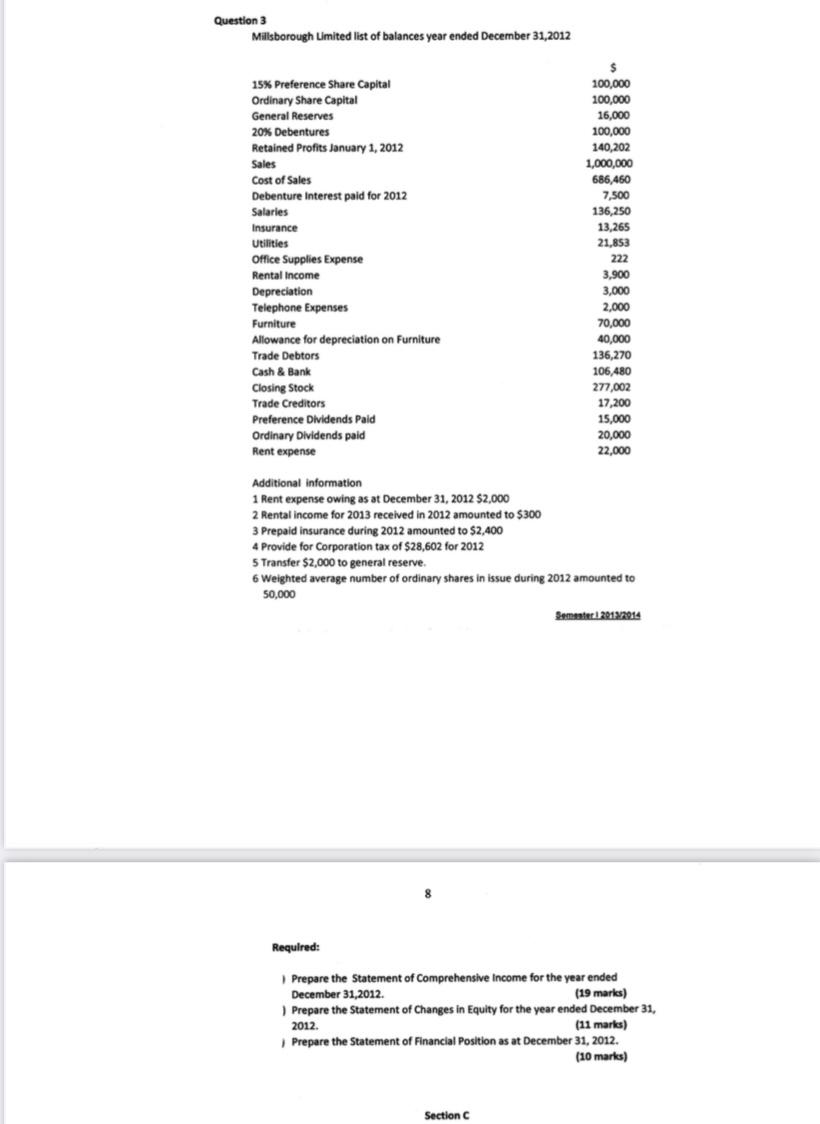

Millsborough Limited list of balances year ended December 31,2012 1 Rent expense owing as at December 31,2012$2,000 2 Rental income for 2013 received in 2012 amounted to $300 3 Prepaid insurance during 2012 amounted to $2,400 4 Provide for Corporation tax of $28,602 for 2012 5 Transfer $2,000 to general reserve. 6 Weighted average number of ordinary shares in issue during 2012 amounted to 50,000 1 Prepare the Statement of Comprehensive Income for the year ended December 31,2012. (19 marks) I Prepare the Statement of Changes in Equity for the year ended December 31 2012. (11 marks) f Prepare the Statement of Financial Position as at December 31, 2012. (10 marks) a) $200,000 of the debentures will be repaid on March 31, 2015 b) maintenance expense unpaid on December, 31, 2014 amounted to 51,600 c) Rental income for December 2014 amounting to $1,625 was received in January 2015. d) Insurance prepaid for 2005 amounted to $12,000. c) Provide for corporation tax of $137,280 for 2014 . f) Transfer $5,000 to general reserves. g) Weighted average number of ordinary shares in issue during the financial year amounted to 800,000. h) Provide for depreciation on the equipment. Depreciation is being provided on the reducing balance at a rate of 20% per annum.

Millsborough Limited list of balances year ended December 31,2012 1 Rent expense owing as at December 31,2012$2,000 2 Rental income for 2013 received in 2012 amounted to $300 3 Prepaid insurance during 2012 amounted to $2,400 4 Provide for Corporation tax of $28,602 for 2012 5 Transfer $2,000 to general reserve. 6 Weighted average number of ordinary shares in issue during 2012 amounted to 50,000 1 Prepare the Statement of Comprehensive Income for the year ended December 31,2012. (19 marks) I Prepare the Statement of Changes in Equity for the year ended December 31 2012. (11 marks) f Prepare the Statement of Financial Position as at December 31, 2012. (10 marks) a) $200,000 of the debentures will be repaid on March 31, 2015 b) maintenance expense unpaid on December, 31, 2014 amounted to 51,600 c) Rental income for December 2014 amounting to $1,625 was received in January 2015. d) Insurance prepaid for 2005 amounted to $12,000. c) Provide for corporation tax of $137,280 for 2014 . f) Transfer $5,000 to general reserves. g) Weighted average number of ordinary shares in issue during the financial year amounted to 800,000. h) Provide for depreciation on the equipment. Depreciation is being provided on the reducing balance at a rate of 20% per annum.

Required: 1. prepare the Income Statement for the year ended December 31, 2014

2. Prepare the Statement of Financial Position as at Decenber, 31, 2014.

3.Prepare the Statement of Financial Position as at December 31, 2012.

Question 3 Millsborough Limited list of balances year ended December 31,2012 3 Prepaid insurance during 2012 amounted to $2,400 4 Provide for Corporation tax of $28,602 for 2012 5 Transfer $2,000 to general reserve. 6 Weighted average number of ordinary shares in issue during 2012 amounted to 50,000 Femmiter1201yro 14 8 Requlred: I Prepare the Statement of Comprehensive income for the year ended December 31,2012. (19 marks) I Prepare the Statement of Changes in Equity for the year ended December 31, 2012. (11 marks) ) Prepare the Statement of Financial Position as at December 31, 2012. (10 marks) Question 3 Millsborough Limited list of balances year ended December 31,2012 3 Prepaid insurance during 2012 amounted to $2,400 4 Provide for Corporation tax of $28,602 for 2012 5 Transfer $2,000 to general reserve. 6 Weighted average number of ordinary shares in issue during 2012 amounted to 50,000 Femmiter1201yro 14 8 Requlred: I Prepare the Statement of Comprehensive income for the year ended December 31,2012. (19 marks) I Prepare the Statement of Changes in Equity for the year ended December 31, 2012. (11 marks) ) Prepare the Statement of Financial Position as at December 31, 2012. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started