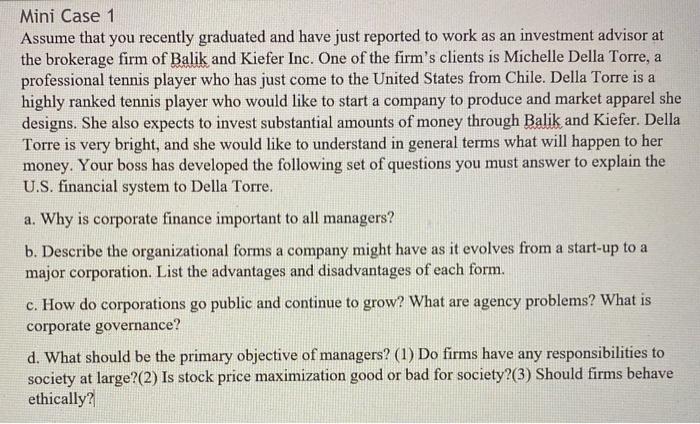

Mini Case 1 Assume that you recently graduated and have just reported to work as an investment advisor at the brokerage firm of Balik and Kiefer Inc. One of the firm's clients is Michelle Della Torre, a professional tennis player who has just come to the United States from Chile. Della Torre is a highly ranked tennis player who would like to start a company to produce and market apparel she designs. She also expects to invest substantial amounts of money through Balik and Kiefer. Della Torre is very bright, and she would like to understand in general terms what will happen to her money. Your boss has developed the following set of questions you must answer to explain the U.S. financial system to Della Torre. a. Why is corporate finance important to all managers? b. Describe the organizational forms a company might have as it evolves from a start-up to a major corporation. List the advantages and disadvantages of each form. c. How do corporations go public and continue to grow? What are agency problems? What is corporate governance? d. What should be the primary objective of managers? (1) Do firms have any responsibilities to society at large?(2) Is stock price maximization good or bad for society?(3) Should firms behave ethically? SUMMARY Financial markets are simply ways of connecting providers of cash with users of cash. Providers exchange cash now for claims on uncertain future cash. The three main forms of business organization are the proprietorship, the partnership, and the corporation. Although each form of organization offers advantages and dis- advantages, corporations conduct much more business than the other forms. . Going public is called an initial public offering (IPO) because it is the first time the company's shares are sold to the general public. Free cash flow (FCF) is the cash flow available (or free) for distribution to a company's investors, including creditors and stockholders, after the company has made invest- ments to sustain ongoing operations. The weighted average cost of capital (WACC) is the average return required by all of the firm's investors. It is determined by the firm's capital structure (the firm's relative amounts of debt and equity), interest rates, the firm's risk, and the market's attitude toward risk. The value of a firm depends on the size of the firm's free cash flows, the timing of those flows, and their risk. If the expected future free cash flows and the cost of capital incorporate all relevant information, then a firm's fundamental value (also called intrinsic value) is defined by: FCF FCF FCF, FCF Value (1 + WACC) (1 + WACC)(1 + WACC) (1 + WACC) The primary objective of management should be to maximize stockholders' wealth, and this means maximizing the company's fundamental value. Legal actions that maximize stock prices usually increase social welfare. Transfers of capital between borrowers and savers take place (1) by direct transfers of money and securities; (2) by transfers through investment banks, which act as go- betweens; and (3) by transfers through financial intermediaries, which create new securities. A financial security is a claim on future cash flows that is standardized and regulated. Debt, equity, and derivatives are the primary types of financial securities. Derivatives, such as options, are claims on other financial securities. In securitization, new securities are created from claims on packages of financial assets. The prospect of more money in the future is required to induce an investor to give up money today. This is a required rate of return from an investor's perspective and a cost from the user's point of view. Four fundamental factors affect the required rate of return (i.e., the cost of money): (1) production opportunities, (2) time preferences for consumption, (3) risk, and (4) inflation Spot markets and futures markets are terms that refer to whether the assets are bought or sold for "on-the-spot" delivery or for delivery at some future date. Money markets are the markets for debt securities with maturities of less than a year. Capital markets are the markets for long-term debt and corporate stocks