Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mind using indirect method to solve this qn? With detailed explaination please... thank you!!! (: Question 6 Brits Distributors Income Statement for the year Revenu

Mind using indirect method to solve this qn? With detailed explaination please... thank you!!! (:

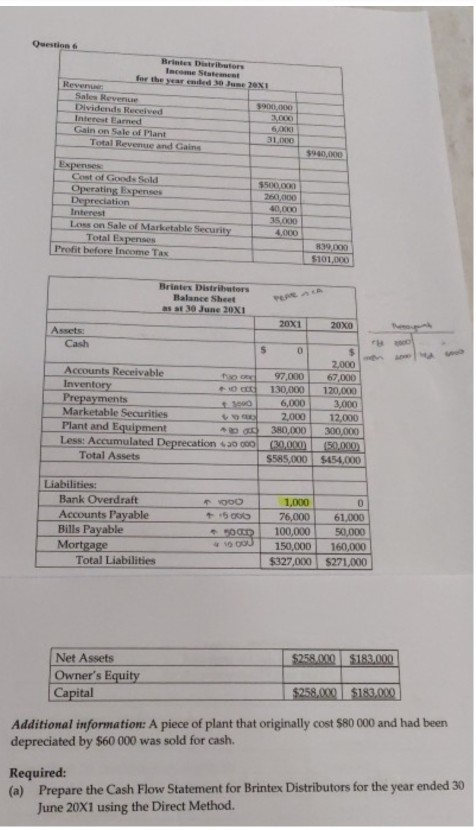

Question 6 Brits Distributors Income Statement for the year Revenu 201 Sales Revenue Dividends Received 90 Internet Earned 3,000 Gain on sale of Plant 6XKI Total Revenue and Gains 31 INNO 39.40.0 Cost of Goods Sold O rating Expenses Depreciation Interest Loss on Sale of Marketable Security Total Expenses Profit before Income Tax 5500 260,000 40.000 35.000 4.000 899.000 5101,000 Brintes Distributors Balance Sheet as at 30 June 20X1 20X120X0 Assets Cash Accounts Receivable Food Inventory Prepayments Marketable Securities Plant and Equipment 0 Less: Accumulated Deprecation 3000 Total Assets 97,000 130.000 6,000 2.000 3 80,000 30.000 $585,000 2.000 67.000 120,000 3,000 12,000 300,000 50.000) $454,000 OD 15006 Liabilities: Bank Overdraft Accounts Payable Bills Payable Mortgage Total Liabilities 1,000 76,000 100,000 150,000 $327,000 10000 61,000 50,000 160,000 $271,000 $258.000 $183,000 Net Assets Owner's Equity Capital $258,000 $183,000 Additional information: A piece of plant that originally cost $80 000 and had been depreciated by $60 000 was sold for cash. Required: (a) Prepare the Cash Flow Statement for Brintex Distributors for the year ended 30 June 20X1 using the Direct MethodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started