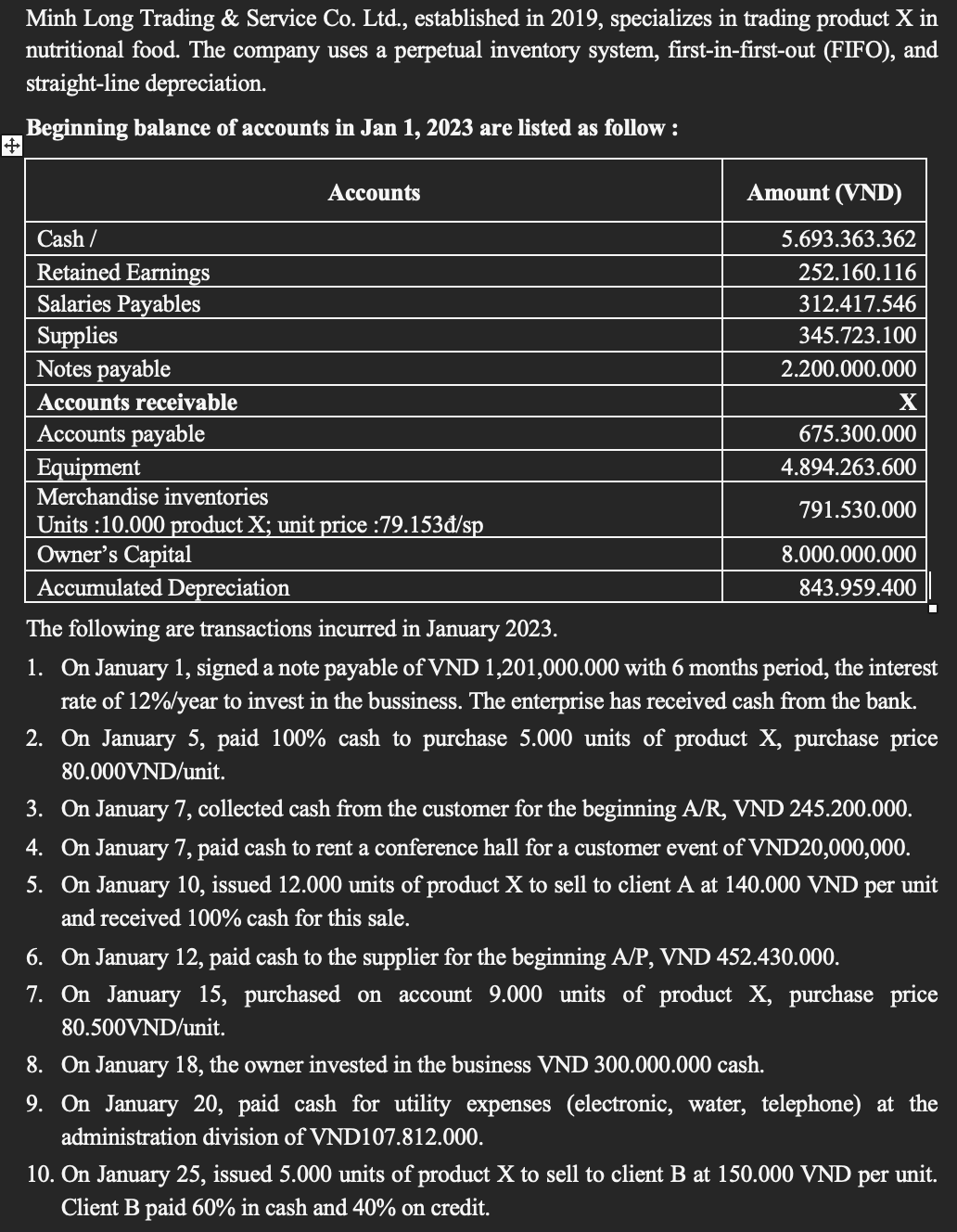

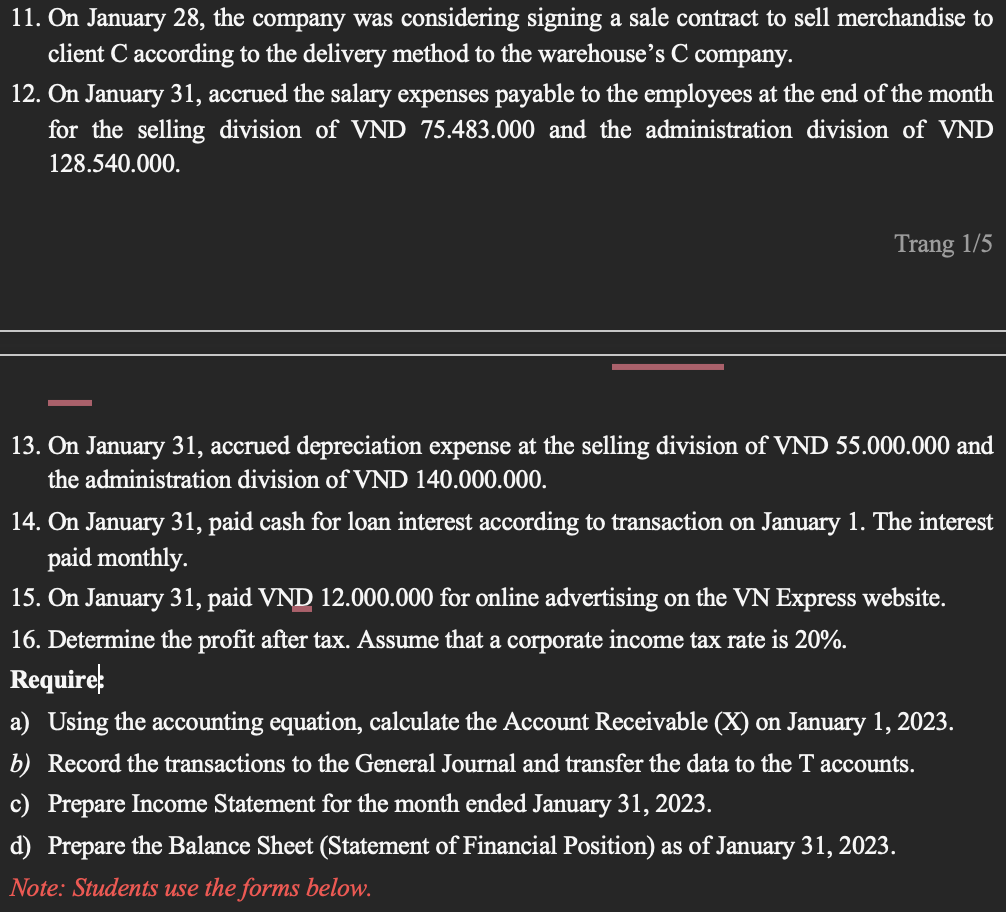

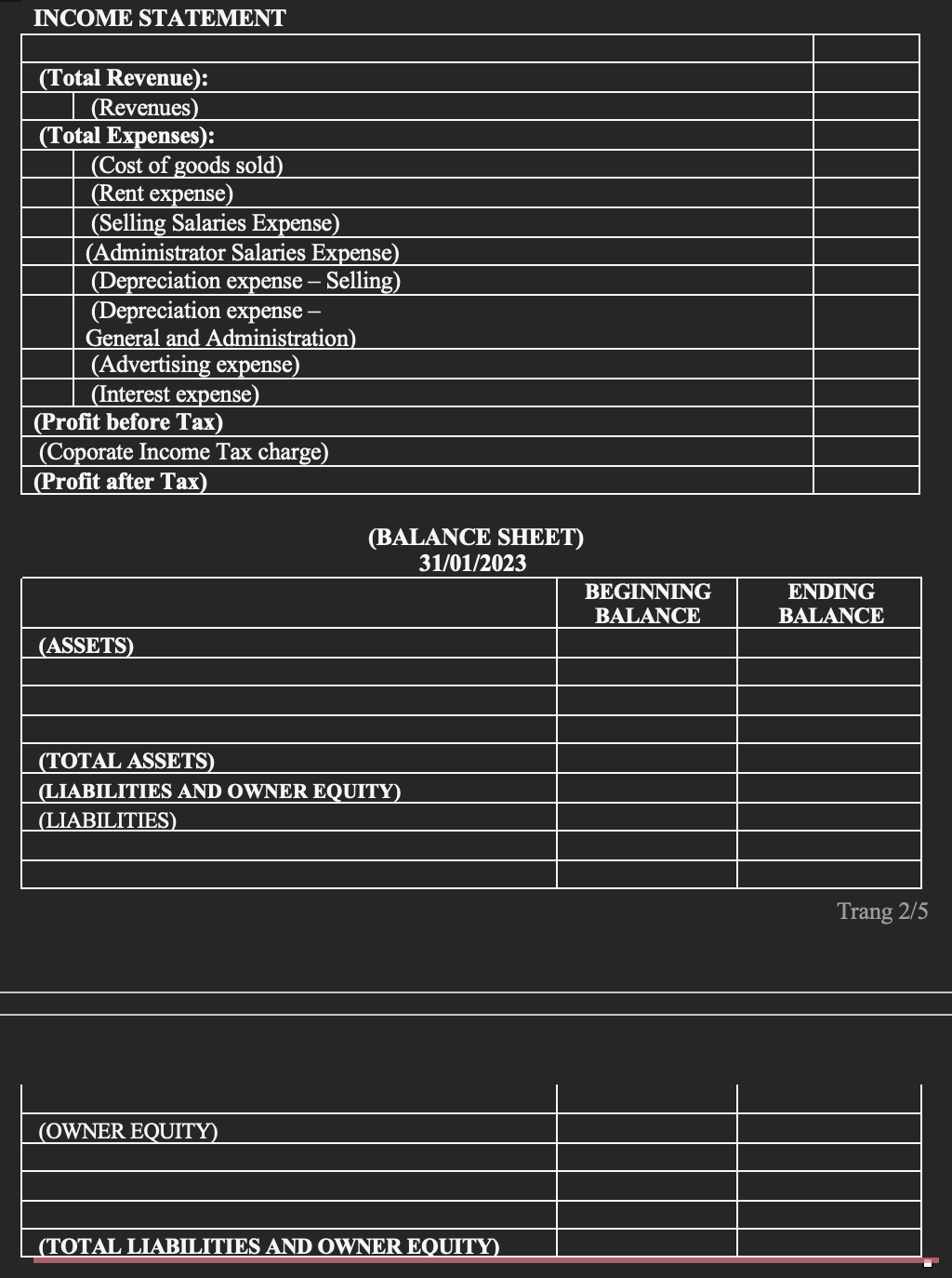

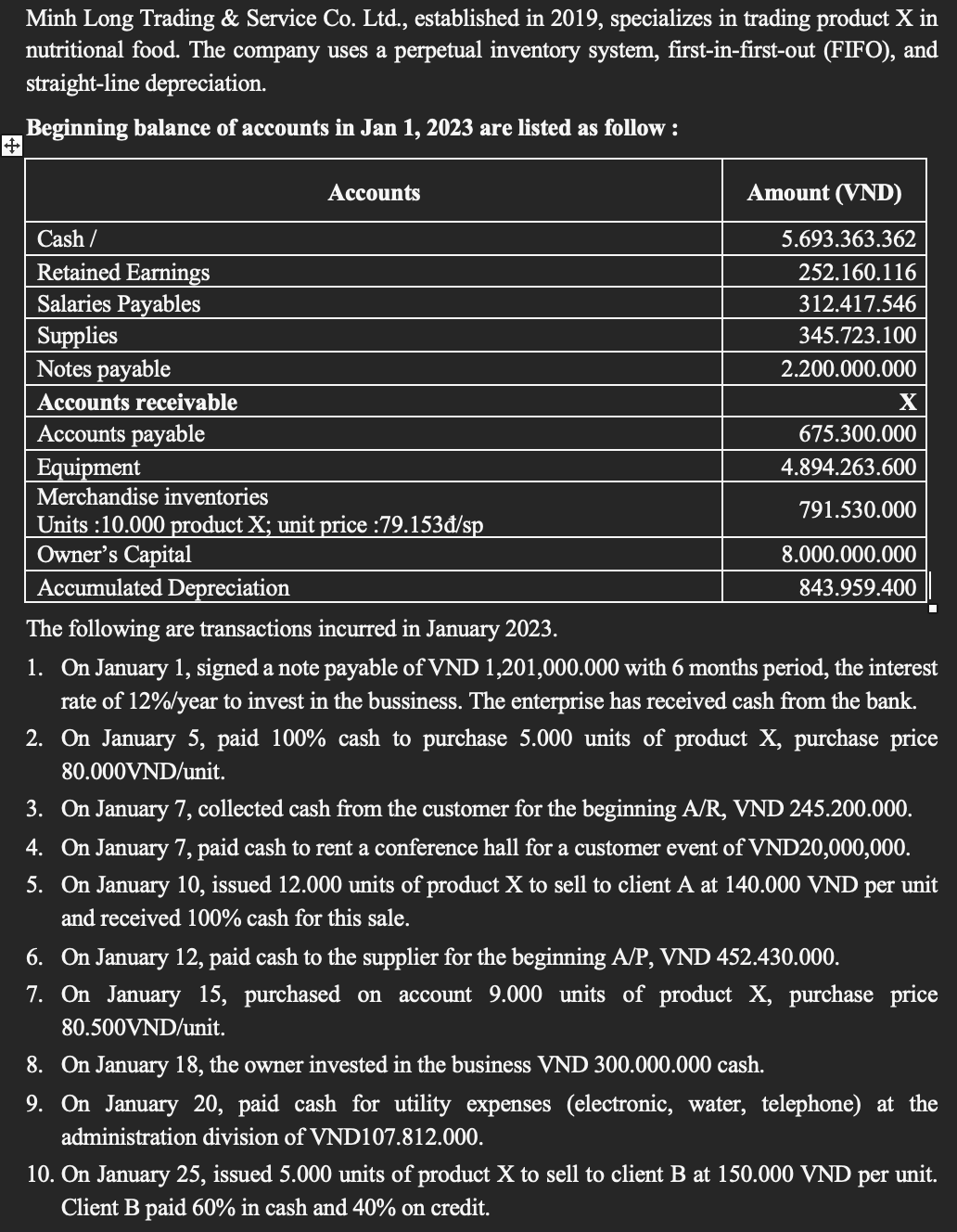

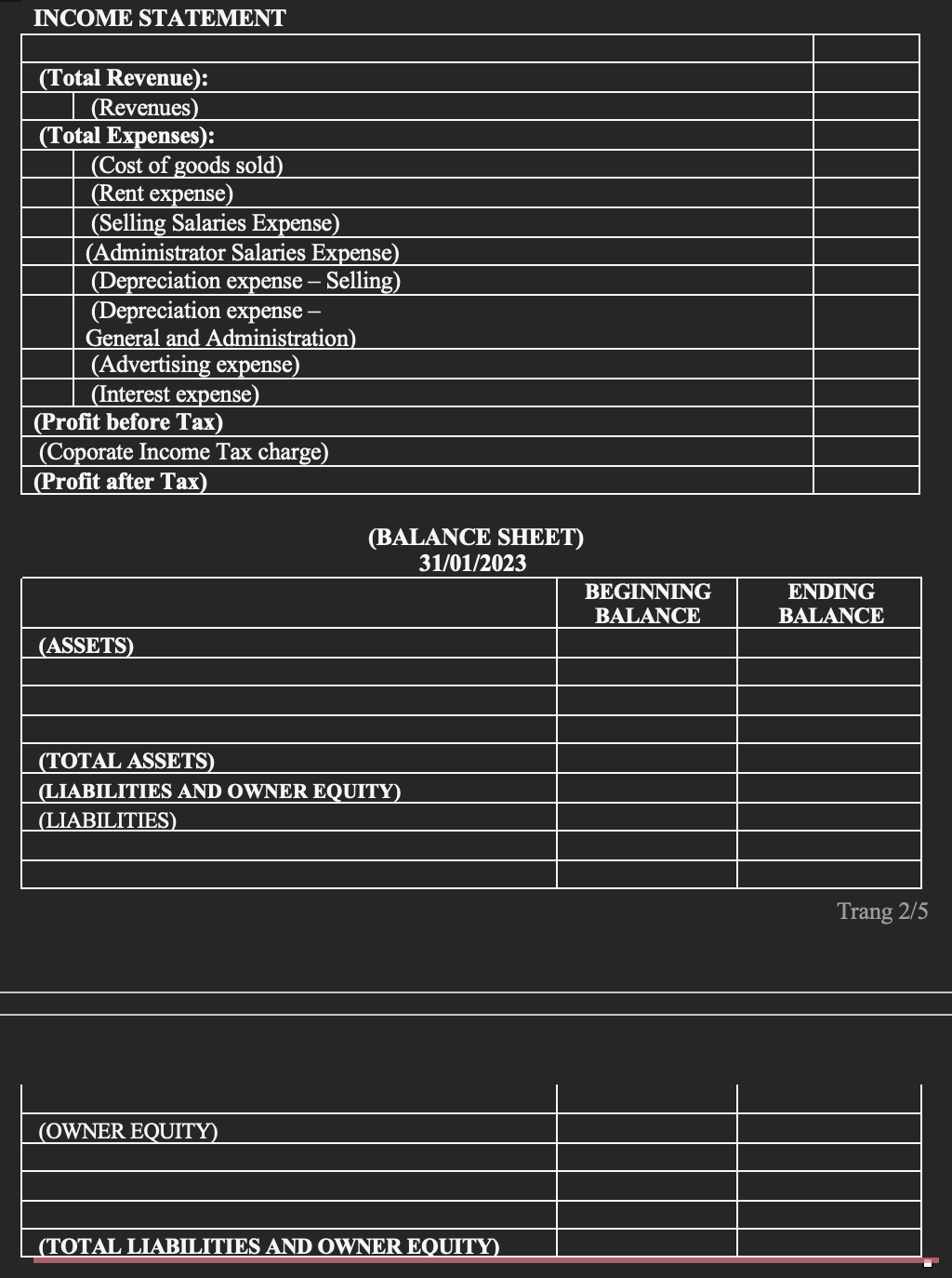

Minh Long Trading \& Service Co. Ltd., established in 2019, specializes in trading product X in nutritional food. The company uses a perpetual inventory system, first-in-first-out (FIFO), and straight-line depreciation. Beginning balance of accounts in Jan 1, 2023 are listed as follow : \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Accounts } & Amount (VND) \\ \hline Cash / & 5.693 .363 .362 \\ \hline Retained Earnings & 252.160 .116 \\ \hline Salaries Payables & 312.417 .546 \\ \hline Supplies & 345.723 .100 \\ \hline Notes payable & 2.200 .000 .000 \\ \hline Accounts receivable & X \\ \hline Accounts payable & 675.300 .000 \\ \hline Equipment & 791.530 .000 \\ \hline MerchandiseinventoriesUnits:10.000productX;unitprice:79.153/sp & 8.000 .000 .000 \\ \hline Owner's Capital & 843.959 .400 \\ \hline Accumulated Depreciation & 7.600 \\ \hline \end{tabular} The following are transactions incurred in January 2023. 1. On January 1, signed a note payable of VND 1,201,000.000 with 6 months period, the interest rate of 12% /year to invest in the bussiness. The enterprise has received cash from the bank. 2. On January 5 , paid 100% cash to purchase 5.000 units of product X, purchase price 80.000VND/unit. 3. On January 7, collected cash from the customer for the beginning A/R, VND 245.200.000. 4. On January 7, paid cash to rent a conference hall for a customer event of VND20,000,000. 5. On January 10 , issued 12.000 units of product X to sell to client A at 140.000 VND per unit and received 100% cash for this sale. 6. On January 12, paid cash to the supplier for the beginning A/P, VND 452.430.000. 7. On January 15, purchased on account 9.000 units of product X, purchase price 80.500VND/unit. 8. On January 18, the owner invested in the business VND 300.000.000 cash. 9. On January 20, paid cash for utility expenses (electronic, water, telephone) at the administration division of VND107.812.000. 10. On January 25, issued 5.000 units of product X to sell to client B at 150.000VND per unit. Client B paid 60% in cash and 40% on credit. 11. On January 28 , the company was considering signing a sale contract to sell merchandise to client C according to the delivery method to the warehouse's C company. 12. On January 31, accrued the salary expenses payable to the employees at the end of the month for the selling division of VND 75.483 .000 and the administration division of VND 128.540.000. Trang 1/5 13. On January 31, accrued depreciation expense at the selling division of VND 55.000.000 and the administration division of VND 140.000.000. 14. On January 31, paid cash for loan interest according to transaction on January 1 . The interest paid monthly. 15. On January 31, paid VND 12.000.000 for online advertising on the VN Express website. 16. Determine the profit after tax. Assume that a corporate income tax rate is 20%. Require: a) Using the accounting equation, calculate the Account Receivable (X) on January 1, 2023. b) Record the transactions to the General Journal and transfer the data to the T accounts. c) Prepare Income Statement for the month ended January 31, 2023. d) Prepare the Balance Sheet (Statement of Financial Position) as of January 31, 2023. Note: Students use the forms below. INCOME STATEMENT (Total Revenue): (Revenues) (Total Expenses): (Cost of goods sold) (Rent expense) (Selling Salaries Expense) (Administrator Salaries Expense) (Depreciation expense - Selling) (Depreciation expense - General and Administration) (Advertising expense) (Interest expense) (Profit before Tax) (Coporate Income Tax charge) (Profit after Tax) (BALANCE SHEET) 31/01/2023 \begin{tabular}{|l|c|c|} \hline & BEGINNINGBALANCE & ENDINGBALANCE \\ \hline (ASSETS) & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline (TOTAL ASSETS) & & \\ \hline (LIABILITIES AND OWNER EQUITY) & & \\ \hline (LIABILITIES) & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Trang 2/5 (OWNER EQUITY) (TOTAL LIABIUTIES AND OWNER EOUITY)