Answered step by step

Verified Expert Solution

Question

1 Approved Answer

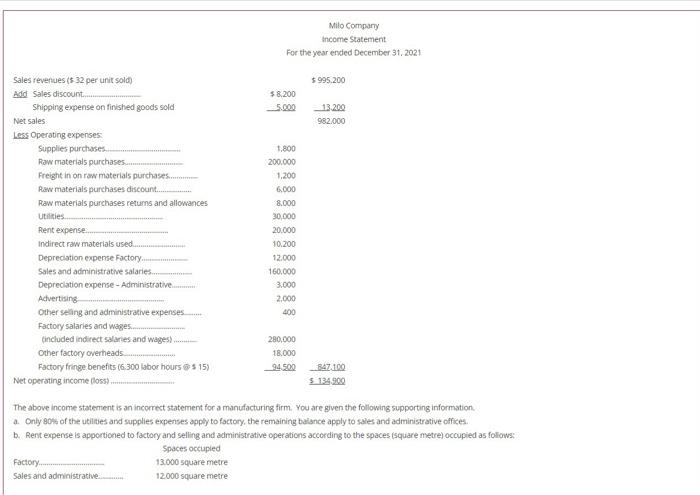

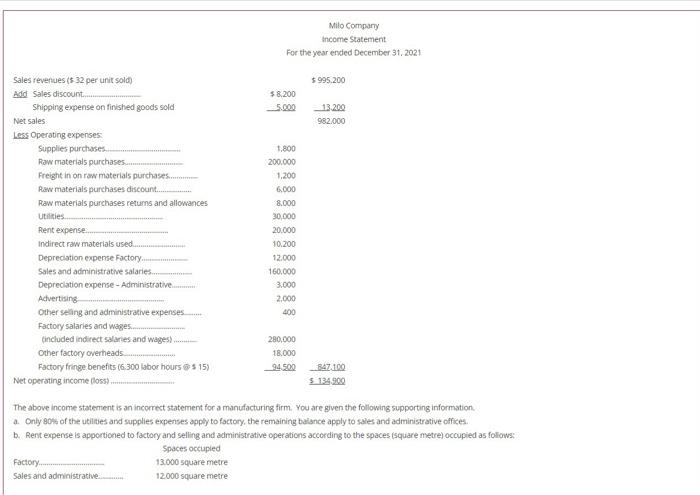

milo Milo Company Income Statement For the year ended December 31, 2021 $995.200 $8.200 5.000 13.200 982.000 Sales revenues (5 32 per unit sold) Add

milo

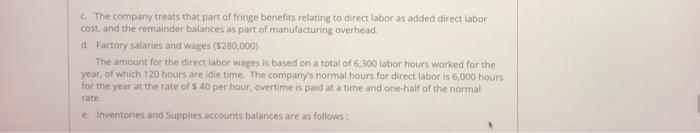

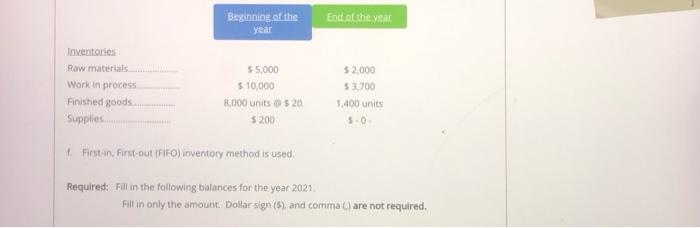

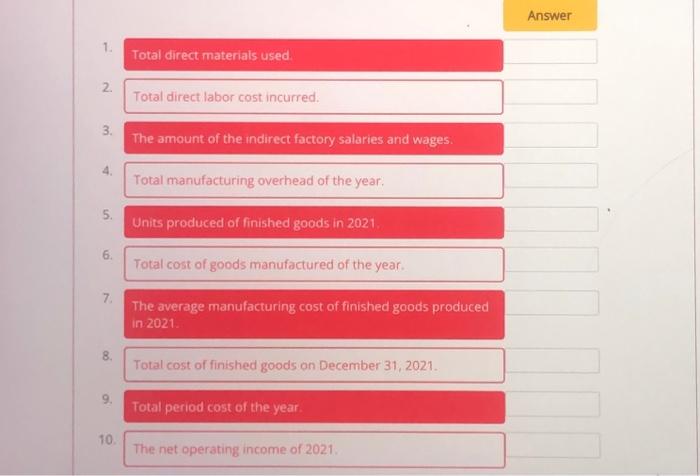

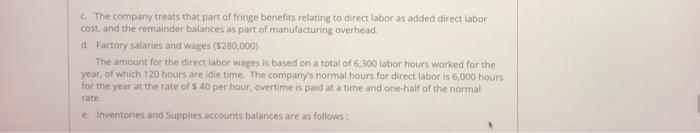

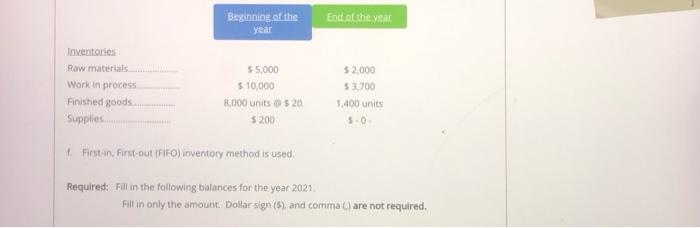

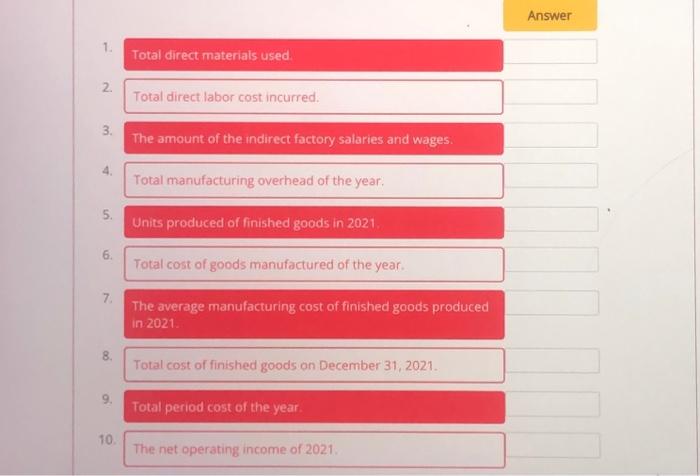

Milo Company Income Statement For the year ended December 31, 2021 $995.200 $8.200 5.000 13.200 982.000 Sales revenues (5 32 per unit sold) Add Sales discount..... Shipping expense on finished goods sold Net sales Less Operating expenses Supplies purchases Raw materials purchases Freight in on raw materials purchases Raw materials purchases discount... Raw materials purchases returns and allowances Utilities Rent expense. Indirect raw materials used Depreciation expense Factory Sales and administrative salaries... Depreciation expense - Administrative Advertising Other selling and administrative expenses...... Factory salaries and wages... included indirect salanes and wages) Other factory overheads Factory fringe benefits (6.300 labor hours $ 15) Net operating income foss 1,800 200.000 1.200 6,000 8.000 30,000 20.000 10.200 12.000 160,000 3.000 2.000 400 280,000 18.000 94.500 347.100 $ 134900 The above income statement is an incorrect statement for a manufacturing firm. You are given the following supporting Information 4. Only 80% of the utilities and supplies expenses apply to factory, the remaining balance apply to sales and administrative offices b. Rent expense Is apportioned to factory and selling and administrative operations according to the spaces (square metre occupied as follows: Spaces occupied Factory 13.000 square metre Sales and administrative 12.000 square metre The company treats that part of fringe benefits relating to direct labor as added direct labor cost, and the remainder balances as part of manufacturing overhead d. Factory Salaries and wages (5280,000) The amount for the direct labor wages is based on a total of 6,300 labor hours worked for the year, of which 120 hours are idle time. The company's normal hours for direct labor is 6,000 hours for the year at the rate of s 40 per hour overtime is paid at a time and one half of the normal Inventories and Supplies accounts balances are as follows: rate Beginning of the year End of the year Inventories Raw materials Work in process Finished goods Supplies 55.000 $ 10,000 8,000 units $ 20 5200 $ 2,000 $3,700 1,400 units 5.0 1. First, Firstout (FIFO) inventory method is used Required: Fill in the following balances for the year 2021 Fill in only the amount. Dollar sign (5), and comma () are not required. Answer 1 Total direct materials used. 2. Total direct labor cost incurred. 3. The amount of the indirect factory salaries and wages. 4 Total manufacturing overhead of the year, 5. Units produced of finished goods in 2021 6. Total cost of goods manufactured of the year. 7 The average manufacturing cost of finished goods produced in 2021 8. Total cost of finished goods on December 31, 2021. 9. Total period cost of the year 10 The net operating income of 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started