Mindtap question helpp!!!

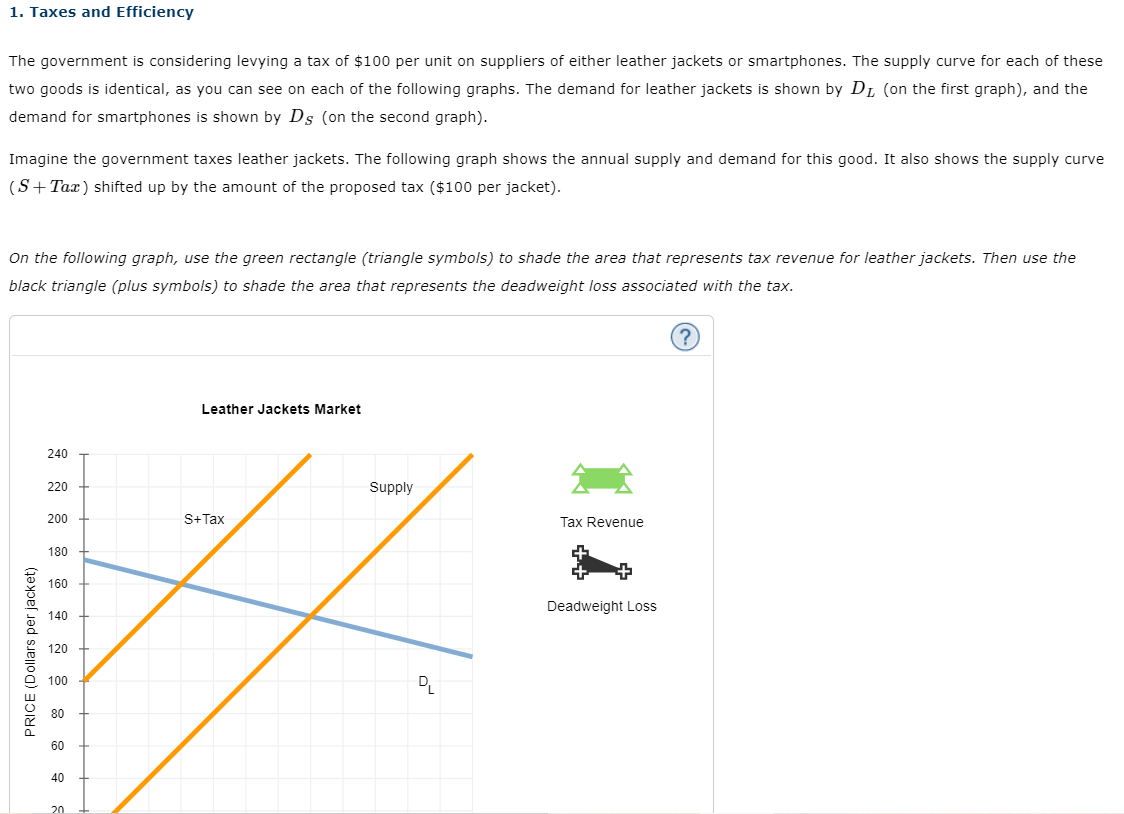

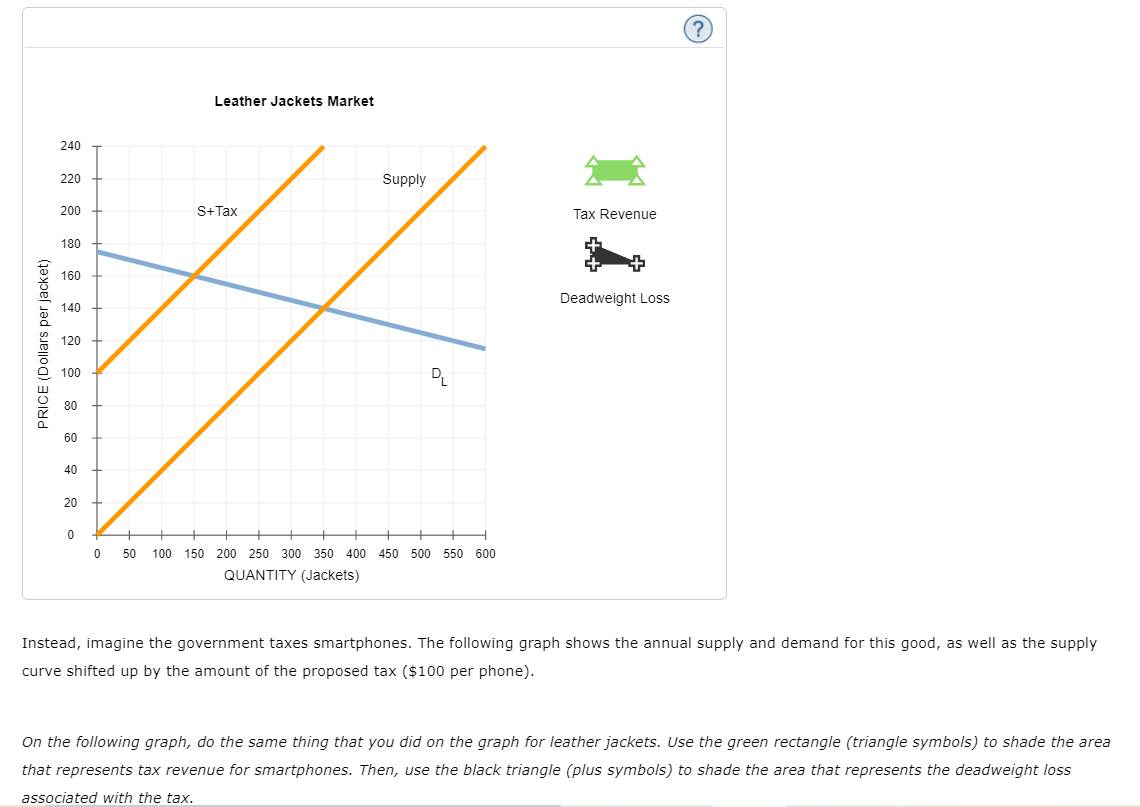

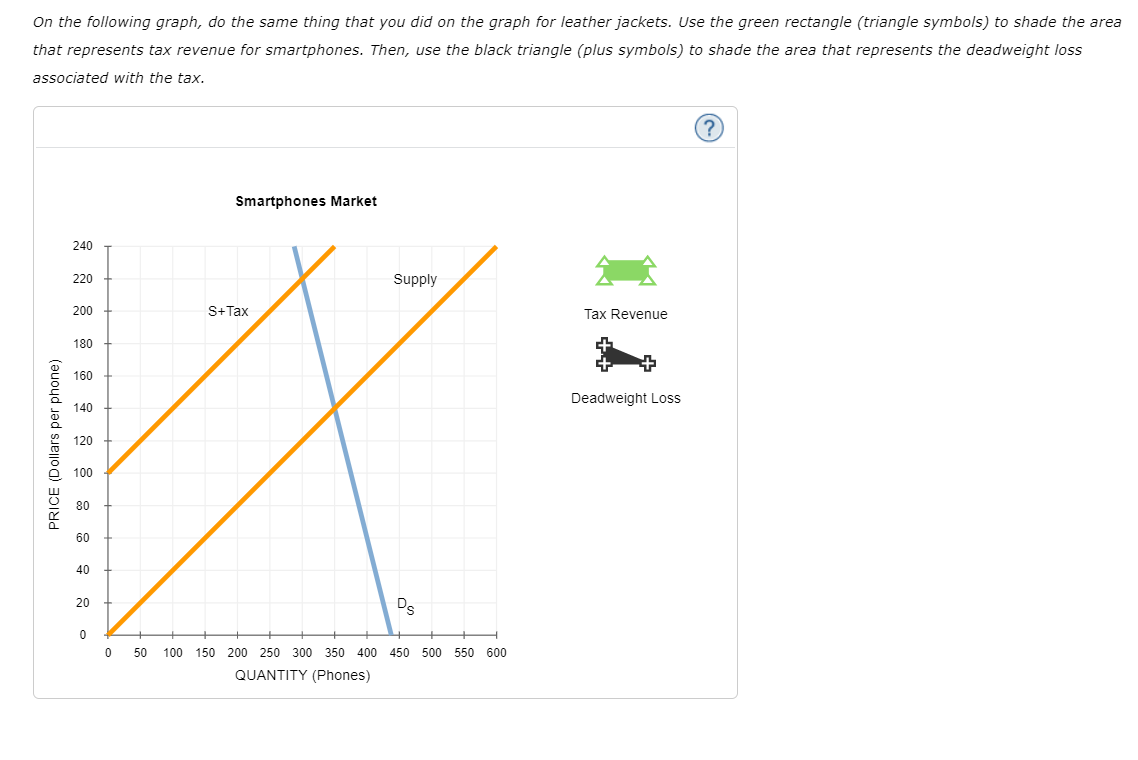

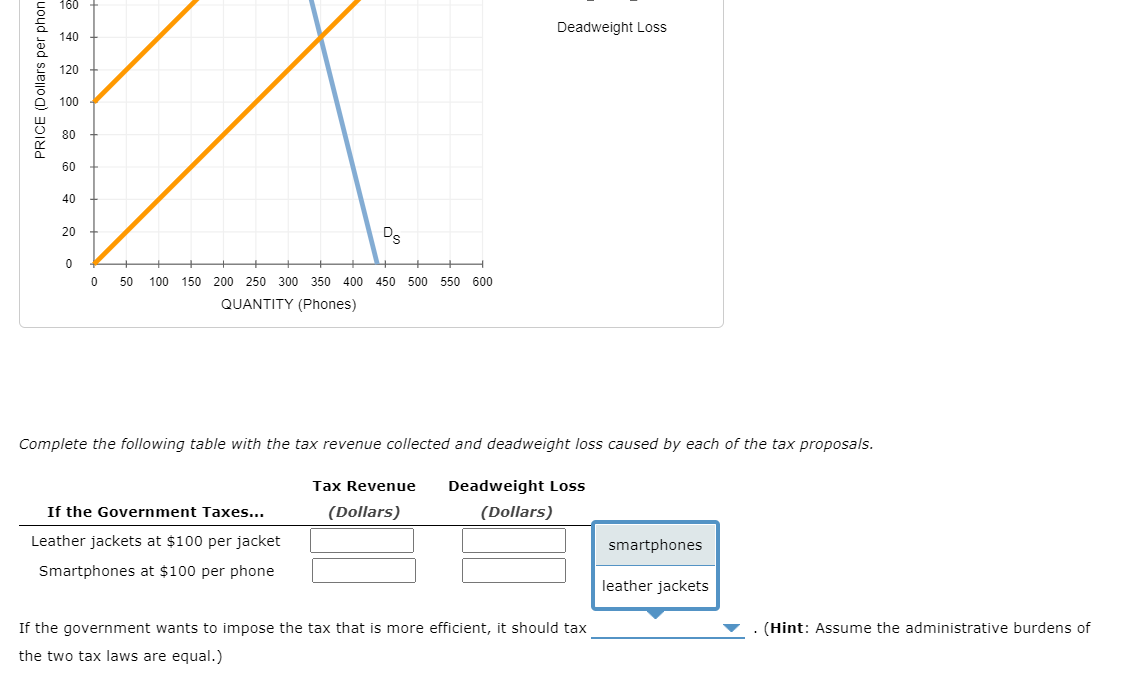

1. Taxes and Efficiency The government is considering levying a tax of $100 per unit on suppliers of either leather jackets or smartphones. The supply curve for each of these two goods is identical, as you can see on each of the following graphs. The demand for leather jackets is shown by Dy (on the first graph), and the demand for smartphones is shown by Ds (on the second graph). Imagine the government taxes leather jackets. The following graph shows the annual supply and demand for this good. It also shows the supply curve (S + Tax ) shifted up by the amount of the proposed tax ($100 per jacket). On the following graph, use the green rectangle (triangle symbols) to shade the area that represents tax revenue for leather jackets. Then use the black triangle (plus symbols) to shade the area that represents the deadweight loss associated with the tax. Leather Jackets Market 240 220 Supply 200 S+ Tax Tax Revenue 180 PRICE (Dollars per jacket) 160 Deadweight Loss 140 120 100 80 40Leather Jackets Market 240 220 Supply i 290 3+1?\" Tax Revenue 1 80 ii 160 140 Deaoweight L033 120 100 D 8|] PRICE (Dollars parjackat) 6|] 2|] (I 5|) 100 150 200 250 300 350 400 450 500 550 EDD QUANTITY (Jackets) Instead, imagine the government taxes smartphones. The following graph shows the annual supply and demand for this good, as well as the supply curve shifted up by the amount of the proposed tax ($100 per phone). Oh the following graph, do the same thing that you did on the graph for leather jackets. Use the green rectangle (triangle symbols) to shade the area that represents tax revenue for smartphones. Then, use the black triangle {plus symbols) to shade the area that represents the deadweight loss associated with the tax. On the following graph, do the same thing that you did on the graph for leather jackets. Use the green rectangle (triangle symbols) to shade the area that represents tax revenue for smartphones. Then, use the black triangle (plus symbols) to shade the area that represents the deadweight loss associated with the tax. Smartphones Market 240 220 Supply 200 S+ Tax Tax Revenue 180 PRICE (Dollars per phone) 160 Deadweight Loss 140 120 100 80 60 40 20 DS 0 50 100 150 200 250 300 350 400 450 500 550 600 QUANTITY (Phones)160 140 120 100 80 PRICE (Dollars par phon 60 20 (I 5|) Deaowelght L033 100 150 200 250 3:00 350 400 450 500 550 600 QUANTITY (Phones) Complete the following table with the tax revenue collected and deadwei'ght loss caused by each of the tax proposals. Tax Reve n ll e If the Government Taxes... (Dollars) Deadweight Loss (Dollars) Leather jackets at $100 per jacket I I Smartphones at $100 per phone I I If the government wants to impose the tax that is more efficient, it should tax the two tax laws are equal.) smartphones leather jackets v . (Hint: Assume the administrative burdens of