Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MILWAUKEE REGIONAL HEALTH SYSTEM Revenue Cycle Management 1. a. Using the template given in Exhibit 30.1, add one additional overall benchmark and one defect benchmark

MILWAUKEE REGIONAL HEALTH SYSTEM Revenue Cycle Management

1. a. Using the template given in Exhibit 30.1, add one additional overall benchmark and one defect benchmark for each of the revenue cycle functions listed.

b. Describe each metric in the completed template and provide justification as to why these benchmarks were chosen over the alternatives listed in Exhibit 30.2

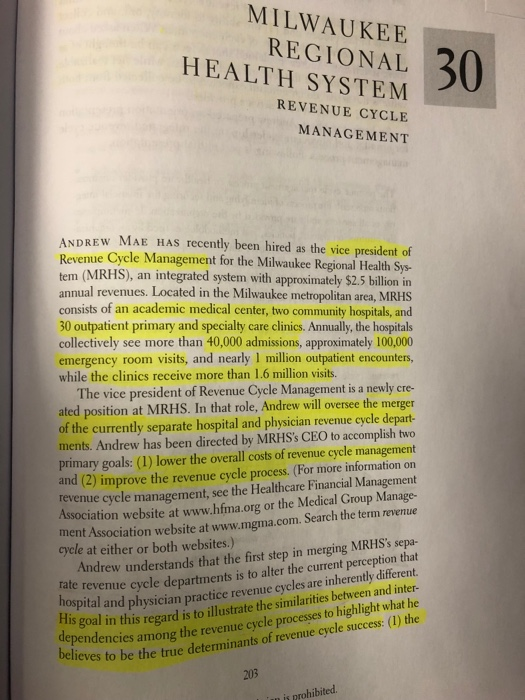

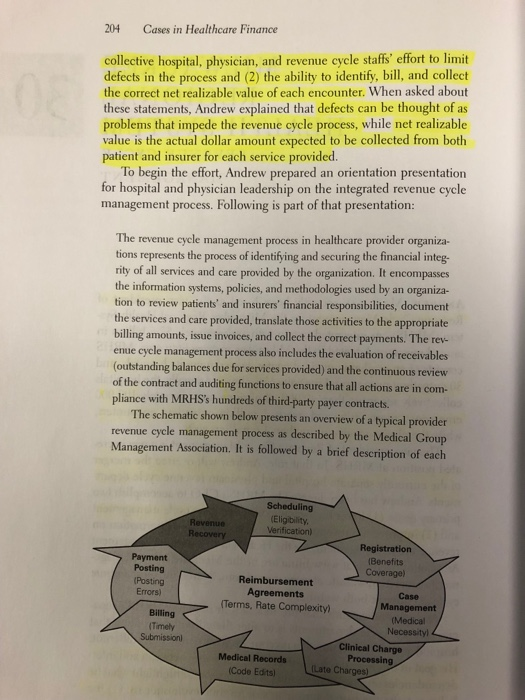

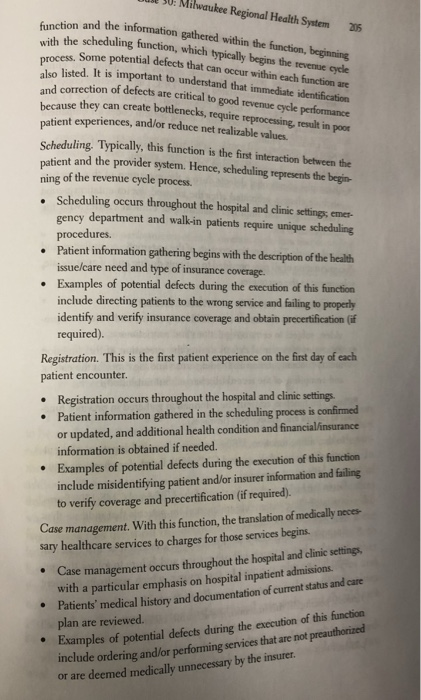

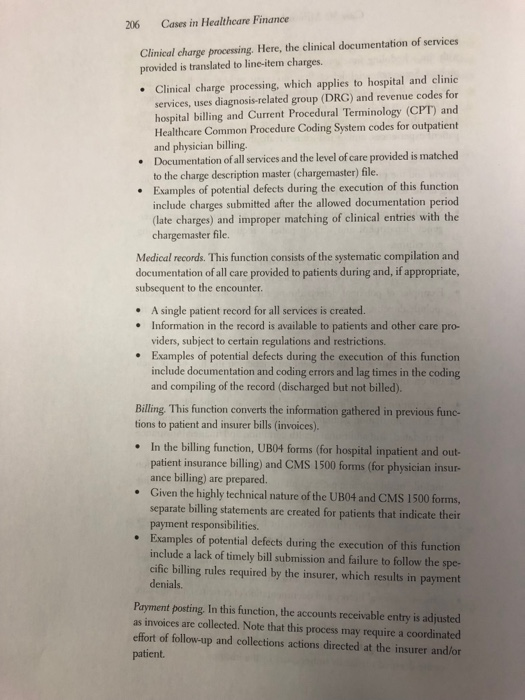

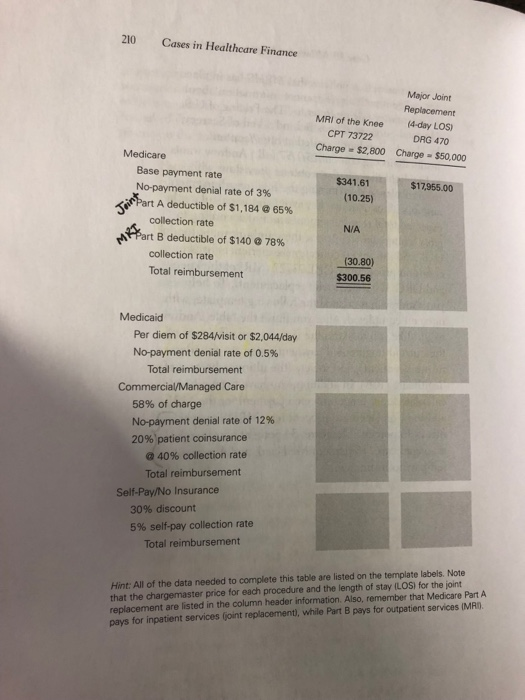

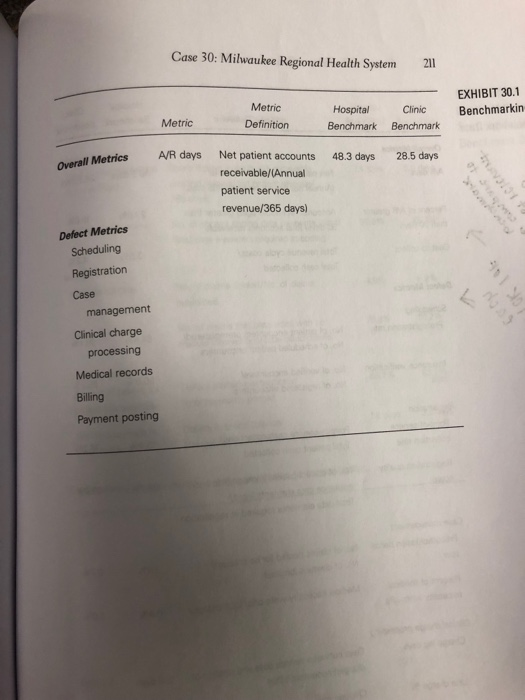

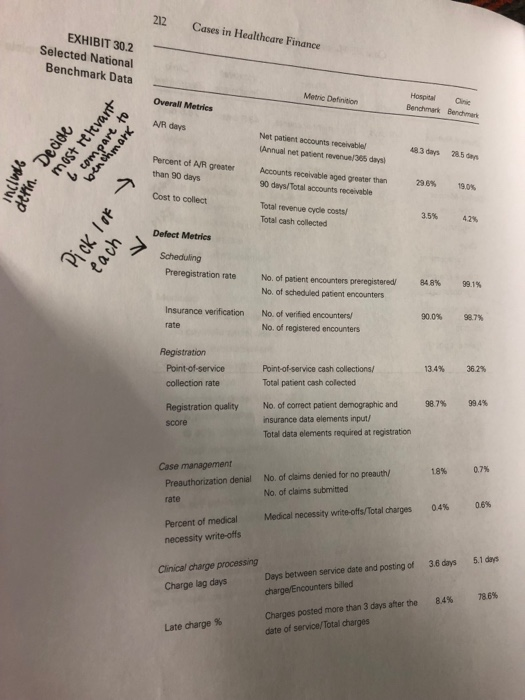

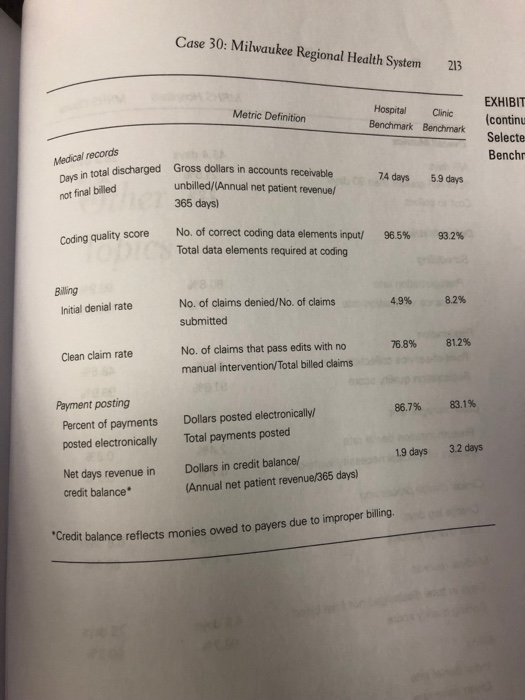

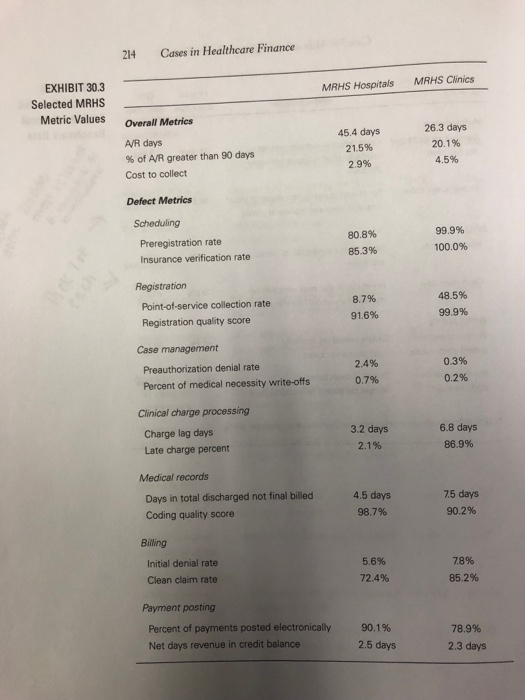

Milwaukee so : Regional Health System sunction and the information gathered within the function, beginning ah the scheduling function, which typically begins the tevenue oycle so listed. It is important to understand that immedate identification because they can create bottlenecks, ncess Some potential defects that can occur within each function are d correction of defects are critical to good revenue cycle performance require reprocessing, result in poor patient experiences, and/or reduce net realizable values. Scheduling. Typically, this function is the first interaction between the ning of the revenue cycle process ent and the provider system. Hence, scheduling represents the begin Scheduling occurs throughout the hospital and clinic seting, emer- gency department and walkin patients require unique scheduling procedures. Patient information gathering begins with the description of the health issue/care need and type of insurance coverage. Examples of potential defects during the execution of this function include directing patients to the wrong service and failing to properly identify and verify insurance coverage and obtain precertification (if required). Registration. This is the first patient experience on the finst day of each patient encounter. Registration occurs throughout the hospital and clinic setings Patient information gathered in the scheduling process is confirmed or updated, and additional health condition and financialinsurance information is obtained if needed. Examples of potential defects during the execution of this function include misidentifying patient and/or insurer information and failing to verify coverage and precertification (if required). Case management. With this function, the translation of medically neces sary healthcare services to charges for those services begins ' Case management occurs throughout the hospital and clinic settings Patients' medical history and documentation of current status and care with a particular emphasis on hospital inpatient admissions plan are reviewed Examples of potential defects during the execution of this function include ordering and/or performing services that are not preauthorized or are deemed medically unnecessary by the insurer Cases in Healtheare Finance 206 Clinical charge processing. Here, the clinical documentation of services provided is translated to line-item charges. Clinical charge processing, which applies to hospital and clinic services, uses diagnosis-related group (DRG) and revenue codes for hospital billing and Current Procedural Terminology (CPT) and Healthcare Common Procedure Coding System codes for outpatient and physician billing. Documentation of all services and the level of care provided is matched . to the charge description master (chargemaster) file. Examples of potential defects during the execution of this function include charges submitted after the allowed documentation period (late charges) and improper matching of clinical entries with the . chargemaster file Medical records. This function consists of the systematic compilation and documentation of all care provided to patients during and, if appropriate, subsequent to the encounter . A single patient record for all services is created. Information in the record is available to patients and other care pro- viders, subject to certain regulations and restrictions. .Examples of potential defects during the execution of this function include documentation and coding errors and lag times in the coding and compiling of the record (discharged but not billed). Billing This function converts the information gathered in previous func-. tions to patient and insurer bills (invoices). In the billing function, UB04 forms (for hospital inpatient and out- patient insurance billing) and CMS 1500 forms (for physician insur- ance billing) are prepared. Given the highly technical nature of the UB04 and CMS 1500 forms, separate billing statements are created for patients that indicate their . payment responsibilities. Examples of potential defects during the execution of this function include a lack of timely bill submission and failure to follow the spe- cific billing rules required by the insurer, which results in payment denials Payment posting, In this function, the accounts receivable entry is adjusted as invoices are collected. Note that this process may require a coordinated effort of follow-up and collections actions directed at the insurer and/or patient. Cases in Healthcare Finance 208 projects prior to the meeting. Unfortunately., Andrew broke his leg in a snowmobile accident and requires surgery and a short hospitalization, so he is unable to get the work done in time for the meeting. Thus, he has asked you, an administrative fellow at MRHS, to help out. He has given you the following three tasks: Establish two overall revenue cycle performance metrics and one defect metric for each revenue cycle function, from scheduling through payment posting The metrics should be based on nationally accepted practices, and the list should include definitions and current benchmark values. Andrew has already started this task, so he provided you with the template shown in Exhibit 30.1, which contains one overall performance metric, accounts receivable (A/R) days, already filled in. Also, he finished compiling a list of metric candidates and benchmark values from various sources, which is provided in Exhibit 30.2. Thus, your task is to choose one additional overall performance metric and the single best defect metric for each function listed in Exhibit 30.1 for both the hospital and clinic settings. Andrew mentioned that there will be a great deal of discussion of these metrics at the meeting, so it is essential that you fully justify your selections 1. 2. Compare the MRHS actual values for the metrics chosen, provided in Exhibit 30.3, with the benchmark values. Discuss the implications of your comparisons and, most important, suggest the corrective actions that should be implemented to bring MRHS in line with national standards for the areas of subpar performance 3. Every year, MRHS performs an extensive pricing study comparing its gross charges (chargemaster prices) to other healthcare providers in its market in order to competitively align its price structure. Of course, MRHS typically gets paid far less than gross charges for the care it provides. The actual billing amount is determined by analyzing the hundreds of imbursement contracts the system has in force with Case 30: Milwaukee Regional Health System21 EXHIBIT 30.1 pital Clinic Bnchmarkin Metric Metric Definition Benchmark Benchmark l Metrics A/R days Net patient accounts 48.3 days 28.5 days receivable/(Annual patient service revenue/365 days) Defect Metrics Scheduling Registration Case management Clinical charge processing Medical records Billing Payment posting 212 Cases in Healthcare Finance EXHIBIT 30.2 Selected National Benchmark Data HospitalCinic Benchmark Benchmark Metric Definition Overall Metrics A/R days Net patient accounts receivablel Annual net patient revenue/385 days 48 3 days 28.5 das Percent of A/R greater Accounts receivable aged greater than than 90 days 296% 19.0% 90 deys/Total accounts receivable Cost to collect Total revenue cycle costs Total cash collected 3.5% 42% Defect Metrics Scheduling Preregistration rate No. of patent encounters preregistered/ No of scheduled patient encounters No. of verified encounters No. of registered encounters 848% 991% 50.7% 90.0% Insurance verification rate 362% 13.4% Point-of-service cash collections/ Total patient cash colected collection rate 994% No. of correct patient demographic and insurance data elements input/ 987% Registration quality score Total data elements required at registration 0.7% 18% No. of claims denied for no preauth No. of claims submitted Case management Preauthorization denial 08% rate 04% Medical necessity write-offs/Total darges Percent of medical necessity write-offs Days between service date and posting of 3.6 days 5.1 days charge/Encounters billed Clinical charge processing Charge lag days 786% 84% Charges posted more than 3 days after the date of service/Total charges Late harge % Cases in Healthcare Finance 214 EXHIBIT 30.3 Selected MRHS Metric Values MRHS Clinics MRHS Hospitals Overall Metrics 26.3 days 20.1% 4.5% 45.4 days 21.5% 2.9% A/R days % of AR greater than 90 days Cost to collect Defect Metrics Scheduling 99.9% 100.0% 80.8% 85.3% Preregistration rate Insurance verification rate Registration 48.5% 99.9% 8.7% Point-of-service collection rate Registration quality score 91.6% Case management 2.4% 0.7% 0.3% Preauthorization denial rate 0.2% Percent of medical necessity write-offs Clinical charge processing Charge lag days Late charge percent 3.2 days 21 % 6.8 days 86.9% Medical records Days in total discharged not final illd 4.5 days 98.7% 75 days 90.2% Coding quality score Billing Initial denial rate Clean claim rate 5.6% 72.4% 78% 85.2% Payment posting Percent of payments posted electronically Net days revenue in credit balance 90.1% 78.9% 2.3 days 2.5 days Milwaukee so : Regional Health System sunction and the information gathered within the function, beginning ah the scheduling function, which typically begins the tevenue oycle so listed. It is important to understand that immedate identification because they can create bottlenecks, ncess Some potential defects that can occur within each function are d correction of defects are critical to good revenue cycle performance require reprocessing, result in poor patient experiences, and/or reduce net realizable values. Scheduling. Typically, this function is the first interaction between the ning of the revenue cycle process ent and the provider system. Hence, scheduling represents the begin Scheduling occurs throughout the hospital and clinic seting, emer- gency department and walkin patients require unique scheduling procedures. Patient information gathering begins with the description of the health issue/care need and type of insurance coverage. Examples of potential defects during the execution of this function include directing patients to the wrong service and failing to properly identify and verify insurance coverage and obtain precertification (if required). Registration. This is the first patient experience on the finst day of each patient encounter. Registration occurs throughout the hospital and clinic setings Patient information gathered in the scheduling process is confirmed or updated, and additional health condition and financialinsurance information is obtained if needed. Examples of potential defects during the execution of this function include misidentifying patient and/or insurer information and failing to verify coverage and precertification (if required). Case management. With this function, the translation of medically neces sary healthcare services to charges for those services begins ' Case management occurs throughout the hospital and clinic settings Patients' medical history and documentation of current status and care with a particular emphasis on hospital inpatient admissions plan are reviewed Examples of potential defects during the execution of this function include ordering and/or performing services that are not preauthorized or are deemed medically unnecessary by the insurer Cases in Healtheare Finance 206 Clinical charge processing. Here, the clinical documentation of services provided is translated to line-item charges. Clinical charge processing, which applies to hospital and clinic services, uses diagnosis-related group (DRG) and revenue codes for hospital billing and Current Procedural Terminology (CPT) and Healthcare Common Procedure Coding System codes for outpatient and physician billing. Documentation of all services and the level of care provided is matched . to the charge description master (chargemaster) file. Examples of potential defects during the execution of this function include charges submitted after the allowed documentation period (late charges) and improper matching of clinical entries with the . chargemaster file Medical records. This function consists of the systematic compilation and documentation of all care provided to patients during and, if appropriate, subsequent to the encounter . A single patient record for all services is created. Information in the record is available to patients and other care pro- viders, subject to certain regulations and restrictions. .Examples of potential defects during the execution of this function include documentation and coding errors and lag times in the coding and compiling of the record (discharged but not billed). Billing This function converts the information gathered in previous func-. tions to patient and insurer bills (invoices). In the billing function, UB04 forms (for hospital inpatient and out- patient insurance billing) and CMS 1500 forms (for physician insur- ance billing) are prepared. Given the highly technical nature of the UB04 and CMS 1500 forms, separate billing statements are created for patients that indicate their . payment responsibilities. Examples of potential defects during the execution of this function include a lack of timely bill submission and failure to follow the spe- cific billing rules required by the insurer, which results in payment denials Payment posting, In this function, the accounts receivable entry is adjusted as invoices are collected. Note that this process may require a coordinated effort of follow-up and collections actions directed at the insurer and/or patient. Cases in Healthcare Finance 208 projects prior to the meeting. Unfortunately., Andrew broke his leg in a snowmobile accident and requires surgery and a short hospitalization, so he is unable to get the work done in time for the meeting. Thus, he has asked you, an administrative fellow at MRHS, to help out. He has given you the following three tasks: Establish two overall revenue cycle performance metrics and one defect metric for each revenue cycle function, from scheduling through payment posting The metrics should be based on nationally accepted practices, and the list should include definitions and current benchmark values. Andrew has already started this task, so he provided you with the template shown in Exhibit 30.1, which contains one overall performance metric, accounts receivable (A/R) days, already filled in. Also, he finished compiling a list of metric candidates and benchmark values from various sources, which is provided in Exhibit 30.2. Thus, your task is to choose one additional overall performance metric and the single best defect metric for each function listed in Exhibit 30.1 for both the hospital and clinic settings. Andrew mentioned that there will be a great deal of discussion of these metrics at the meeting, so it is essential that you fully justify your selections 1. 2. Compare the MRHS actual values for the metrics chosen, provided in Exhibit 30.3, with the benchmark values. Discuss the implications of your comparisons and, most important, suggest the corrective actions that should be implemented to bring MRHS in line with national standards for the areas of subpar performance 3. Every year, MRHS performs an extensive pricing study comparing its gross charges (chargemaster prices) to other healthcare providers in its market in order to competitively align its price structure. Of course, MRHS typically gets paid far less than gross charges for the care it provides. The actual billing amount is determined by analyzing the hundreds of imbursement contracts the system has in force with Case 30: Milwaukee Regional Health System21 EXHIBIT 30.1 pital Clinic Bnchmarkin Metric Metric Definition Benchmark Benchmark l Metrics A/R days Net patient accounts 48.3 days 28.5 days receivable/(Annual patient service revenue/365 days) Defect Metrics Scheduling Registration Case management Clinical charge processing Medical records Billing Payment posting 212 Cases in Healthcare Finance EXHIBIT 30.2 Selected National Benchmark Data HospitalCinic Benchmark Benchmark Metric Definition Overall Metrics A/R days Net patient accounts receivablel Annual net patient revenue/385 days 48 3 days 28.5 das Percent of A/R greater Accounts receivable aged greater than than 90 days 296% 19.0% 90 deys/Total accounts receivable Cost to collect Total revenue cycle costs Total cash collected 3.5% 42% Defect Metrics Scheduling Preregistration rate No. of patent encounters preregistered/ No of scheduled patient encounters No. of verified encounters No. of registered encounters 848% 991% 50.7% 90.0% Insurance verification rate 362% 13.4% Point-of-service cash collections/ Total patient cash colected collection rate 994% No. of correct patient demographic and insurance data elements input/ 987% Registration quality score Total data elements required at registration 0.7% 18% No. of claims denied for no preauth No. of claims submitted Case management Preauthorization denial 08% rate 04% Medical necessity write-offs/Total darges Percent of medical necessity write-offs Days between service date and posting of 3.6 days 5.1 days charge/Encounters billed Clinical charge processing Charge lag days 786% 84% Charges posted more than 3 days after the date of service/Total charges Late harge % Cases in Healthcare Finance 214 EXHIBIT 30.3 Selected MRHS Metric Values MRHS Clinics MRHS Hospitals Overall Metrics 26.3 days 20.1% 4.5% 45.4 days 21.5% 2.9% A/R days % of AR greater than 90 days Cost to collect Defect Metrics Scheduling 99.9% 100.0% 80.8% 85.3% Preregistration rate Insurance verification rate Registration 48.5% 99.9% 8.7% Point-of-service collection rate Registration quality score 91.6% Case management 2.4% 0.7% 0.3% Preauthorization denial rate 0.2% Percent of medical necessity write-offs Clinical charge processing Charge lag days Late charge percent 3.2 days 21 % 6.8 days 86.9% Medical records Days in total discharged not final illd 4.5 days 98.7% 75 days 90.2% Coding quality score Billing Initial denial rate Clean claim rate 5.6% 72.4% 78% 85.2% Payment posting Percent of payments posted electronically Net days revenue in credit balance 90.1% 78.9% 2.3 days 2.5 daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started